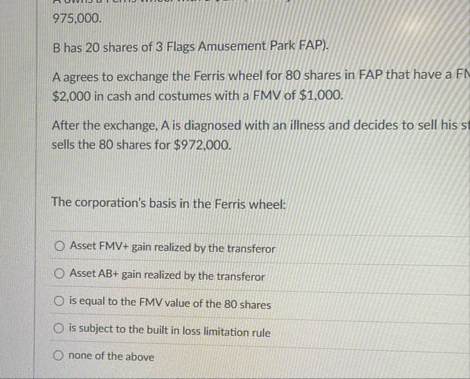

Question: 9 7 5 , 0 0 0 . B has 2 0 shares of 3 Flags Amusement Park FAP ) . A agrees to exchange

B has shares of Flags Amusement Park FAP

A agrees to exchange the Ferris wheel for shares in FAP that have a FN $ in cash and costumes with a FMV of $

After the exchange, A is diagnosed with an illness and decides to sell his st sells the shares for $

The corporation's basis in the Ferris wheel:

Asset FMV gain realized by the transferor

Asset gain realized by the transferor

is equal to the FMV value of the shares

is subject to the built in loss limitation rule

none of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock