Question: 9 : 5 4 k ( 7 3 Back ECON 3 1 5 HW 3 . docx Switch To Light Mode Please feel free to

:

Back

ECON HW docx

Switch To Light Mode

Please feel free to work in groups of three or less. If you do so please make sure only one of you is submitting the HW Make sure you write everyone's name.

Show all your work. Only scanned pdf copies or neatly typed word documents are accepted. If you do use generative AI make sure you look into the sources from where the model has pulled the answers from because you might get wrong answers.

Assume there is no arbitrage. SHOW and explain how the risk neutral probability in Page of Shreve additional chapter cannot have certain values ie what are the possible values of p points

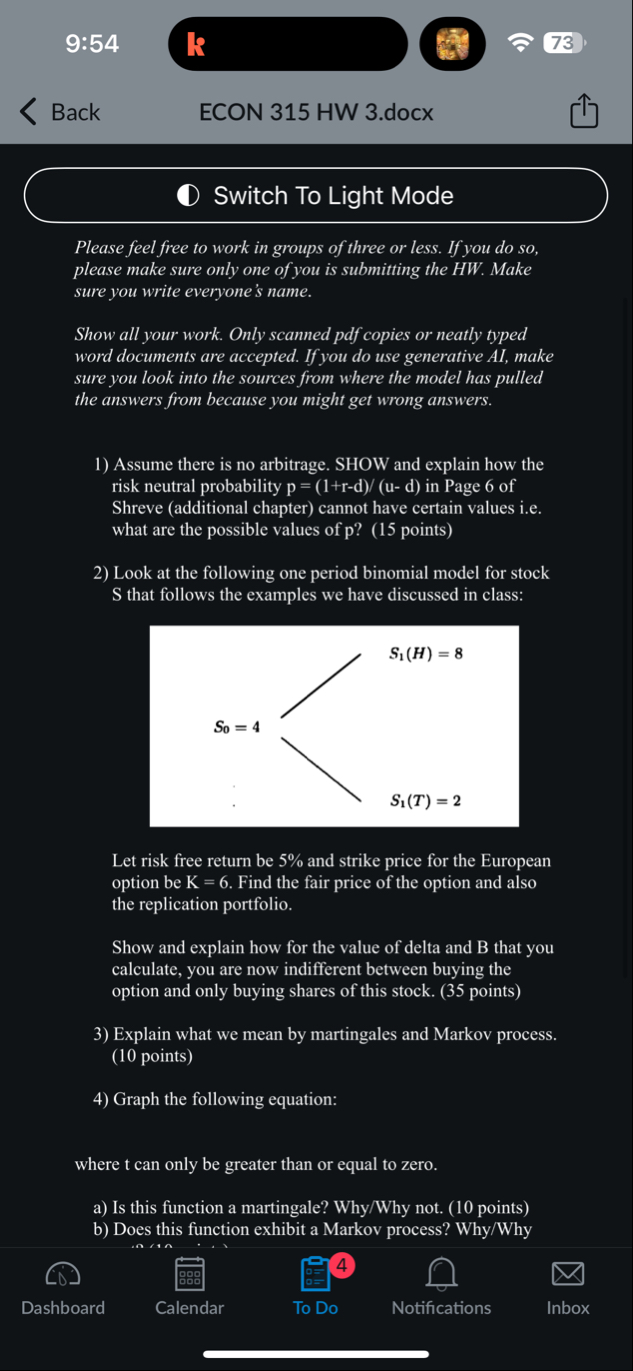

Look at the following one period binomial model for stock S that follows the examples we have discussed in class:

Let risk free return be and strike price for the European option be Find the fair price of the option and also the replication portfolio.

Show and explain how for the value of delta and B that you calculate, you are now indifferent between buying the option and only buying shares of this stock. points

Explain what we mean by martingales and Markov process. points

Graph the following equation:

where can only be greater than or equal to zero.

a Is this function a martingale? WhyWhy not. points

b Does this function exhibit a Markov process? WhyWhy

Dashboard

Calendar

To Do

Notifications

Inbox:

Back

ECON HW docx

Switch To Light Mode

Let risk free return be and strike price for the European option be Find the fair price of the option and also the replication portfolio.

Show and explain how for the value of delta and B that you calculate, you are now indifferent between buying the option and only buying shares of this stock. points

Explain what we mean by martingales and Markov process. points

Graph the following equation:

where can only be greater than or equal to zero.

a Is this function a martingale? WhyWhy not. points

b Does this function exhibit a Markov process? WhyWhy not? points

Consider the following equation two equations that give us stock returnsprofits for two Stocks Q and Z where and

a Here, is a variable that captures weather behavior such that has to be between and Both stocks and are highly influenced by Find maximum and minimum values for both these stocks and also find the x value that achieves the maximum value for both stocks. points

b At Q starts accruing losses. Assume you do not want to lose more than $ on Q How do you hedge to ensure your losses are contained? points

Dashboard

Calendar

To Do

Notifications

Inbox

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock