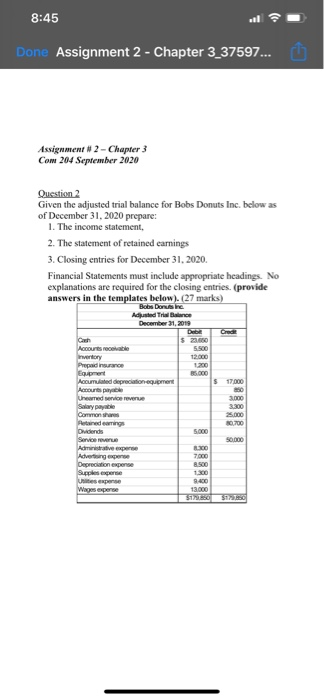

Question: 8:45 Done Assignment 2 - Chapter 3_37597... Assignment #2 - Chapter 3 Com 204 September 2020 Question 2 Given the adjusted trial balance for Bobs

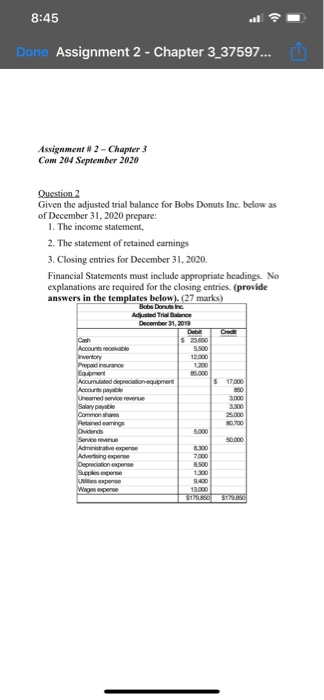

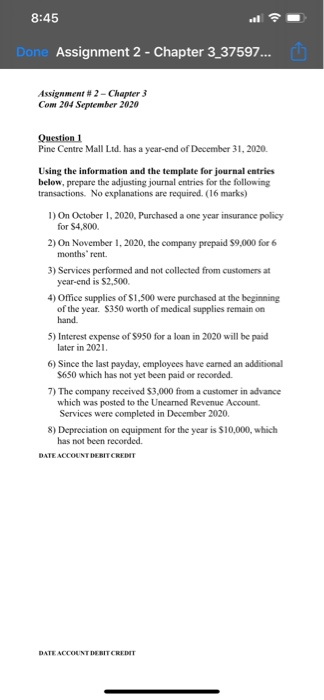

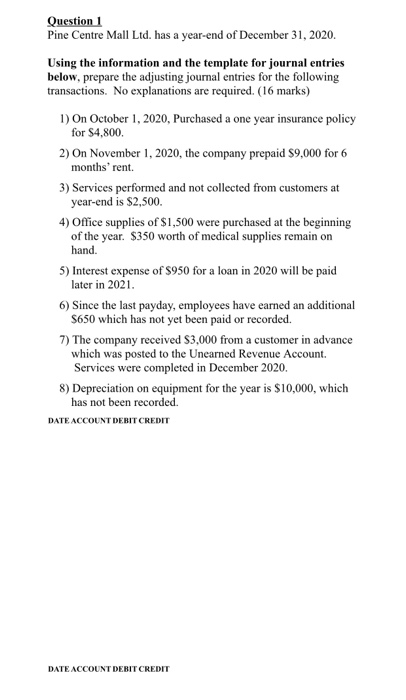

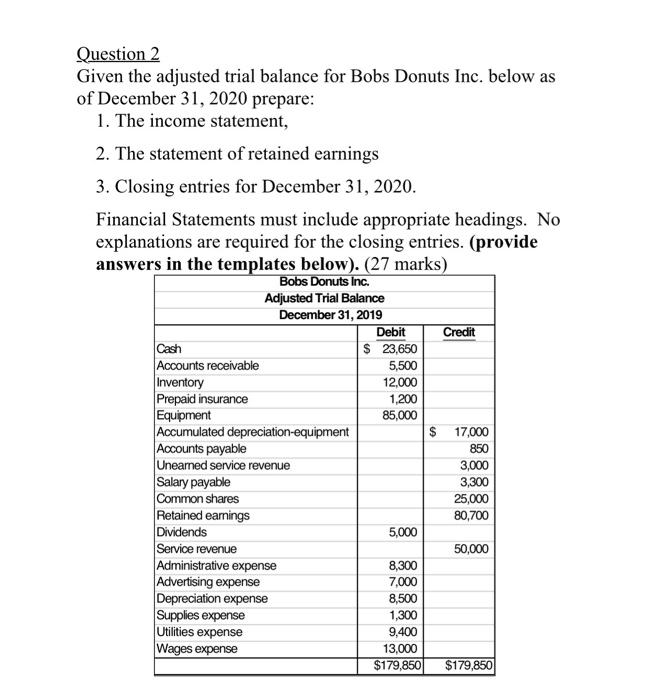

8:45 Done Assignment 2 - Chapter 3_37597... Assignment #2 - Chapter 3 Com 204 September 2020 Question 2 Given the adjusted trial balance for Bobs Donuts Inc. below as of December 31, 2020 prepare: 1. The income statement 2. The statement of retained earnings 3. Closing entries for December 31, 2020. Financial Statements must include appropriate headings. No explanations are required for the closing entries. (provide answers in the templates below). (27 marks) Bobs Dorus ne Adjusted Trial Balance December 31, 2019 C Accounts 12.000 1.200 $17.000 0 3.000 3.300 Accumulated depreciation equipment Accounts payable Unerred or Salay payable Commons Dividends Service Advertungen Depreciation expense 0.700 5.000 50.000 7.000 Uspense Wag expense 1.300 400 13.000 SINTO 8:45 Done Assignment 2 - Chapter 3_37597... Assignment #2 - Chapter 3 Com 204 September 2020 Question 2 Given the adjusted trial balance for Bobs Donuts Inc. below as of December 31, 2020 prepare: 1. The income statement 2. The statement of retained earnings 3. Closing entries for December 31, 2020. Financial Statements must include appropriate headings. No explanations are required for the closing entries. (provide answers in the templates below). (27 marks) Bobs Dorus ne Adjusted Trial Balance December 31, 2019 C Accounts 12.000 1.200 $17.000 0 3.000 3.300 Accumulated depreciation equipment Accounts payable Unerred or Salay payable Commons Dividends Service Advertungen Depreciation expense 0.700 5.000 50.000 7.000 Uspense Wag expense 1.300 400 13.000 SINTO 8:45 Done Assignment 2 - Chapter 3-37597... Assignment #2 - Chapter 3 Com 204 September 2020 Question 1 Pine Centre Mall Ltd. has a year-end of December 31, 2020. Using the information and the template for journal entries below, prepare the adjusting journal entries for the following transactions. No explanations are required. (16 marks) 1) On October 1, 2020, Purchased a one year insurance policy for $4.800 2) On November 1, 2020, the company prepaid $9,000 for 6 months' rent 3) Services performed and not collected from customers at year-end is S2,500 4) Office supplies of $1,500 were purchased at the beginning of the year. $350 worth of medical supplies remain on hand. 5) Interest expense of $950 for a loan in 2020 will be paid later in 2021. 6) Since the last payday, employees have cared an additional $650 which has not yet been paid or recorded. 7) The company received $3,000 from a customer in advance which was posted to the Unearned Revenue Account Services were completed in December 2020. 8) Depreciation on equipment for the year is $10,000, which has not been recorded. DATE ACCOUNT DEBIT CREDIT DATE ACCOUNT DEBIT CREDIT Question 1 Pine Centre Mall Ltd. has a year-end of December 31, 2020. Using the information and the template for journal entries below, prepare the adjusting journal entries for the following transactions. No explanations are required. (16 marks) 1) On October 1, 2020, Purchased a one year insurance policy for $4,800 2) On November 1, 2020, the company prepaid $9,000 for 6 months' rent 3) Services performed and not collected from customers at year-end is $2,500. 4) Office supplies of $1,500 were purchased at the beginning of the year. $350 worth of medical supplies remain on hand. 5) Interest expense of $950 for a loan in 2020 will be paid later in 2021. 6) Since the last payday, employees have earned an additional $650 which has not yet been paid or recorded. 7) The company received $3,000 from a customer in advance which was posted to the Unearned Revenue Account Services were completed in December 2020. 8) Depreciation on equipment for the year is $10,000, which has not been recorded. DATE ACCOUNT DEBIT CREDIT DATE ACCOUNT DEBIT CREDIT Question 2 Given the adjusted trial balance for Bobs Donuts Inc. below as of December 31, 2020 prepare: 1. The income statement, 2. The statement of retained earnings 3. Closing entries for December 31, 2020. Financial Statements must include appropriate headings. No explanations are required for the closing entries. (provide answers in the templates below). (27 marks) Bobs Donuts Inc. Adjusted Trial Balance December 31, 2019 Debit Credit Cash $ 23,650 Accounts receivable 5,500 Inventory 12,000 Prepaid insurance 1,200 Equipment 85,000 Accumulated depreciation equipment 17,000 Accounts payable 850 Unearned service revenue 3,000 Salary payable 3,300 Common shares 25,000 Retained earnings 80,700 Dividends 5,000 Service revenue 50,000 Administrative expense 8,300 Advertising expense 7,000 Depreciation expense 8,500 Supplies expense 1,300 Utilities expense 9,400 Wages expense 13,000 $179,850 $179,850 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts