Question: 88. Hightow Ltd. is replacing its computer equipment network that was purchased four years ago with a new network. The original cost of the

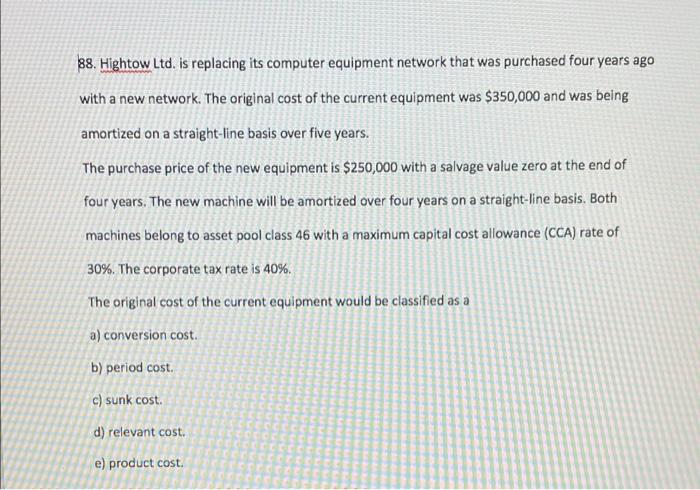

88. Hightow Ltd. is replacing its computer equipment network that was purchased four years ago with a new network. The original cost of the current equipment was $350,000 and was being amortized on a straight-line basis over five years. The purchase price of the new equipment is $250,000 with a salvage value zero at the end of four years. The new machine will be amortized over four years on a straight-line basis. Both machines belong to asset pool class 46 with a maximum capital cost allowance (CCA) rate of 30%. The corporate tax rate is 40%. The original cost of the current equipment would be classified as a a) conversion cost. b) period cost. c) sunk cost. d) relevant cost. e) product cost.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Sunk cost Cost that is incurred in past and it is not relevant for decisio... View full answer

Get step-by-step solutions from verified subject matter experts