Question: 9 , 0 0 0 IS WRONG * * * * Answer is not complete. Complete this question by entering your answers in the tabs

IS WRONG Answer is not complete.

Complete this question by entering your answers in the tabs below.

In order to compare performance with Company A estimate what Bs depreciation expense would have been for if the

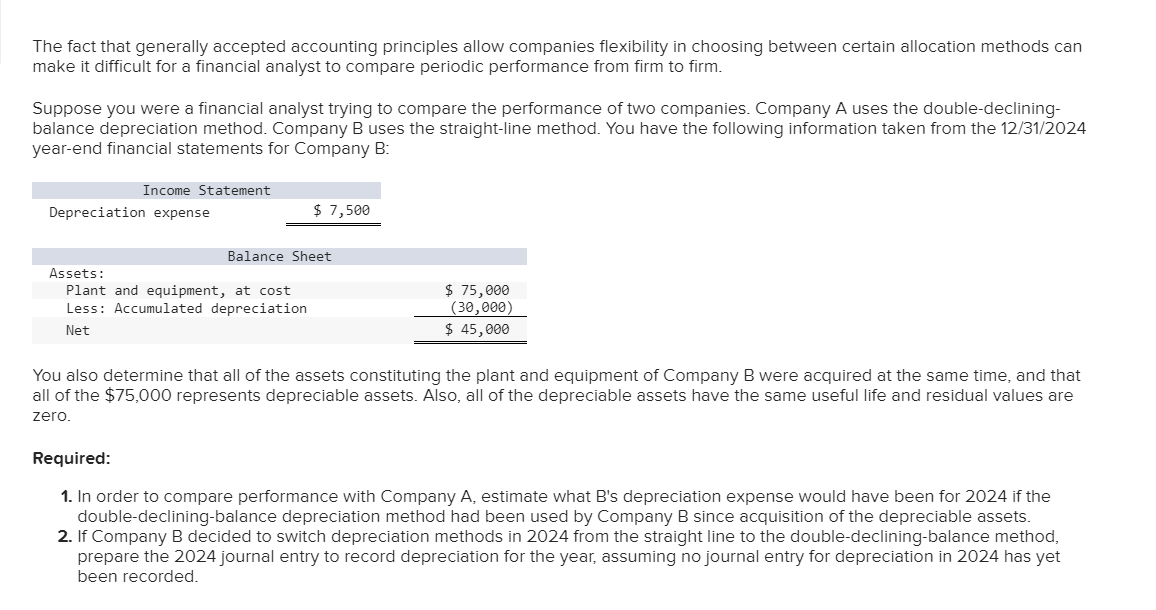

doubledecliningbalance depreciation method had been used by Company B since acquisition of the depreciable assets.The fact that generally accepted accounting principles allow companies flexibility in choosing between certain allocation methods can

make it difficult for a financial analyst to compare periodic performance from firm to firm.

Suppose you were a financial analyst trying to compare the performance of two companies. Company A uses the doubledeclining

balance depreciation method. Company B uses the straightline method. You have the following information taken from the

yearend financial statements for Company B:

You also determine that all of the assets constituting the plant and equipment of Company B were acquired at the same time, and that

all of the $ represents depreciable assets. Also, all of the depreciable assets have the same useful life and residual values are

zero.

Required:

In order to compare performance with Company A estimate what Bs depreciation expense would have been for if the

doubledecliningbalance depreciation method had been used by Company B since acquisition of the depreciable assets.

If Company B decided to switch depreciation methods in from the straight line to the doubledecliningbalance method,

prepare the journal entry to record depreciation for the year, assuming no journal entry for depreciation in has yet

been recorded.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock