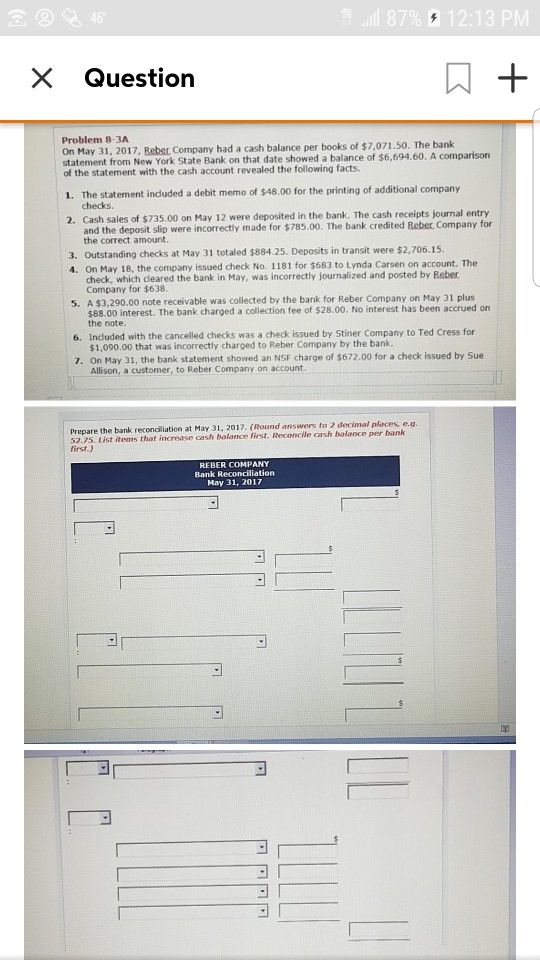

Question: 87% 12:13 PM Question Problem 8-3A On May 31, 2017, Reber Company had a cash balance per statement from New York State Bank on that

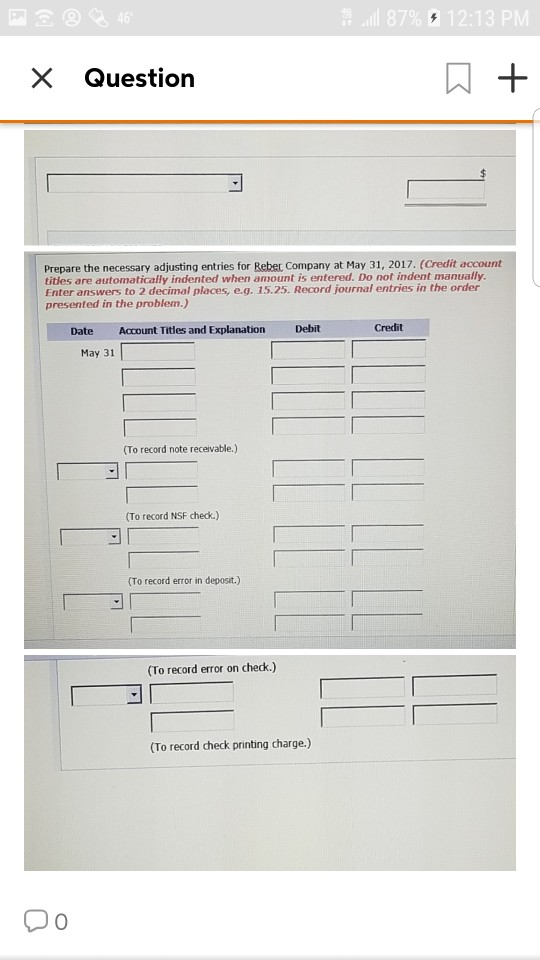

87% 12:13 PM Question Problem 8-3A On May 31, 2017, Reber Company had a cash balance per statement from New York State Bank on that date showed a balance of $6,694.60. A comparison of the statement with the cash account revealed the following facts. The statement induded a debit memo of $48.00 for the printing of additional company checks 1. 2. Cash sales of $735.00 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $785.00. The bank credited Beber, Company for the correct amount. tstanding checks at May 31 totaled $884.25. Deposits in transit were $2,706.15 4. On May 18, the company issued check No. 1181 for $683 to Lynda Carsen on account. The check, which deared the bank in May, was incorrectly journalized and posted by Reber Company for $638 $3,290.00 note receivable was collected by the bank for Reber Company on May 31 plus $88.00 interest. The bank charged a collection fee of $28.00. No interest has been accrued on the note 6. Induded with the cancelled checks was a check issued by Stiner Company to Ted Cress for $1,090.00 that was incorrectly charged to Reber Company by the bank . On May 31, the bank statement showed an NSF charge of $672.00 for a check issued by Sue Prepare the bank recondiliation at May 31, 2017. (Round answers to 2 decimal places, first.) Reconcile REBER COMPANY May 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts