Question: 8C. Assemble the following from previous continuous problems: (1) the governmental funds Balance Sheet and Statement of Revenues, Expenditures, and Changes in Fund Balances from

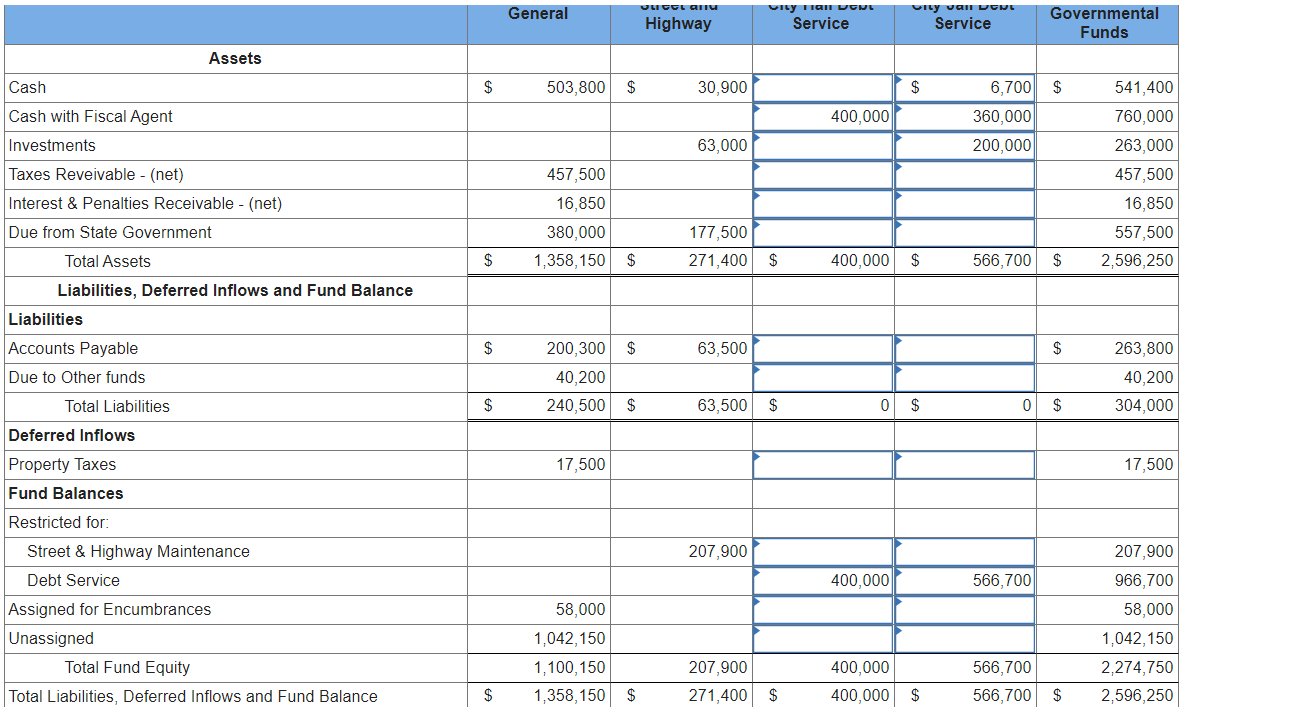

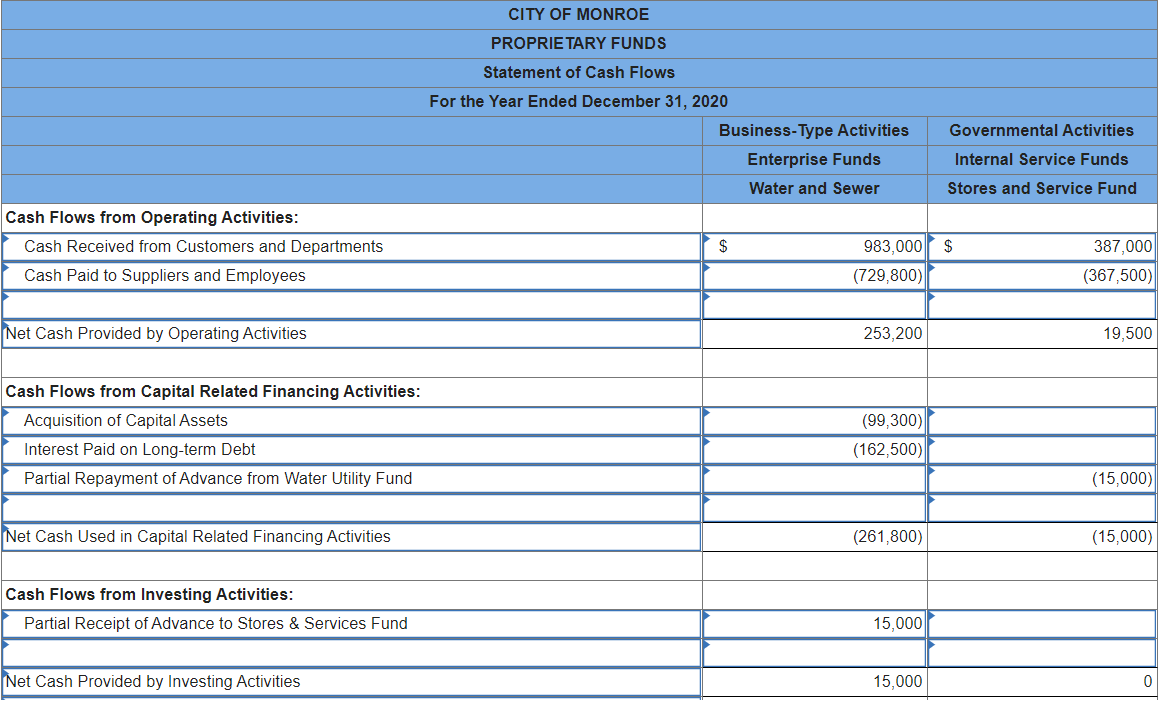

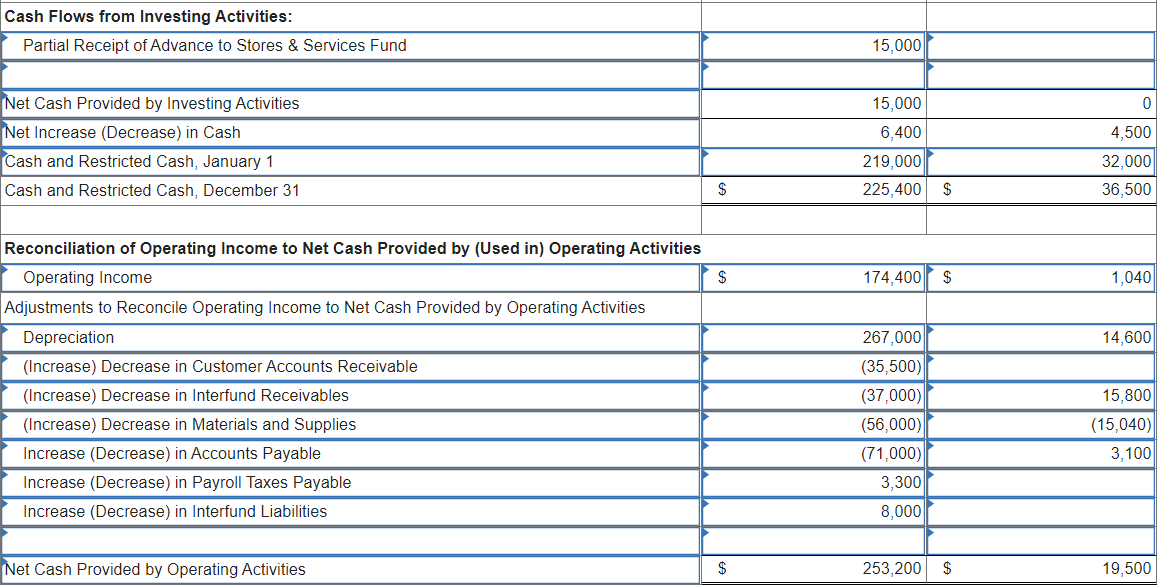

8C. Assemble the following from previous continuous problems: (1) the governmental funds Balance Sheet and Statement of Revenues, Expenditures, and Changes in Fund Balances from Section 5C; (3) the proprietary funds Statement of Net Position and Statement of Revenues, Expenses, and Changes in Fund Net Position from Section 6C. Required: 1. Start a worksheet for adjustments, using the trial balance format illustrated in the text (i.e. list accounts with debit balances first, then accounts with credit balances). Enter the balances from the governmental funds financial statements prepared for Section 5-C. When doing this, follow the following guidelines:

- Net Position: Use a single account for net position (which will include the beginning balance of all fund balance accounts).

- Intergovernmental Revenues: When setting up the worksheet, set up separate lines for the intergovernmental revenues as follows:

State Grant for Highway and Street Maintenance - 1,067,500

Operational Grant-General Government - 332,000

Capital Grant-Public Safety - 1,335,000

Total - 2,734,500

- Capital Assets: It is not necessary to set up separate lines for different classes of capital (fixed) assets or accumulated depreciation (simply use one row for Capital Assets and another for Accumulated Depreciation).

- Confirm that the total debits and credits equal.

2. Prepare worksheet entries and post to the worksheet for the following items. Identify each adjustment by the letter used in the problem:

- Record the January 1, 2020 balances of general fixed asset and related accumulated depreciation accounts. The City of Monroe had the following balances (excluding Internal Service Funds):

Cost Accumulated Depreciation

Totals 67,900,000 32,000,000

- Eliminate the capital expenditures shown in the governmental funds Statement of Revenues, Expenditures, and Changes in Fund Balances.

- Depreciation Expense (governmental activities) for the year totaled $5,130,000.

- Eliminate the other financing sources from the sale of bonds by recording a liability for bonds payable and the related premium.

- As of January 1, 2020, the City of Monroe had $12,000,000 in general obligation bonds outstanding.

- Eliminate the expenditures for bond principal.

- Accrue interest in the amount of $328,000. (Two bond issues were outstanding; interest payments for both were last made on July 1, 2020. The computation is as follows: ($11,200,000 0.03 6/12) + ($4,000,000 0.08 6/12) = $328,000).

- Adjust for the interest accrued in the prior year government-wide statements, but recorded as an expenditure in the 2020 fund basis statements, ($12,000,000 0.03 6/12) = $180,000.

- Amortize bond premium in the amount of $10,000.

- Make adjustments for additional revenue accrual. The only adjustment is for property taxes to eliminate the current year deferral of property taxes.

- Adjust for the $21,000 of property taxes that was deferred in 2019 and recognized as revenue in the 2020 fund-basis statements.

- Assume the City adopted a policy in 2020 of allowing employees to accumulate compensated absences. Make an adjustment accruing the expense of $42,000 Charge compensated absences expense.

- Bring in the balances of the internal service fund balance sheet accounts. Again, use a single account for all capital assets and a second account for all accumulated depreciation balances (use a separate column of the worksheet to enter Internal Service Fund entries).

- No revenues from internal service funds were with external parties. Assume $3,200 of the $11,200 Due from Other Funds in the internal service accounts represents a receivable from the General Fund and the remaining $8,000 is due from the enterprise fund. Eliminate the $3,200 interfund receivables.

- Reduce governmental fund expenses by the net operating profit of internal service funds. As the amount is small, reduce general government expenses for the entire amount.

- Eliminate transfers that are between departments reported within governmental activities.

3. Prepare a Statement of Activities for the City of Monroe for the Year Ended December 31, 2020. For purposes of this statement, assume:

- $332,000 in the General Fund is a state grant specifically to support general government programs.

- $1,067,500 in the Street and Highway Fund is an operating grant specifically for highway and street maintenance expenses.

- $1,335,000 in the City Jail Construction Fund is a capital grant that applies to public safety.

Use the balances computed from the worksheet completed in part 2 for the governmental activities portion of the statement. Use the solution to P6C (Enterprise fund) to prepare the business activities portion (net any short-term interfund payables/receivables). 4. Prepare a Statement of Net Position for the City of Monroe as of December 31, 2020. Group all capital assets, net of depreciation. Include a breakdown in the Net Position section for (a) Capital Assets, net of related debt, (b) Restricted, and (c) Unrestricted. For purposes of classifying net position for the governmental activities, assume:

- For the governmental activities net position invested in capital assets, net of related debt, the related debt includes the bonds payable, the premium on bonds payable, and the advance from the water utility fund.

- The special revenue fund resources are restricted by the granting agency for street and highway maintenance. Assume $204,500 are the only restricted resources in the governmental activities.

5. Prepare the reconciliation necessary to convert from the fund balance reported in the governmental funds Balance Sheet to the Net Position in the government-wide Statement of Net Position. 6. Prepare the reconciliation necessary to convert from the change in fund balances in the governmental funds Statement of Revenues, Expenditures, and Changes in Fund Balances to the change in net position in the government-wide Statement of Activities.

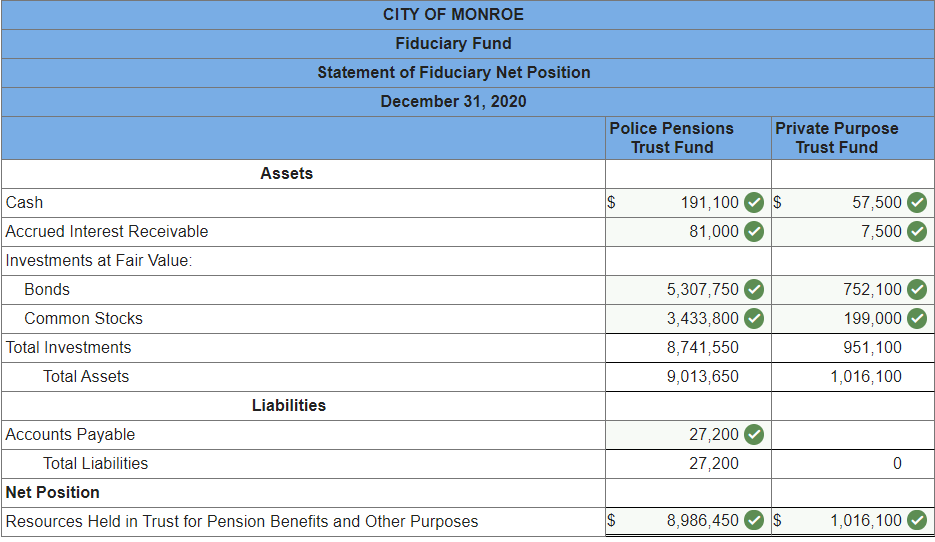

** Below, I have attached the 5-C Balance Sheet, 6-C Statement of Cash Flows, and 7-C Statement of Net Position. Please let me know if you need anything else.**

General Highway VILy Tran Nu Service Ully vall LONU Service Governmental Funds Assets Cash $ 503,800 $ 30,900 $ 6,700 $ 400,000 360,000 200,000 63,000 Cash with Fiscal Agent Investments Taxes Reveivable - (net) Interest & Penalties Receivable - (net) Due from State Government 457,500 16,850 380,000 1,358,150 541,400 760,000 263,000 457,500 16,850 557,500 2,596,250 177,500 271,400 Total Assets $ $ $ 400,000 $ 566,700 $ Liabilities, Deferred Inflows and Fund Balance Liabilities $ $ 63,500 $ 263,800 Accounts Payable Due to Other funds 200,300 40,200 240,500 40,200 Total Liabilities $ $ 63,500 $ 0 $ 0 $ 304,000 Deferred Inflows 17,500 17,500 Property Taxes Fund Balances Restricted for Street & Highway Maintenance 207,900 207,900 400,000 566,700 Debt Service Assigned for Encumbrances Unassigned Total Fund Equity Total Liabilities, Deferred Inflows and Fund Balance 58,000 1,042, 150 1,100,150 1,358,150 966,700 58,000 1,042, 150 2,274,750 2,596,250 207,900 271,400 $ 400,000 400,000 566,700 566,700 $ $ $ $ CITY OF MONROE PROPRIETARY FUNDS Statement of Cash Flows For the Year Ended December 31, 2020 Business-Type Activities Enterprise Funds Water and Sewer Governmental Activities Internal Service Funds Stores and Service Fund Cash Flows from Operating Activities: Cash Received from Customers and Departments Cash Paid to Suppliers and Employees $ $ 983,000 (729,800) 387,000 (367,500) Net Cash Provided by Operating Activities 253,200 19,500 Cash Flows from Capital Related Financing Activities: Acquisition of Capital Assets Interest Paid on Long-term Debt Partial Repayment of Advance from Water Utility Fund (99,300) (162,500) (15,000) Net Cash Used in Capital Related Financing Activities (261,800) (15,000) Cash Flows from Investing Activities: Partial Receipt of Advance to Stores & Services Fund 15,000 Net Cash Provided by Investing Activities 15,000 0 Cash Flows from Investing Activities: Partial Receipt of Advance to Stores & Services Fund 15,000 15,000 0 Net Cash Provided by Investing Activities Net Increase (Decrease) in Cash Cash and Restricted Cash, January 1 Cash and Restricted Cash, December 31 6,400 219,000 4,500 32,000 36,500 $ 225,400 $ $ 174,400 $ 1,040 14,600 Reconciliation of Operating Income to Net Cash Provided by (Used in) Operating Activities Operating Income Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Activities Depreciation (Increase) Decrease in Customer Accounts Receivable (Increase) Decrease in Interfund Receivables (Increase) Decrease in Materials and Supplies Increase (Decrease) in Accounts Payable Increase (Decrease) in Payroll Taxes Payable Increase (Decrease) in Interfund Liabilities 267,000 (35,500) (37,000) (56,000) (71,000) 3,300 8,000 15,800 (15,040) 3,100 Net Cash Provided by Operating Activities $ 253,200 $ 19,500 CITY OF MONROE Fiduciary Fund Statement of Fiduciary Net Position December 31, 2020 Police Pensions Trust Fund Private Purpose Trust Fund Assets $ $ 191,100 81,000 57,500 7,500 Cash Accrued Interest Receivable Investments at Fair Value: Bonds Common Stocks Total Investments Total Assets Liabilities Accounts Payable Total Liabilities Net Position Resources Held in Trust for Pension Benefits and Other Purposes 5,307,750 3,433,800 8,741,550 9,013,650 752,100 199,000 951,100 1,016,100 27,200 27,200 0 $ 8,986,450 $ $ 1,016,100 General Highway VILy Tran Nu Service Ully vall LONU Service Governmental Funds Assets Cash $ 503,800 $ 30,900 $ 6,700 $ 400,000 360,000 200,000 63,000 Cash with Fiscal Agent Investments Taxes Reveivable - (net) Interest & Penalties Receivable - (net) Due from State Government 457,500 16,850 380,000 1,358,150 541,400 760,000 263,000 457,500 16,850 557,500 2,596,250 177,500 271,400 Total Assets $ $ $ 400,000 $ 566,700 $ Liabilities, Deferred Inflows and Fund Balance Liabilities $ $ 63,500 $ 263,800 Accounts Payable Due to Other funds 200,300 40,200 240,500 40,200 Total Liabilities $ $ 63,500 $ 0 $ 0 $ 304,000 Deferred Inflows 17,500 17,500 Property Taxes Fund Balances Restricted for Street & Highway Maintenance 207,900 207,900 400,000 566,700 Debt Service Assigned for Encumbrances Unassigned Total Fund Equity Total Liabilities, Deferred Inflows and Fund Balance 58,000 1,042, 150 1,100,150 1,358,150 966,700 58,000 1,042, 150 2,274,750 2,596,250 207,900 271,400 $ 400,000 400,000 566,700 566,700 $ $ $ $ CITY OF MONROE PROPRIETARY FUNDS Statement of Cash Flows For the Year Ended December 31, 2020 Business-Type Activities Enterprise Funds Water and Sewer Governmental Activities Internal Service Funds Stores and Service Fund Cash Flows from Operating Activities: Cash Received from Customers and Departments Cash Paid to Suppliers and Employees $ $ 983,000 (729,800) 387,000 (367,500) Net Cash Provided by Operating Activities 253,200 19,500 Cash Flows from Capital Related Financing Activities: Acquisition of Capital Assets Interest Paid on Long-term Debt Partial Repayment of Advance from Water Utility Fund (99,300) (162,500) (15,000) Net Cash Used in Capital Related Financing Activities (261,800) (15,000) Cash Flows from Investing Activities: Partial Receipt of Advance to Stores & Services Fund 15,000 Net Cash Provided by Investing Activities 15,000 0 Cash Flows from Investing Activities: Partial Receipt of Advance to Stores & Services Fund 15,000 15,000 0 Net Cash Provided by Investing Activities Net Increase (Decrease) in Cash Cash and Restricted Cash, January 1 Cash and Restricted Cash, December 31 6,400 219,000 4,500 32,000 36,500 $ 225,400 $ $ 174,400 $ 1,040 14,600 Reconciliation of Operating Income to Net Cash Provided by (Used in) Operating Activities Operating Income Adjustments to Reconcile Operating Income to Net Cash Provided by Operating Activities Depreciation (Increase) Decrease in Customer Accounts Receivable (Increase) Decrease in Interfund Receivables (Increase) Decrease in Materials and Supplies Increase (Decrease) in Accounts Payable Increase (Decrease) in Payroll Taxes Payable Increase (Decrease) in Interfund Liabilities 267,000 (35,500) (37,000) (56,000) (71,000) 3,300 8,000 15,800 (15,040) 3,100 Net Cash Provided by Operating Activities $ 253,200 $ 19,500 CITY OF MONROE Fiduciary Fund Statement of Fiduciary Net Position December 31, 2020 Police Pensions Trust Fund Private Purpose Trust Fund Assets $ $ 191,100 81,000 57,500 7,500 Cash Accrued Interest Receivable Investments at Fair Value: Bonds Common Stocks Total Investments Total Assets Liabilities Accounts Payable Total Liabilities Net Position Resources Held in Trust for Pension Benefits and Other Purposes 5,307,750 3,433,800 8,741,550 9,013,650 752,100 199,000 951,100 1,016,100 27,200 27,200 0 $ 8,986,450 $ $ 1,016,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts