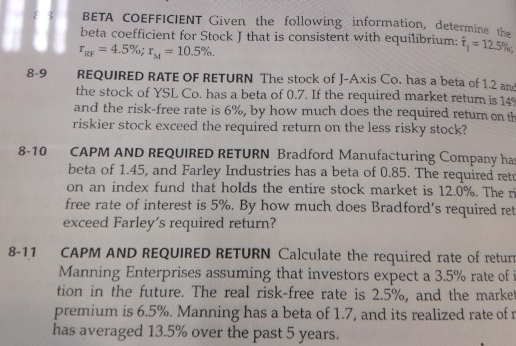

Question: 8-9 8-10 BETA COEFFICIENT Given the following information, determine the beta coefficient for Stock J that is consistent with equilibrium: f. = 12.5% FIRE =

8-9 8-10 BETA COEFFICIENT Given the following information, determine the beta coefficient for Stock J that is consistent with equilibrium: f. = 12.5% FIRE = 4.5%; r = 10.5% REQUIRED RATE OF RETURN The stock of J-Axis Co. has a beta of 1.2 and the stock of YSL Co. has a beta of 0.7. If the required market return is 149 and the risk-free rate is 6%, by how much does the required return on the riskier stock exceed the required return on the less risky stock? CAPM AND REQUIRED RETURN Bradford Manufacturing Company has beta of 1.45, and Farley Industries has a beta of 0.85. The required rett on an index fund that holds the entire stock market is 12.0%. The free rate of interest is 5%. By how much does Bradford's required ret exceed Farley's required return? CAPM AND REQUIRED RETURN Calculate the required rate of returi Manning Enterprises assuming that investors expect a 3.5% rate of i tion in the future. The real risk-free rate is 2.5%, and the market premium is 6.5%. Manning has a beta of 1.7, and its realized rate of has averaged 13.5% over the past 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts