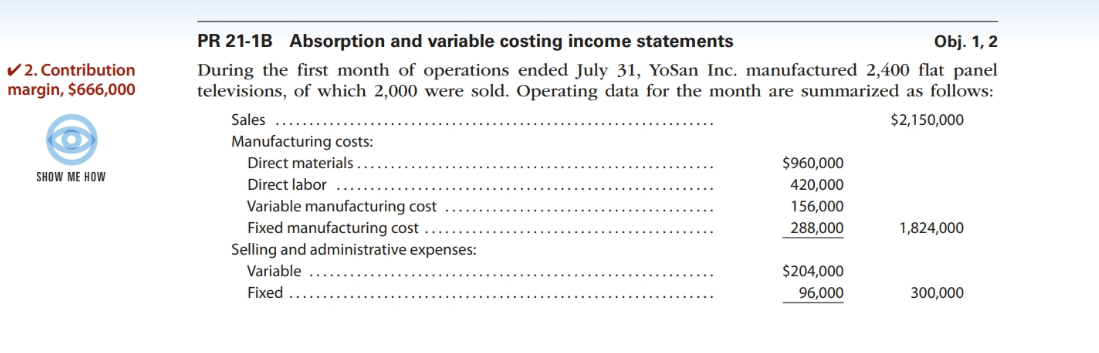

Question: 9' 2. Contribution margin, $666,000 @ PR 2113 Absorption and variable costing income statements on]. 1, 2 During the rst month of operations ended July

![costing income statements on]. 1, 2 During the rst month of operations](https://s3.amazonaws.com/si.experts.images/answers/2024/06/667febc1e270a_457667febc1bcb18.jpg)

9' 2. Contribution margin, $666,000 @ PR 2113 Absorption and variable costing income statements on]. 1, 2 During the rst month of operations ended July 31, YoSan Inc. manufactured 2,400 flat panel televisions, of which 2,000 were sold. Operating data for the month are summarized as follows: Sales ................................................................. Manufacturing costs: Direct materials ..................................................... $960,000 Direct labor ........................................................ 420.000 Variable manufacturing cost ........................................ 156,000 Fixed manufacturing cost ........................................... 288,000 Selling and administrative expenses: Variable ........... . ................................................ $204,000 Fixed ............................................................... 96,000 $2,150,000 1,824,000 300,000 Instructions 1. Prepare an income statement based on the absorption costing concept. 2. Prepare an income statement based on the variable costing concept. 3. - Explain the reason for the difference in the amount of operating income reported in (1) and (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts