Question: 8:22 ounting IFRS 4th Edit... E16.1 (LO 1) (Issuance and Repurchase of Convertible Bonds) Angela AG issues 2,000 convertible bonds at January 1, 2022.

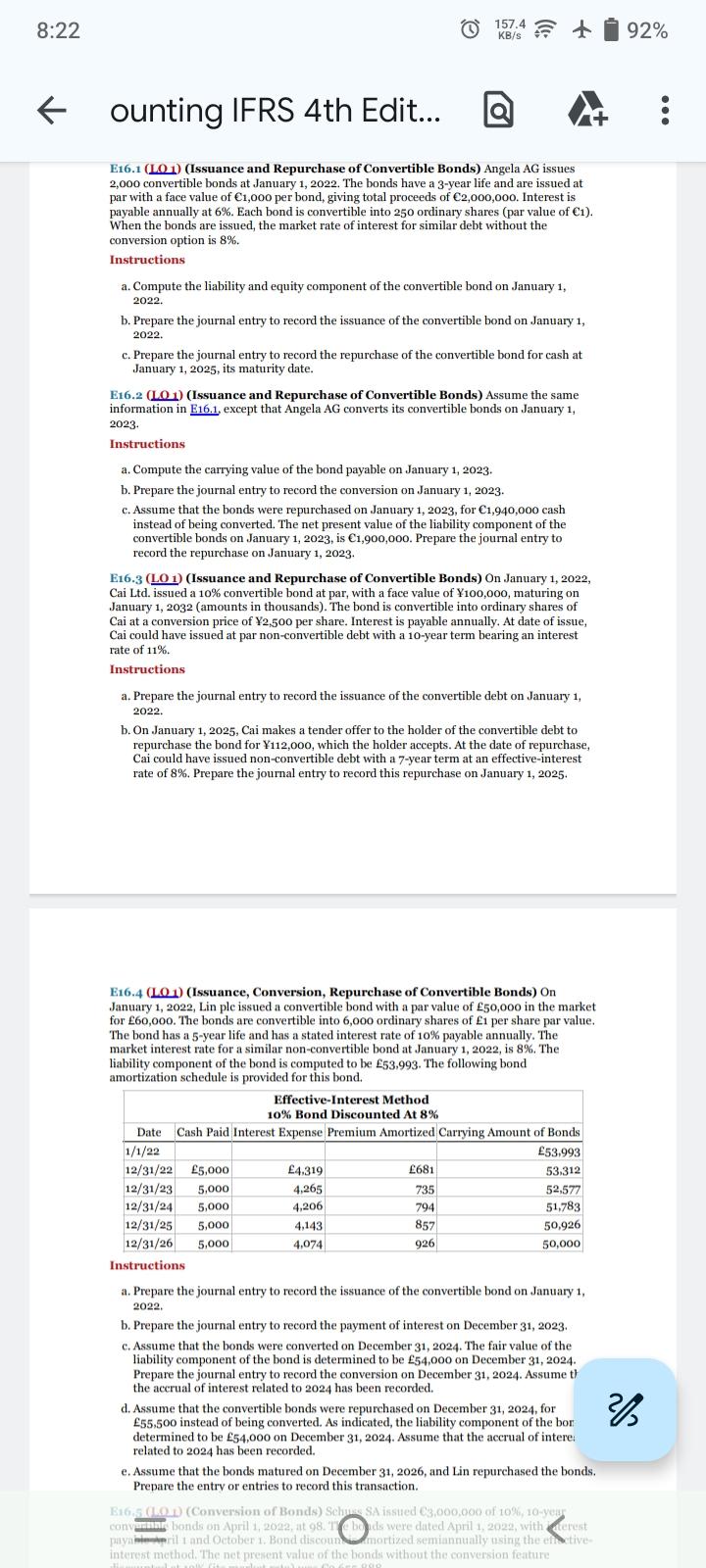

8:22 ounting IFRS 4th Edit... E16.1 (LO 1) (Issuance and Repurchase of Convertible Bonds) Angela AG issues 2,000 convertible bonds at January 1, 2022. The bonds have a 3-year life and are issued at par with a face value of 1,000 per bond, giving total proceeds of 2,000,000. Interest is payable annually at 6%. Each bond is convertible into 250 ordinary shares (par value of 1). When the bonds are issued, the market rate of interest for similar debt without the conversion option is 8%. Instructions a. Compute the liability and equity component of the convertible bond on January 1, 2022. b. Prepare the journal entry to record the issuance of the convertible bond on January 1, 2022. 157.4 KB/s c. Prepare the journal entry to record the repurchase of the convertible bond for cash at January 1, 2025, its maturity date. E16.2 (LO 1) (Issuance and Repurchase of Convertible Bonds) Assume the same information in E16.1, except that Angela AG converts its convertible bonds on January 1, 2023. Instructions a. Compute the carrying value of the bond payable on January 1, 2023. b. Prepare the journal entry to record the conversion on January 1, 2023. c. Assume that the bonds were repurchased on January 1, 2023, for 1,940,000 cash instead of being converted. The net present value of the liability component of the convertible bonds on January 1, 2023, is 1,900,000. Prepare the journal entry to record the repurchase on January 1, 2023. E16.3 (LO 1) (Issuance and Repurchase of Convertible Bonds) On January 1, 2022, Cai Ltd. issued a 10% convertible bond at par, with a face value of Y100,000, maturing on January 1, 2032 (amounts in thousands). The bond is convertible into ordinary shares of Cai at a conversion price of 2,500 per share. Interest is payable annually. At date of issue, Cai could have issued at par non-convertible debt with a 10-year term bearing an interest rate of 11%. Instructions a. Prepare the journal entry to record the issuance of the convertible debt on January 1, 2022. b. On January 1, 2025, Cai makes a tender offer to the holder of the convertible debt to repurchase the bond for Y112,000, which the holder accepts. At the date of repurchase, Cai could have issued non-convertible debt with a 7-year term at an effective-interest rate of 8%. Prepare the journal entry to record this repurchase on January 1, 2025. E16.4 (LO 1) (Issuance, Conversion, Repurchase of Convertible Bonds) On January 1, 2022, Lin ple issued a convertible bond with a par value of 50,000 in the market for 60,000. The bonds are convertible into 6,000 ordinary shares of 1 per share par value. The bond has a 5-year life and has a stated interest rate of 10% payable annually. The market interest rate for a similar non-convertible bond at January 1, 2022, is 8%. The liability component of the bond is computed to be 53,993. The following bond amortization schedule is provided for this bond. Effective-Interest Method 10% Bond Discounted At 8% Date Cash Paid Interest Expense Premium Amortized Carrying Amount of Bonds 1/1/22 53.993 12/31/22 5,000 53,312 12/31/23 5,000 52,577 12/31/24 5,000 51,783 12/31/25 5,000 50,926 12/31/26 5,000 50,000 Instructions 4,319 4,265 4,206 4,143 4,074 681 735 794 857 926 a. Prepare the journal entry to record the issuance of the convertible bond on January 1, 2022. b. Prepare the journal entry to record the payment of interest on December 31, 2023. c. Assume that the bonds were converted on December 31, 2024. The fair value of the liability component of the bond is determined to be 54,000 on December 31, 2024. Prepare the journal entry to record the conversion on December 31, 2024. Assume th the accrual of interest related to 2024 has been recorded. d. Assume that the convertible bonds were repurchased on December 31, 2024, for 55,500 instead of being converted. As indicated, the liability component of the bor determined to be 54,000 on December 31, 2024. Assume that the accrual of intere: related to 2024 has been recorded. e. Assume that the bonds matured on December 31, 2026, and Lin repurchased the bonds. Prepare the entry or entries to record this transaction. E16.5 (LQ) (Conversion of Bonds) Schuss SA issued 3,000,000 of 10%, 10-year convennar bonds on April 1, 2022, at 98. The bonds were dated April 1, 2022, with terest payapril 1 and October 1. Bond discounmortized semiannually using the effective- interest method. The net present value of the bonds without the conversion feature au dad at all fit 000 92% 2

Step by Step Solution

There are 3 Steps involved in it

It seems that you have provided an image showing a set of questions related to the accounting for issuance conversion repurchase and amortization of convertible bonds Unfortunately the image is not fu... View full answer

Get step-by-step solutions from verified subject matter experts