Question: 9 - 3 APPLICATION PROBLEM Journalizing adjusting and reversing entries for accrued expenses Auxbury, Inc., has gathered the following information relating to accrued interest, accrued

APPLICATION PROBLEM

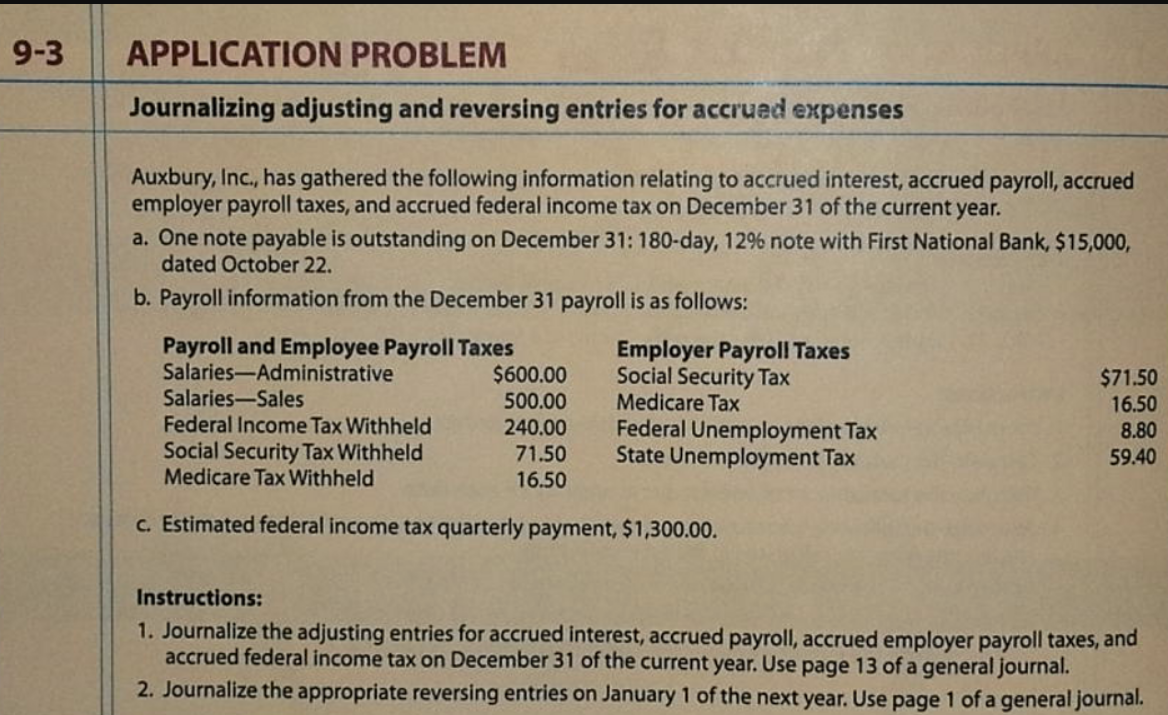

Journalizing adjusting and reversing entries for accrued expenses

Auxbury, Inc., has gathered the following information relating to accrued interest, accrued payroll, accrued

employer payroll taxes, and accrued federal income tax on December of the current year.

a One note payable is outstanding on December : day, note with First National Bank, $

dated October

b Payroll information from the December payroll is as follows:

c Estimated federal income tax quarterly payment, $

Instructions:

Journalize the adjusting entries for accrued interest, accrued payroll, accrued employer payroll taxes, and

accrued federal income tax on December of the current year. Use page of a general journal.

Journalize the appropriate reversing entries on January of the next year. Use page of a general journal APPLICATION PROBLEM

Journalizing adjusting and reversing entries for accrued expenses

Auxbury, Inc., has gathered the following information relating to accrued interest, accrued payroll, accrued

employer payroll taxes, and accrued federal income tax on December of the current year.

a One note payable is outstanding on December : day, note with First National Bank, $

dated October

b Payroll information from the December payroll is as follows:

c Estimated federal income tax quarterly payment, $

Instructions:

Journalize the adjusting entries for accrued interest, accrued payroll, accrued employer payroll taxes, and

accrued federal income tax on December of the current year. Use page of a general journal.

Journalize the appropriate reversing entries on January of the next year. Use page of a general journal.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock