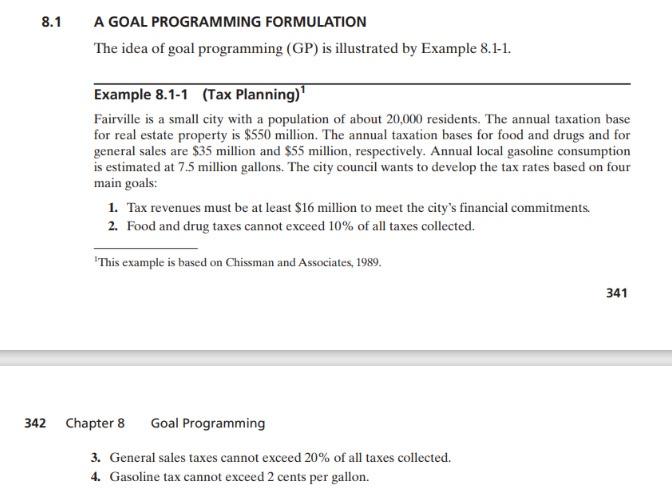

Question: 8-23. Solve Problem 8-1 using the following priority ordering for the goals: G1 G2 G3 G4 G5 (*8-1. Formulate the Fairville tax problem, assuming that

8-23. Solve Problem 8-1 using the following priority ordering for the goals:

G1 G2 G3 G4 G5

(*8-1. Formulate the Fairville tax problem, assuming that the town council is specifying an

additional goal, G5, that requires gasoline tax to equal at least 20% of the total tax bill.)

**Please solve problem 8-23 using the modified simplex method.

plz help me :(

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock