Question: 9 : 2 2 EJERCICIOS PRACTICA.docx OK Ejercicio de Pr ctica 5 Cash Flows Statement The comparative balance sheet of C . T . Green

:

EJERCICIOS PRACTICA.docx

OK

Ejercicio de Prctica

Cash Flows Statement

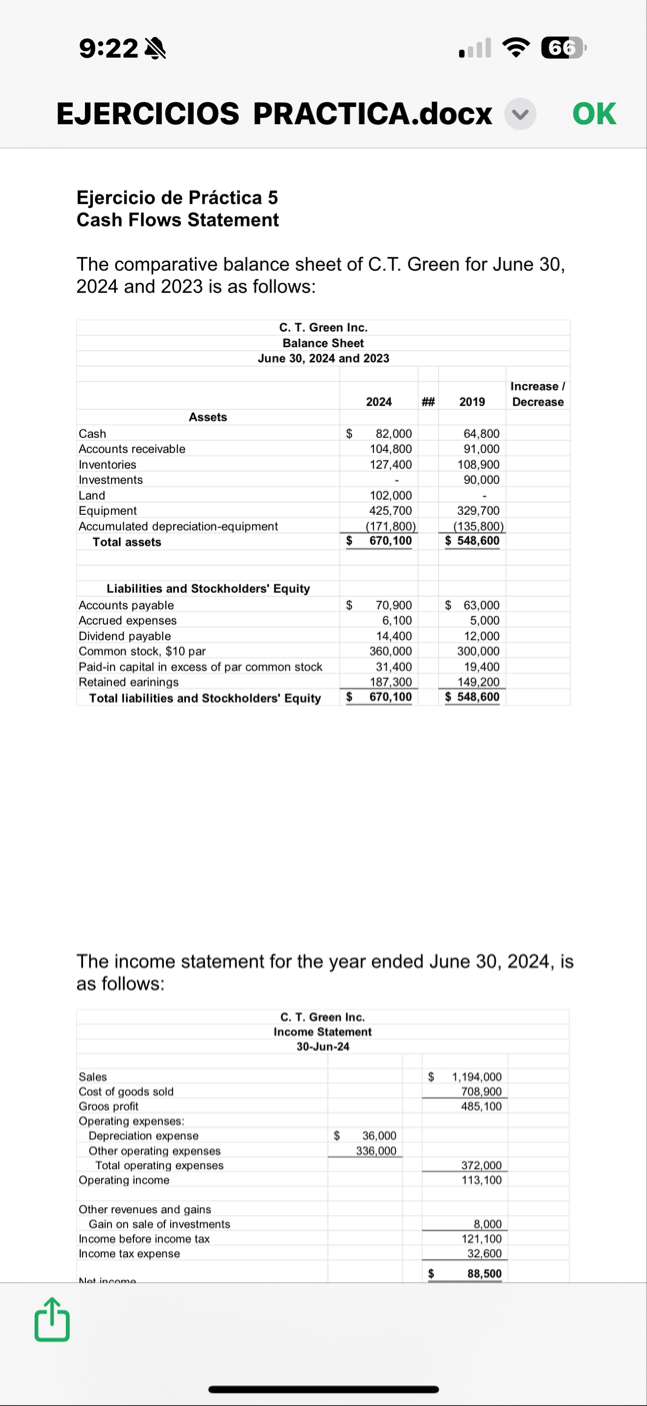

The comparative balance sheet of CT Green for June and is as follows:

tableC T Green Inc.Balance SheetJune and ##Increase DecreaseAssetsCash$ Accounts receivable,InventoriesInvestmentsLandEquipmentAccumulated depreciationequipment,Total assets,$ $ Liabilities and Stockholders' Equity,,,,Accounts payable,$ $ Accrued expenses,Dividend payable,Common stock, $ par,Paidin capital in excess of par common stock,Retained earinings,Total liabilities and Stockholders' Equity,$ $

The income statement for the year ended June is as follows:

tableC T Green Inc.Income StatementJunSales$ Cost of goods sold,,Groos profit,,Operating expenses:,,,Depreciation expense,$ Other operating expenses,Total operating expenses,,Operating income,,Other revenues and gains,,,Gain on sale of investments,,Income before income tax,,Income tax expense,,Nat inarma,,$

:

EJERCICIOS PRACTICA.docx

OK

The income statement for the year ended June is as follows:

tableC T Green Inc.Income StatementJunSales$ Cost of goods sold,,Groos profit,,Operating expenses:,,,Depreciation expense,$ Other operating expenses,Total operating expenses,,Operating income,,Other revenues and gains,,,Gain on sale of investments,,Income before income tax,,Income tax expense,,Net income,,$

The following additional information was taken from the records of C T Green, Inc.

a Equipment and land were acquired for cash.

b The investments were sold for $

c The common stock was issued for cash

d There was a $ debit to Retained Earnings for cash dividend declared.

Instructions

Prepare a statement of cash flows, using indirect method of presenting cash flows from operating activities, investing, and financing activities.

Prepare a statement of cash flows, using a direct method of presenting cash flows from operating activities.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock