Question: 9. 15.1 (only for initial values) On March 1, 2020, Farmworth Company is entering liquidation. The book value of its assets total $400,000, including $10,000

9.

15.1 (only for initial values)

On March 1, 2020, Farmworth Company is entering liquidation. The book value of its assets total $400,000, including $10,000 in cash, and the book value of its liabilities total $360,000. Additional information is as follows:

1. Expected proceeds from reported assets other than cash are:

Receivables, $30,000

Inventory, $70,000

Plant and equipment, $175,000

2. Expected costs of liquidating assets are $25,000.

Required

a. Calculate the cumulative effect of the adjustment to Farmworths net assets due to adoption of the liquidation basis of accounting.

Use a negative sign with your answer if the cumulative effect reduces net assets.

-140,000

b. Prepare a statement of net assets in liquidation as of March 1, 2020

Use a negative sign with your net assets answer, if appropriate.

| Farmworth Company Statement of Net Assets in Liquidation March 1, 2020 | |

|---|---|

| Assets | |

| Cash | 10,000

|

| Receivables | 30,000

|

| Inventory | 70,000

|

| Plant and equipment | 175,000

|

| Total assets | 285,000

|

| Liabilities | |

| Reported liabilities | 360,000

|

| Accrued liquidation cost | 25,000

|

| Total liabilities | 385,000

|

| Net assets | -100,000 |

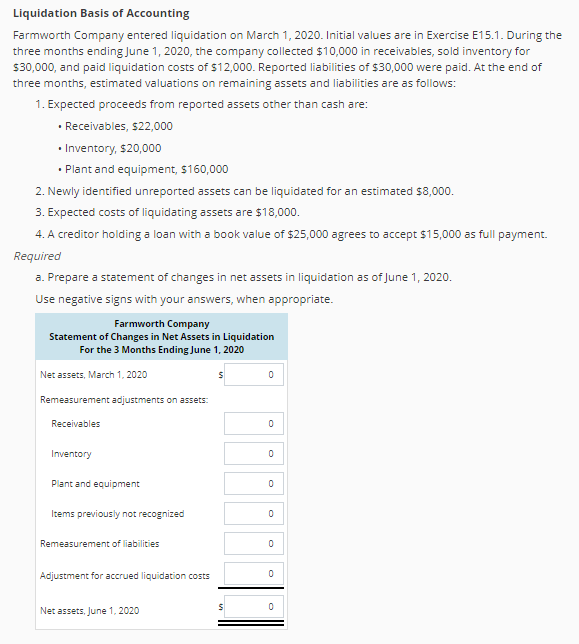

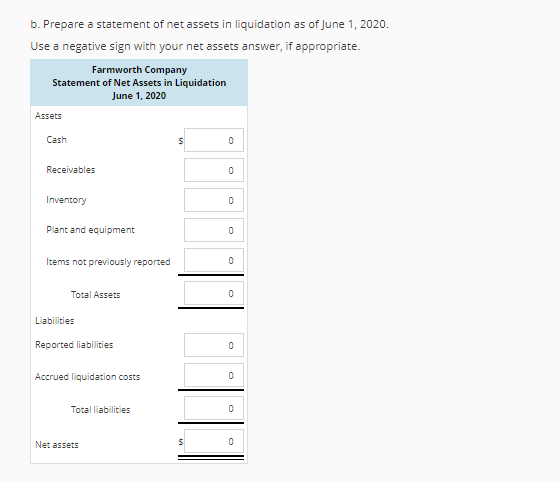

Liquidation Basis of Accounting Farmworth Company entered liquidation on March 1, 2020. Initial values are in Exercise E15.1. During the three months ending June 1, 2020, the company collected $10,000 in receivables, sold inventory for 30,000, and paid liquidation costs of $12,000. Reported liabilities of $30,000 were paid. At the end of three months, estimated valuations on remaining assets and liabilities are as follows 1. Expected proceeds from reported assets other than cash are Receivables, $22,000 Inventory, $2,000 Plant and equipment, $160,000 2. Newly identified unreported assets can be liquidated for an estimated $8,000. 3. Expected costs of liquidating assets are $18,000. Required Prespare asatement a302 Use negative signs with your answers, when appropriate. Farmworth Company Statement of Changes in Net Assets in Liquidation For the 3 Months Ending June 1, 2020 Net assets, March 1, 2020 Remeasurement adjustments on assets: Receivables tl Inventory Plant and equipment Items previously not recognized bl Adjustment for accrued liquidation costs Net assets, June 1, 2020 b. Prepare a statement of net assets in liquidation as of June 1, 2020. Use a negative sign with your net assets answer, if appropriate. Farmworth Company Statement of Net Assets in Liquidation June 1, 2020 Assets Cash Receivables Ines f.INy Plant and equipment Items not previously reported Total Assets lies Reported liabilities Accrued liquidation costs Total liabilities Net assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts