Question: 9. (3 points; 1 point each; no partial credit) a) A major announcement is about to be made for Hoosier Company. You are unsure which

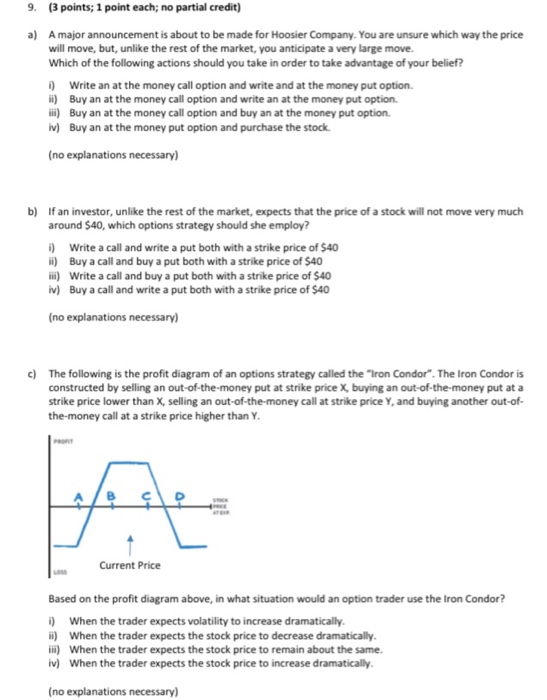

9. (3 points; 1 point each; no partial credit) a) A major announcement is about to be made for Hoosier Company. You are unsure which way the price will move, but, unlike the rest of the market, you anticipate a very large move. Which of the following actions should you take in order to take advantage of your belief? i) Write an at the money call option and write and at the money put option i) Buy an at the money call option and write an at the money put option ) Buy an at the money call option and buy an at the money put option Buy an at the money put option and purchase the stock (no explanations necessary) b) If an investor, unlike the rest of the market, expects that the price of a stock will not move very much around $40, which options strategy should she employ? 1) Write a call and write a put both with a strike price of $40 1) Buy a call and buy a put both with a strike price of $40 iii) Write a call and buy a put both with a strike price of $40 iv) Buy a call and write a put both with a strike price of $40 (no explanations necessary) c) The following is the profit diagram of an options strategy called the "Iron Condor". The Iron Condor is constructed by selling an out-of-the-money put at strike price X, buying an out-of-the-money put at a strike price lower than X, selling an out-of-the-money call at strike price Y, and buying another out-of- the-money call at a strike price higher than Y. Current Price Based on the profit diagram above, in what situation would an option trader use the Iron Condor? 1) When the trader expects volatility to increase dramatically. 1) When the trader expects the stock price to decrease dramatically 1) When the trader expects the stock price to remain about the same. iv) When the trader expects the stock price to increase dramatically (no explanations necessary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts