Question: + 86% 1 20:02 Read Only - You can't save changes to t... that supply 6. For the purposes of the Goods and Services Tax

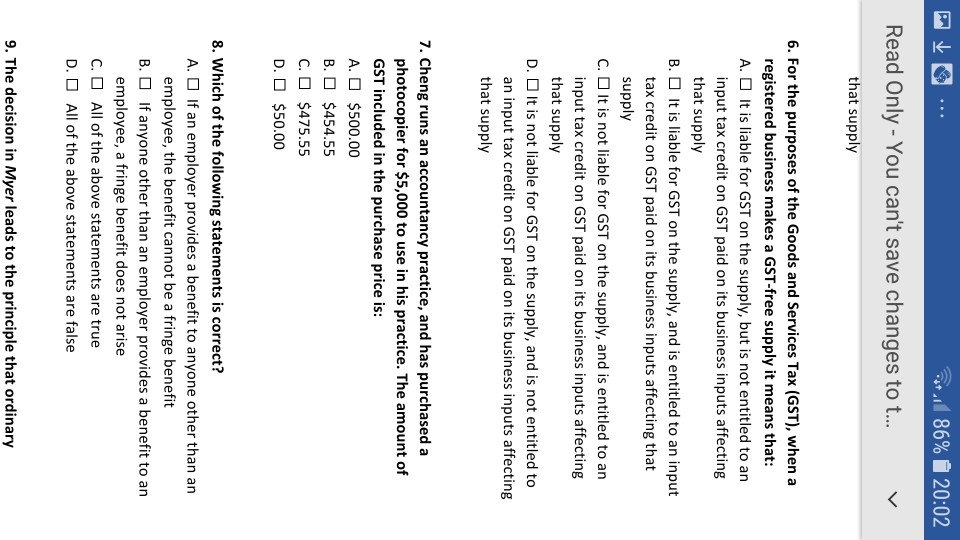

+ 86% 1 20:02 Read Only - You can't save changes to t... that supply 6. For the purposes of the Goods and Services Tax (GST), when a registered business makes a GST-free supply it means that: A. It is liable for GST on the supply, but is not entitled to an input tax credit on GST paid on its business inputs affecting that supply B. It is liable for GST on the supply, and is entitled to an input tax credit on GST paid on its business inputs affecting that supply C. It is not liable for GST on the supply, and is entitled to an input tax credit on GST paid on its business inputs affecting that supply D. It is not liable for GST on the supply, and is not entitled to an input tax credit on GST paid on its business inputs affecting that supply 7. Cheng runs an accountancy practice, and has purchased a photocopier for $5,000 to use in his practice. The amount of GST included in the purchase price is: A. O $500.00 B. O $454.55 C. O $475.55 D. O $50.00 8. Which of the following statements is correct? A. If an employer provides a benefit to anyone other than an employee, the benefit cannot be a fringe benefit B. If anyone other than an employer provides a benefit to an employee, a fringe benefit does not arise C. O All of the above statements are true D. O All of the above statements are false 9. The decision in Myer leads to the principle that ordinary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts