Question: + 86% 1 20:02 Read Only - You can't save changes to t... answer to each of these parts. For example, if you think the

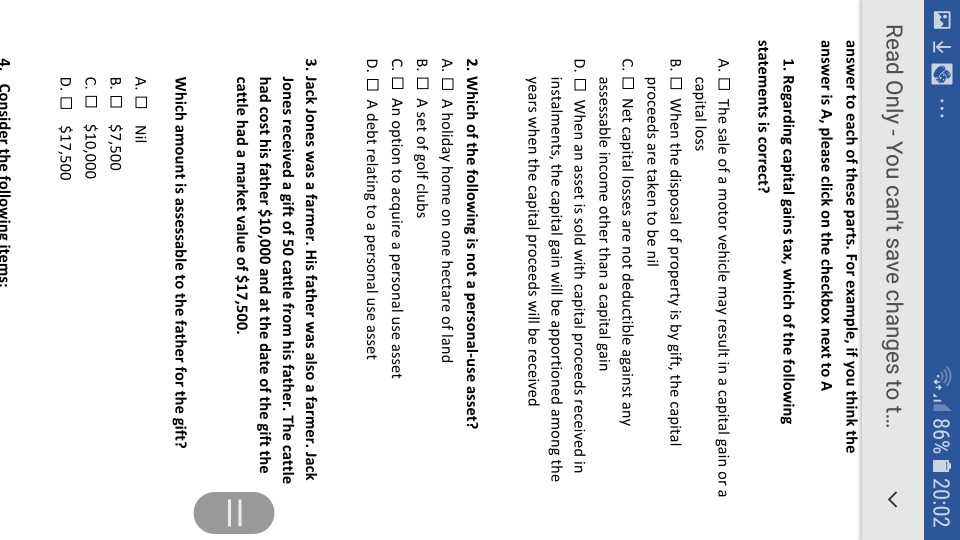

+ 86% 1 20:02 Read Only - You can't save changes to t... answer to each of these parts. For example, if you think the answer is A, please click on the checkbox next to A 1. Regarding capital gains tax, which of the following statements is correct? A. The sale of a motor vehicle may result in a capital gain or a capital loss B. When the disposal of property is by gift, the capital proceeds are taken to be nil C. O Net capital losses are not deductible against any assessable income other than a capital gain D. O When an asset is sold with capital proceeds received in instalments, the capital gain will be apportioned among the years when the capital proceeds will be received 2. Which of the following is not a personal use asset? A. O A holiday home on one hectare of land B. A set of golf clubs C. An option to acquire a personal use asset D. O A debt relating to a personal use asset 3. Jack Jones was a farmer. His father was also a farmer. Jack Jones received a gift of 50 cattle from his father. The cattle had cost his father $10,000 and at the date of the gift the cattle had a market value of $17,500. = Which amount is assessable to the father for the gift? A. O Nil B. O $7,500 C. O $10,000 D. O $17,500 4. Consider the following items

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts