Question: 8:27 Question Full View You asked 4m ago Asked in Finance 1. A bond has 10 years to maturity, a coupon rate of 5% (coupons

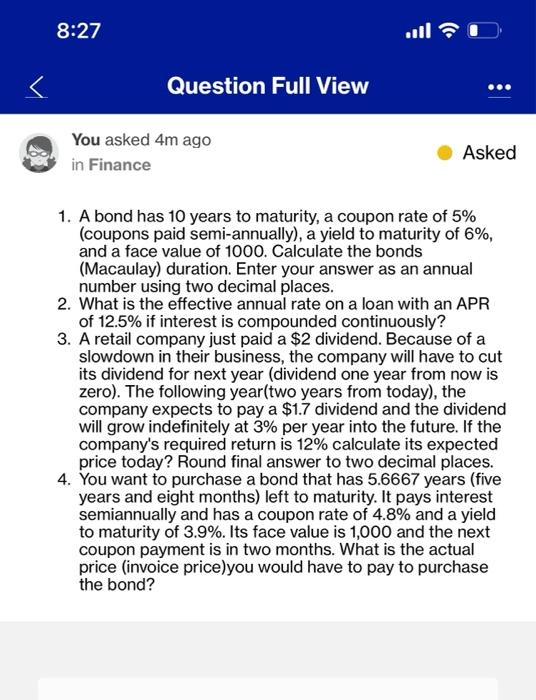

8:27 Question Full View You asked 4m ago Asked in Finance 1. A bond has 10 years to maturity, a coupon rate of 5% (coupons paid semi-annually), a yield to maturity of 6%, and a face value of 1000. Calculate the bonds (Macaulay) duration. Enter your answer as an annual number using two decimal places. 2. What is the effective annual rate on a loan with an APR of 12.5% if interest is compounded continuously? 3. A retail company just paid a $2 dividend. Because of a slowdown in their business, the company will have to cut its dividend for next year (dividend one year from now is zero). The following year(two years from today), the company expects to pay a $1.7 dividend and the dividend will grow indefinitely at 3% per year into the future. If the company's required return is 12% calculate its expected price today? Round final answer to two decimal places. 4. You want to purchase a bond that has 5.6667 years (five years and eight months) left to maturity. It pays interest semiannually and has a coupon rate of 4.8% and a yield to maturity of 3.9%. Its face value is 1,000 and the next coupon payment is in two months. What is the actual price (invoice price)you would have to pay to purchase the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts