Question: 9. A consumer electronics company was formed to develop cell phones that run on or are recharged by fuel cells. The company purchased a

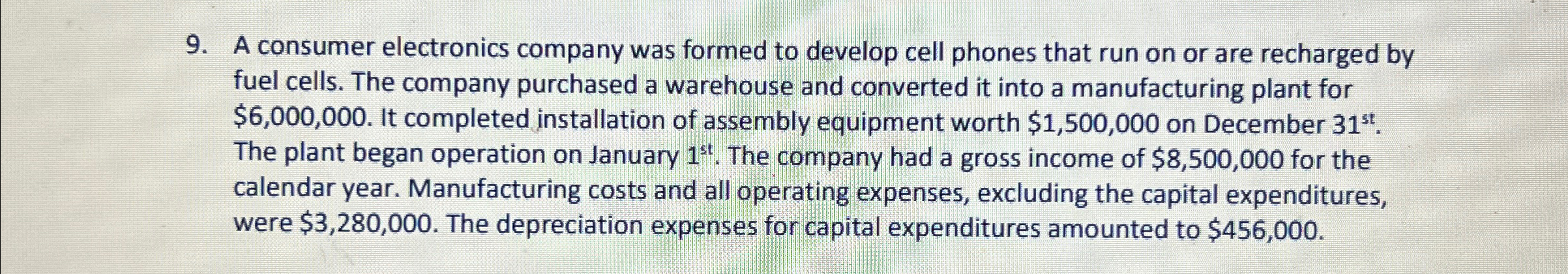

9. A consumer electronics company was formed to develop cell phones that run on or are recharged by fuel cells. The company purchased a warehouse and converted it into a manufacturing plant for $6,000,000. It completed installation of assembly equipment worth $1,500,000 on December 31st. The plant began operation on January 1st. The company had a gross income of $8,500,000 for the calendar year. Manufacturing costs and all operating expenses, excluding the capital expenditures, were $3,280,000. The depreciation expenses for capital expenditures amounted to $456,000.

Step by Step Solution

There are 3 Steps involved in it

It seems youve provided information about the formation a... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

66425e1aa09a2_981727.pdf

180 KBs PDF File

66425e1aa09a2_981727.docx

120 KBs Word File