Question: 8.26 and 8.27 CHAPTER 286 us S, which is defined by 8.25 Let Ds be the Macaulay duration of the surplus S, which Ds =

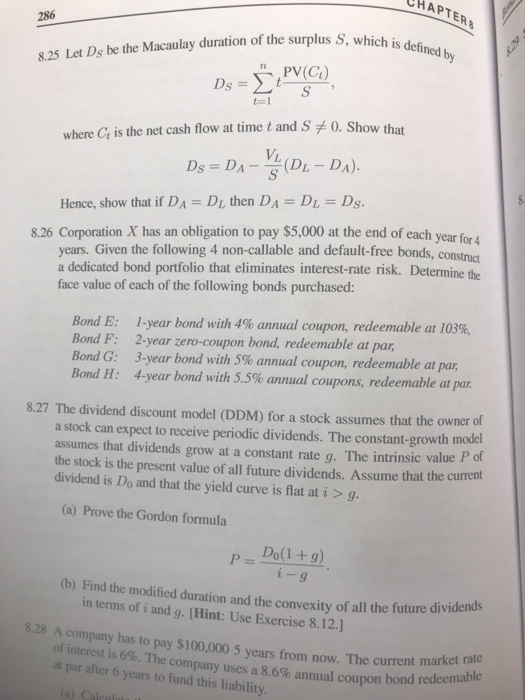

CHAPTER 286 us S, which is defined by 8.25 Let Ds be the Macaulay duration of the surplus S, which Ds = PRECES where is the net cash flow at time t and S +0. Show that Ds= DA - (DL Da). Hence, show that if DA = D. then DA = D = Ds. 8.26 Corporation X has an obligation to pay $5,000 at the end of each year for years. Given the following 4 non-callable and default-free bonds, construct a dedicated bond portfolio that eliminates interest-rate risk. Determine the face value of each of the following bonds purchased: Bond E: -year bond with 4% annual coupon, redeemable at 103%, Bond F: 2-year zero-coupon bond, redeemable at par, Bond G: 3-year bond with 5% annual coupon, redeemable at par, Bond H: 4-year bond with 5.5% annual coupons, redeemable at par. 8.27 The dividend discount model (DDM) for a stock assumes that the owner of a stock can expect to receive periodic dividends. The constant-growth model assumes that dividends grow at a constant rate q. The intrinsic value on the stock is the present value of all future dividends. Assume that the current dividend is D, and that the yield curve is flat at i > 9. (a) Prove the Gordon formula P= Do(1+g) 1- 9 (b) Find the modified duration and the convexity of all the future in terms of i and g. (Hint: Use Exercise 8.12.) xity of all the future dividends 8.28 A company has to pay $100,000 5 years from now. The current mark of interest is 6%. The company uses a 8.6% annual coupon bond at par after 6 years to fund this liability. ne current market rate mal coupon bond redeemable CHAPTER 286 us S, which is defined by 8.25 Let Ds be the Macaulay duration of the surplus S, which Ds = PRECES where is the net cash flow at time t and S +0. Show that Ds= DA - (DL Da). Hence, show that if DA = D. then DA = D = Ds. 8.26 Corporation X has an obligation to pay $5,000 at the end of each year for years. Given the following 4 non-callable and default-free bonds, construct a dedicated bond portfolio that eliminates interest-rate risk. Determine the face value of each of the following bonds purchased: Bond E: -year bond with 4% annual coupon, redeemable at 103%, Bond F: 2-year zero-coupon bond, redeemable at par, Bond G: 3-year bond with 5% annual coupon, redeemable at par, Bond H: 4-year bond with 5.5% annual coupons, redeemable at par. 8.27 The dividend discount model (DDM) for a stock assumes that the owner of a stock can expect to receive periodic dividends. The constant-growth model assumes that dividends grow at a constant rate q. The intrinsic value on the stock is the present value of all future dividends. Assume that the current dividend is D, and that the yield curve is flat at i > 9. (a) Prove the Gordon formula P= Do(1+g) 1- 9 (b) Find the modified duration and the convexity of all the future in terms of i and g. (Hint: Use Exercise 8.12.) xity of all the future dividends 8.28 A company has to pay $100,000 5 years from now. The current mark of interest is 6%. The company uses a 8.6% annual coupon bond at par after 6 years to fund this liability. ne current market rate mal coupon bond redeemable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts