Question: 9. (?) 10. (b) 11. (?) 12. (c) Chapter 10 9. When prevailing rates rise what should happen to most fixed rate bonds in the

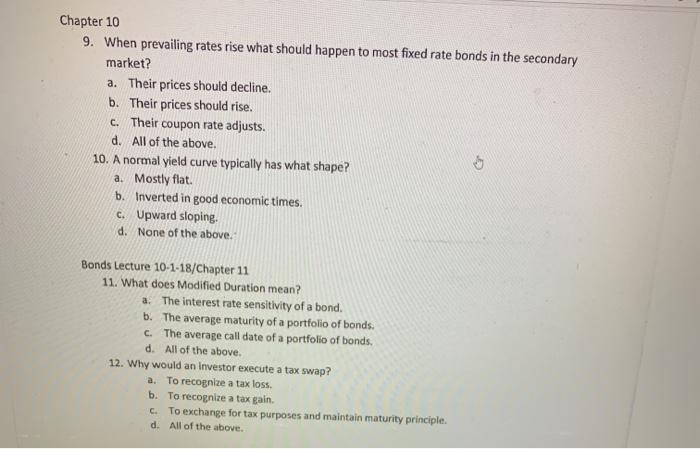

Chapter 10 9. When prevailing rates rise what should happen to most fixed rate bonds in the secondary market? a. Their prices should decline. b. Their prices should rise. c. Their coupon rate adjusts. d. All of the above. 10. A normal yield curve typically has what shape? a. Mostly flat. b. Inverted in good economic times. c. Upward sloping. d. None of the above. Cr Bonds Lecture 10-1-18/Chapter 11 11. What does Modified Duration mean? a. The interest rate sensitivity of a bond. b. The average maturity of a portfolio of bonds. C. The average call date of a portfolio of bonds. d. All of the above. 12. Why would an investor execute a tax swap? a. To recognize a tax loss. b. To recognize a tax gain. C. To exchange for tax purposes and maintain maturity principle. d. All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts