Question: 87% 20:00 Read Only - You can't save changes to t... Question 1 ABC Pty Ltd sells upmarket washing machines. It had $200,000 stock on

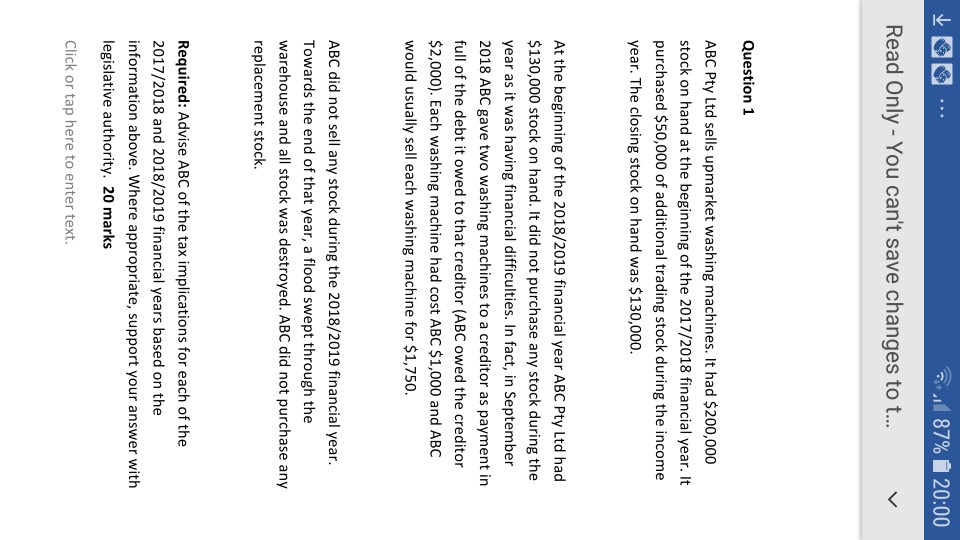

87% 20:00 Read Only - You can't save changes to t... Question 1 ABC Pty Ltd sells upmarket washing machines. It had $200,000 stock on hand at the beginning of the 2017/2018 financial year. It purchased $50,000 of additional trading stock during the income year. The closing stock on hand was $130,000. At the beginning of the 2018/2019 financial year ABC Pty Ltd had $130,000 stock on hand. It did not purchase any stock during the year as it was having financial difficulties. In fact, in September 2018 ABC gave two washing machines to a creditor as payment in full of the debt it owed to that creditor (ABC owed the creditor $2,000). Each washing machine had cost ABC $1,000 and ABC would usually sell each washing machine for $1,750. ABC did not sell any stock during the 2018/2019 financial year. Towards the end of that year, a flood swept through the warehouse and all stock was destroyed. ABC did not purchase any replacement stock. Required: Advise ABC of the tax implications for each of the 2017/2018 and 2018/2019 financial years based on the information above. Where appropriate, support your answer with legislative authority. 20 marks Click or tap here to enter text

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts