Question: 8:43 BUSI 2093 - Case Study (1) (BUSI 2093 Intro company is currently operamy autum capacity, fixed assets will also grow proportional to sales, same

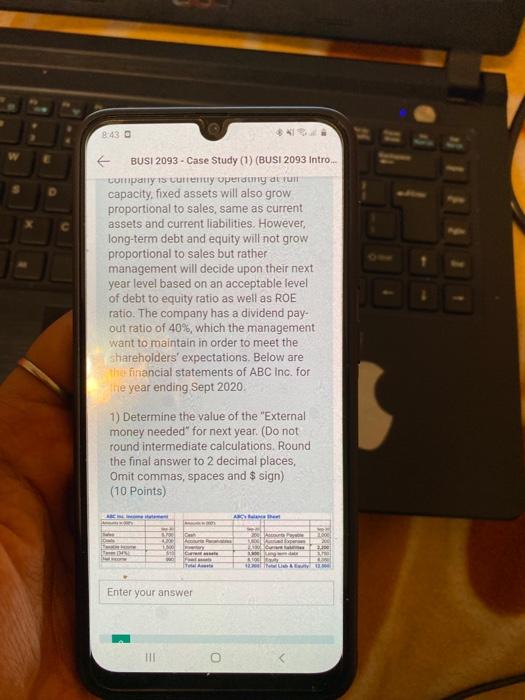

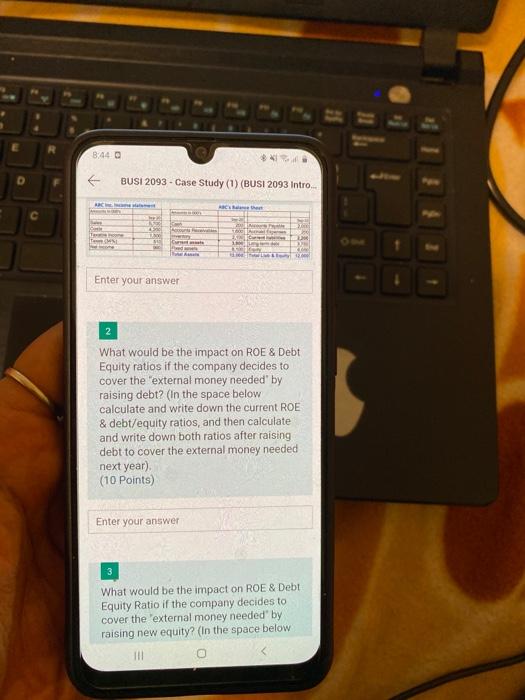

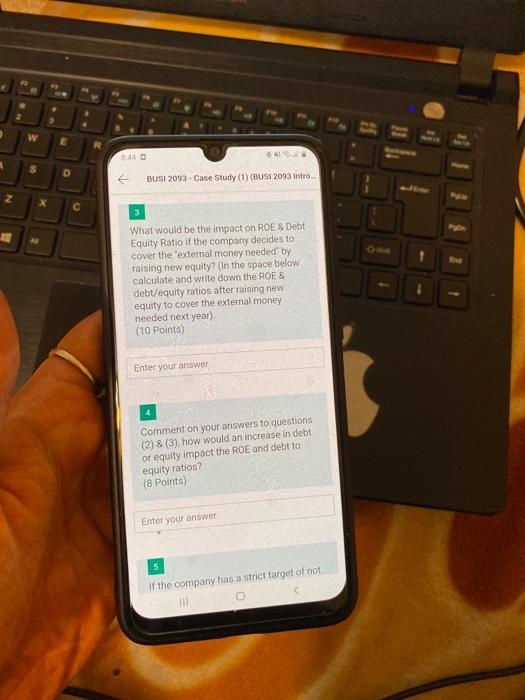

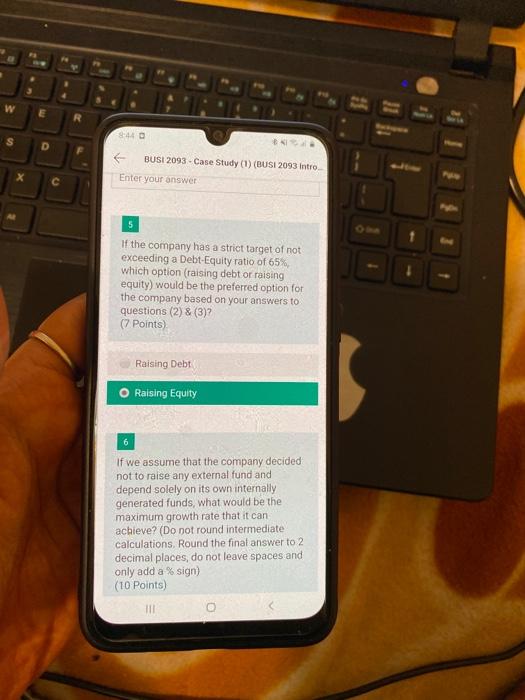

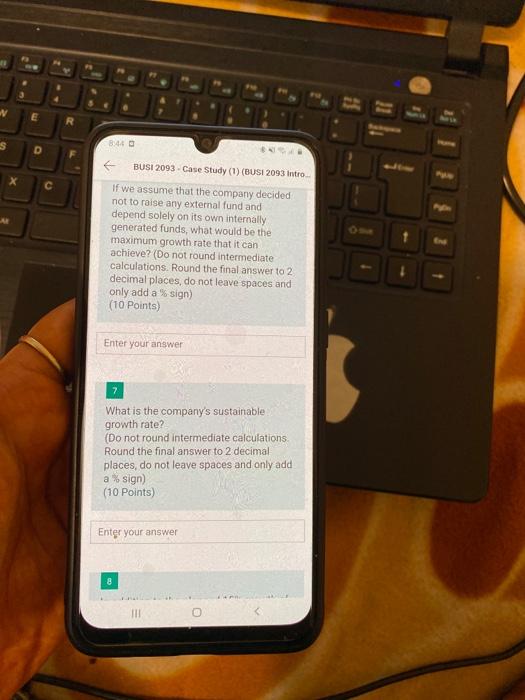

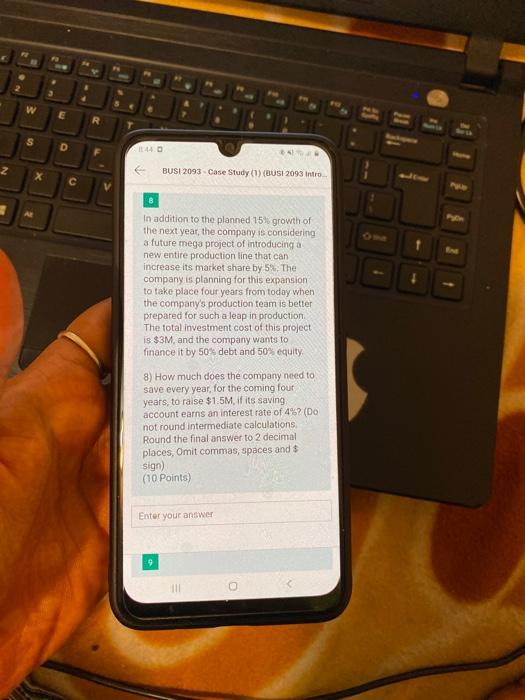

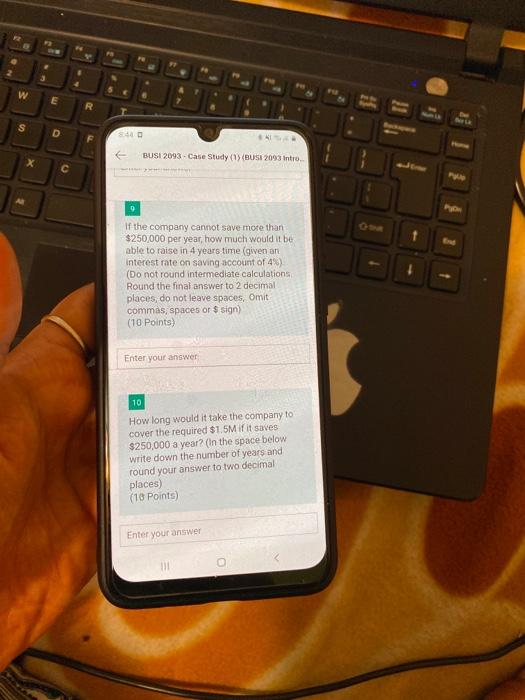

8:43 BUSI 2093 - Case Study (1) (BUSI 2093 Intro company is currently operamy autum capacity, fixed assets will also grow proportional to sales, same as current assets and current liabilities. However, long-term debt and equity will not grow proportional to sales but rather management will decide upon their next year level based on an acceptable level of debt to equity ratio as well as ROE ratio. The company has a dividend pay- out ratio of 40%, which the management want to maintain in order to meet the shareholders' expectations. Below are this financial statements of ABC Inc. for the year ending Sept 2020. 1) Determine the value of the "External money needed" for next year. (Do not round intermediate calculations. Round the final answer to 2 decimal places, Omit commas, spaces and $ sign) (10 Points) AN SE 100 20 30 TE T Enter your answer HT 8:44 BUSI 2093 - Case Study (1) (BUSI 2093 Intro... AC C WY MNE Enter your answer 2 What would be the impact on ROE & Debt Equity ratios if the company decides to cover the external money needed' by raising debt? (In the space below calculate and write down the current ROE & debt/equity ratios, and then calculate and write down both ratios after raising debt to cover the external money needed next year) (10 points) Enter your answer 3 What would be the impact on ROE & Debt Equity Ratio if the company decides to cover the 'external money needed' by raising new equity? (In the space below TI w R S D BUSI 2093 - Case Study (1) (BUSI 2093 Intro Z 3 What would be the impact on ROE & Debt Equity Ratio if the company decides to cover the 'external money needed by raising new equity? (In the space below calculate and write down the ROE & debt/equity ratios after raising new equity to cover the external money needed next year) (10 Points) Enter your answer Comment on your answers to questions (2) & (3), how would an increase in debt or equity impact the ROE and debt to equity ratios? (8 Points) Enter your answer 5 If the company has a strict target of not HID E SO D F BUSI 2093 - Case Study (1) (BUSI 2093 Intro Enter your answer C 5 If the company has a strict target of not exceeding a Debt-Equity ratio of 65% which option (raising debtor raising equity) would be the preferred option for the company based on your answers to questions (2) & (3)? (7 points) Raising Debt Raising Equity 6 If we assume that the company decided not to raise any external fund and depend solely on its own internally generated funds, what would be the maximum growth rate that it can achieve? (Do not round intermediate calculations, Round the final answer to 2 decimal places do not leave spaces and only add a % sign) (10 Points) MI O 3 E R S D X C BUSI 2093 - Case Study (1) (BUSI 2093 Intro If we assume that the company decided not to raise any external fund and depend solely on its own internally generated funds, what would be the maximum growth rate that it can achieve? (Do not round intermediate calculations. Round the final answer to 2 decimal places, do not leave spaces and only add a sign) (10 Points) Enter your answer What is the company's sustainable growth rate? (Do not round intermediate calculations Round the final answer to 2 decimal places, do not leave spaces and only add a % sign) (10 Points) Enter your answer HII w E R I? S D Z BUSI 2093 Case Study ( ) (BUSI 2093 Intro C V AE In addition to the planned 15% growth of the next year, the company is considering a future mega project of introducing a new entire production line that can increase its market share by 5%, The company is planning for this expansion to take place four years from today when the company's production team is better prepared for such a leap in production The total investment cost of this project is $3M, and the company wants to finance it by 50% debt and 50% equity 8) How much does the company need to save every year for the coming four years, to raise $1.5M, if its saving account earns an interest rate of 4%? (DO not round intermediate calculations Round the final answer to 2 decimal places, Omit commas, spaces and $ sign) (10 Points) Enter your answer 9 3 w E R S D F BUSI 2093 - Case Study (USA 2093 Intro 9 if the company cannot save more than $250,000 per year, how much would it be able to raise in 4 years time (given on interest rate on saving account of 4 (Do not round intermediate calculations Round the final answer to 2 decimal places, do not leave spaces, Omit commas, spaces or $ sign) (10 Points) + Enter your answer 10 How long would it take the company to cover the required $1.5M if it saves $250,000 a year? (In the space below write down the number of years and round your answer to two decimal places) (10 points) Enter your answer 8 E R T Y D F V BUSI 2093 - Case Study (1) (BUSI 2093 Intro nowe places, do not leave spaces, Omit commas, spaces or sign) (10 Points) Enter your answer 10 How long would it take the company to cover the required $1.5M if it soves $250,000 a year? (In the space below write down the number of years and round your answer to two decimal places) (10 Points) Enter your answer Submit The Colised by the owner of the form The data you Submit will be sent to the former Never give you Dowd Powered by Microsoft Privacy and colors Terms of 8:43 BUSI 2093 - Case Study (1) (BUSI 2093 Intro company is currently operamy autum capacity, fixed assets will also grow proportional to sales, same as current assets and current liabilities. However, long-term debt and equity will not grow proportional to sales but rather management will decide upon their next year level based on an acceptable level of debt to equity ratio as well as ROE ratio. The company has a dividend pay- out ratio of 40%, which the management want to maintain in order to meet the shareholders' expectations. Below are this financial statements of ABC Inc. for the year ending Sept 2020. 1) Determine the value of the "External money needed" for next year. (Do not round intermediate calculations. Round the final answer to 2 decimal places, Omit commas, spaces and $ sign) (10 Points) AN SE 100 20 30 TE T Enter your answer HT 8:44 BUSI 2093 - Case Study (1) (BUSI 2093 Intro... AC C WY MNE Enter your answer 2 What would be the impact on ROE & Debt Equity ratios if the company decides to cover the external money needed' by raising debt? (In the space below calculate and write down the current ROE & debt/equity ratios, and then calculate and write down both ratios after raising debt to cover the external money needed next year) (10 points) Enter your answer 3 What would be the impact on ROE & Debt Equity Ratio if the company decides to cover the 'external money needed' by raising new equity? (In the space below TI w R S D BUSI 2093 - Case Study (1) (BUSI 2093 Intro Z 3 What would be the impact on ROE & Debt Equity Ratio if the company decides to cover the 'external money needed by raising new equity? (In the space below calculate and write down the ROE & debt/equity ratios after raising new equity to cover the external money needed next year) (10 Points) Enter your answer Comment on your answers to questions (2) & (3), how would an increase in debt or equity impact the ROE and debt to equity ratios? (8 Points) Enter your answer 5 If the company has a strict target of not HID E SO D F BUSI 2093 - Case Study (1) (BUSI 2093 Intro Enter your answer C 5 If the company has a strict target of not exceeding a Debt-Equity ratio of 65% which option (raising debtor raising equity) would be the preferred option for the company based on your answers to questions (2) & (3)? (7 points) Raising Debt Raising Equity 6 If we assume that the company decided not to raise any external fund and depend solely on its own internally generated funds, what would be the maximum growth rate that it can achieve? (Do not round intermediate calculations, Round the final answer to 2 decimal places do not leave spaces and only add a % sign) (10 Points) MI O 3 E R S D X C BUSI 2093 - Case Study (1) (BUSI 2093 Intro If we assume that the company decided not to raise any external fund and depend solely on its own internally generated funds, what would be the maximum growth rate that it can achieve? (Do not round intermediate calculations. Round the final answer to 2 decimal places, do not leave spaces and only add a sign) (10 Points) Enter your answer What is the company's sustainable growth rate? (Do not round intermediate calculations Round the final answer to 2 decimal places, do not leave spaces and only add a % sign) (10 Points) Enter your answer HII w E R I? S D Z BUSI 2093 Case Study ( ) (BUSI 2093 Intro C V AE In addition to the planned 15% growth of the next year, the company is considering a future mega project of introducing a new entire production line that can increase its market share by 5%, The company is planning for this expansion to take place four years from today when the company's production team is better prepared for such a leap in production The total investment cost of this project is $3M, and the company wants to finance it by 50% debt and 50% equity 8) How much does the company need to save every year for the coming four years, to raise $1.5M, if its saving account earns an interest rate of 4%? (DO not round intermediate calculations Round the final answer to 2 decimal places, Omit commas, spaces and $ sign) (10 Points) Enter your answer 9 3 w E R S D F BUSI 2093 - Case Study (USA 2093 Intro 9 if the company cannot save more than $250,000 per year, how much would it be able to raise in 4 years time (given on interest rate on saving account of 4 (Do not round intermediate calculations Round the final answer to 2 decimal places, do not leave spaces, Omit commas, spaces or $ sign) (10 Points) + Enter your answer 10 How long would it take the company to cover the required $1.5M if it saves $250,000 a year? (In the space below write down the number of years and round your answer to two decimal places) (10 points) Enter your answer 8 E R T Y D F V BUSI 2093 - Case Study (1) (BUSI 2093 Intro nowe places, do not leave spaces, Omit commas, spaces or sign) (10 Points) Enter your answer 10 How long would it take the company to cover the required $1.5M if it soves $250,000 a year? (In the space below write down the number of years and round your answer to two decimal places) (10 Points) Enter your answer Submit The Colised by the owner of the form The data you Submit will be sent to the former Never give you Dowd Powered by Microsoft Privacy and colors Terms of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts