Question: ( $ 9 1 , 0 0 0 ) . Under the 3 - year, non - cancelable contract, Cullumber will receive

$ Under the year, noncancelable contract, Cullumber will receive title to the machine at the end of the lease. The machine has a year useful life and no residual value. The lease was signed on January Crane expects to earn an return on its investment, and this implicit rate is known by Cullumber. The annual rentals are payable on each December beginning December

Click here to view factor tables.

b

Your answer is correct.

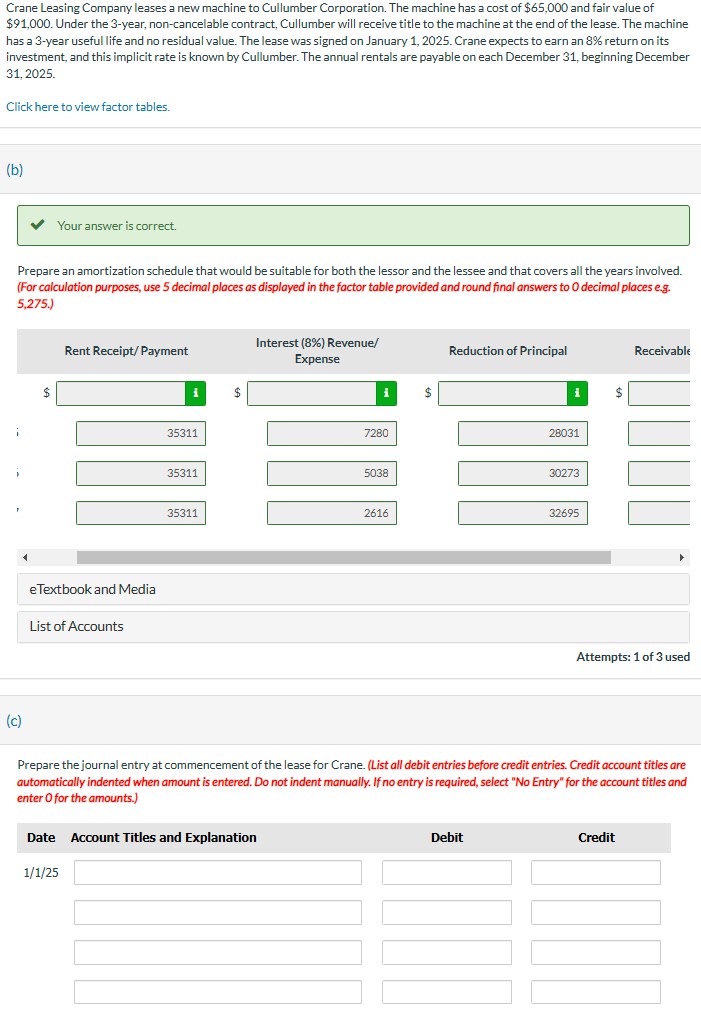

Prepare an amortization schedule that would be suitable for both the lessor and the lessee and that covers all the years involved. For calculation purposes, use decimal places as displayed in the factor table provided and round final answers to decimal places eg

List of Accounts

Attempts: of used

c

Prepare the journal entry at commencement of the lease for Crane. List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter O for the amounts.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock