Question: 9 3 3 points Citee Corp. has no debt but can borrow at 6.7 percent. The firm's WACC is currently 9.5 percent, and the tax

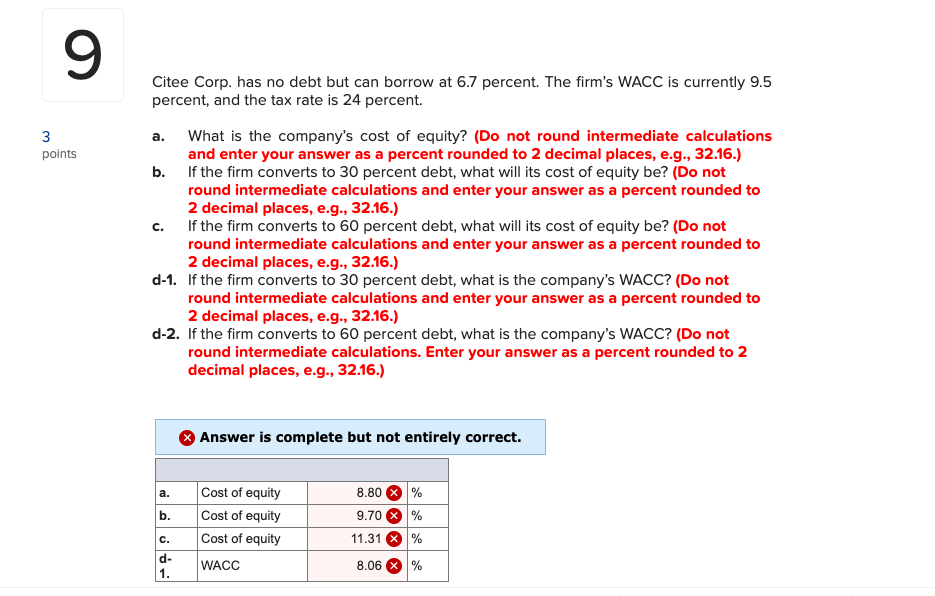

9 3 3 points Citee Corp. has no debt but can borrow at 6.7 percent. The firm's WACC is currently 9.5 percent, and the tax rate is 24 percent. a. What is the company's cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If the firm converts to 30 percent debt, what will its cost of equity be? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) If the firm converts to 60 percent debt, what will its cost of equity be? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) d-1. If the firm converts to 30 percent debt, what is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) d-2. If the firm converts to 60 percent debt, what is the company's WACC? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. Answer is complete but not entirely correct. a. b. Cost of equity Cost of equity Cost of equity WACC 8.80 % 9.70 % 11.31 % % c. d- 1. 8.06 % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts