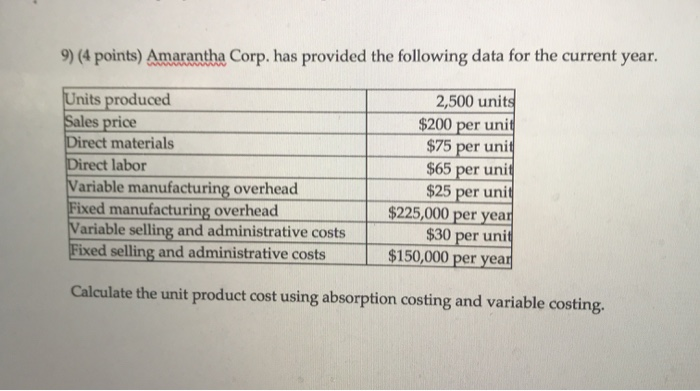

Question: 9) (4 points) Amarantha Corp. has provided the following data for the current year. Units produced Sales price Direct materials Direct labor Variable manufacturing overhead

9) (4 points) Amarantha Corp. has provided the following data for the current year. Units produced Sales price Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative costs Fixed selling and administrative costs 2,500 units $200 per unit $75 per unit $65 per unit $25 per unit $225,000 per year $30 per unit $150,000 per year Calculate the unit product cost using absorption costing and variable costing

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock