Question: Orange SAE issued a bond with a par value of $1000 in January 2020, redeemable in January 2025 at par. The coupon rate is

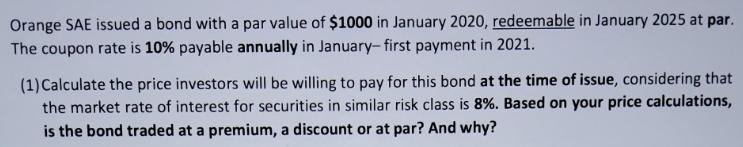

Orange SAE issued a bond with a par value of $1000 in January 2020, redeemable in January 2025 at par. The coupon rate is 10% payable annually in January-first payment in 2021. (1) Calculate the price investors will be willing to pay for this bond at the time of issue, considering that the market rate of interest for securities in similar risk class is 8%. Based on your price calculations, is the bond traded at a premium, a discount or at par? And why?

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below The price investors will be willing to ... View full answer

Get step-by-step solutions from verified subject matter experts