Question: 9. (a) What is the difference between active and passive bona porciono management [3 marks] (b) Lemon Grove PLC is required to make an 8,000,000

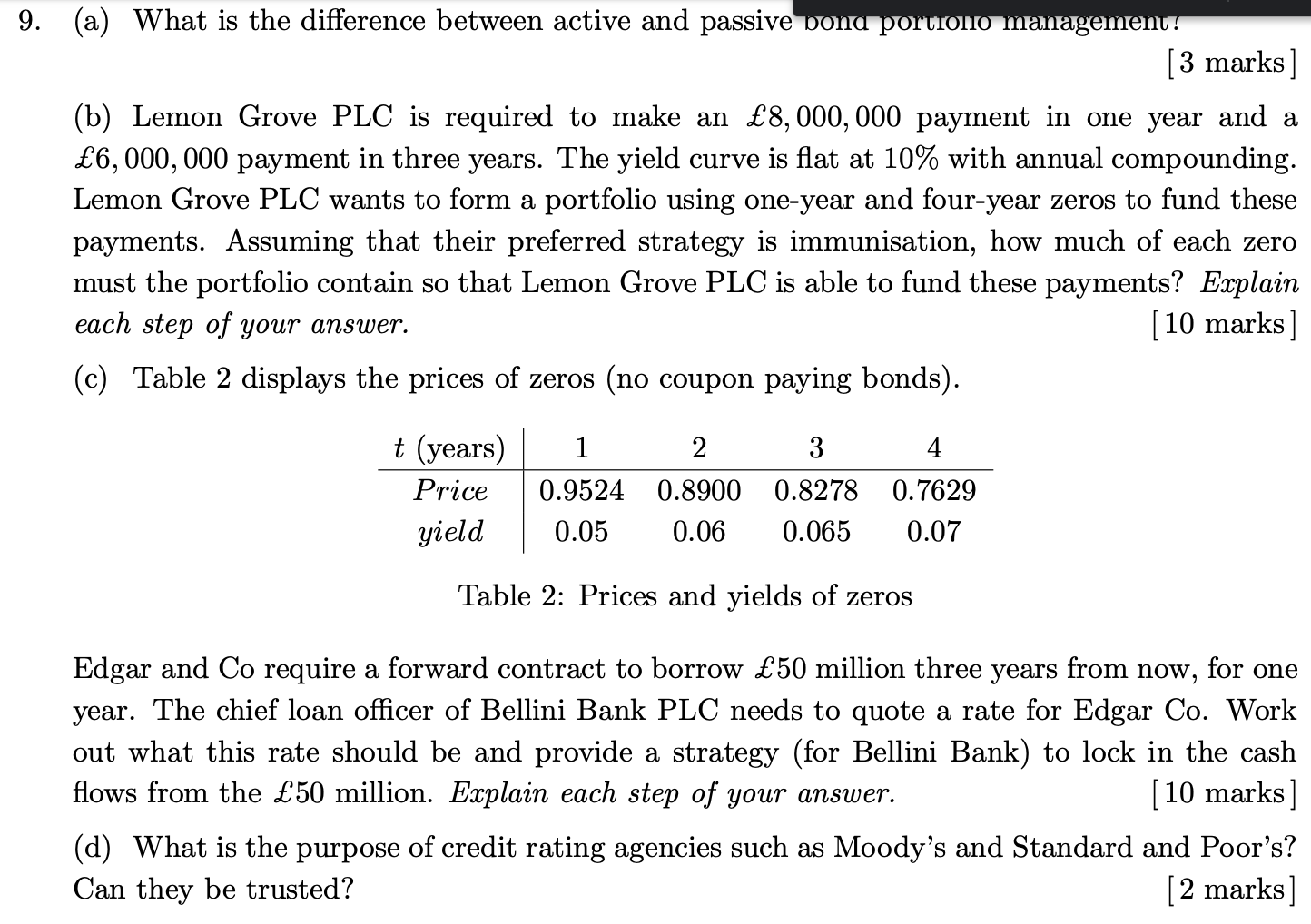

9. (a) What is the difference between active and passive bona porciono management [3 marks] (b) Lemon Grove PLC is required to make an 8,000,000 payment in one year and a 6,000,000 payment in three years. The yield curve is flat at 10% with annual compounding. Lemon Grove PLC wants to form a portfolio using one-year and four-year zeros to fund these payments. Assuming that their preferred strategy is immunisation, how much of each zero must the portfolio contain so that Lemon Grove PLC is able to fund these payments? Explain each step of your answer. [10 marks] (c) Table 2 displays the prices of zeros (no coupon paying bonds). t(years) 1 2 3 4 Price 0.9524 0.8900 0.8278 0.7629 yield 0.05 0.06 0.065 0.07 Table 2: Prices and yields of zeros Edgar and Co require a forward contract to borrow 50 million three years from now, for one year. The chief loan officer of Bellini Bank PLC needs to quote a rate for Edgar Co. Work out what this rate should be and provide a strategy (for Bellini Bank) to lock in the cash flows from the 50 million. Explain each step of your answer. [10 marks] (d) What is the purpose of credit rating agencies such as Moody's and Standard and Poor's? Can they be trusted? [2 marks] 9. (a) What is the difference between active and passive bona porciono management [3 marks] (b) Lemon Grove PLC is required to make an 8,000,000 payment in one year and a 6,000,000 payment in three years. The yield curve is flat at 10% with annual compounding. Lemon Grove PLC wants to form a portfolio using one-year and four-year zeros to fund these payments. Assuming that their preferred strategy is immunisation, how much of each zero must the portfolio contain so that Lemon Grove PLC is able to fund these payments? Explain each step of your answer. [10 marks] (c) Table 2 displays the prices of zeros (no coupon paying bonds). t(years) 1 2 3 4 Price 0.9524 0.8900 0.8278 0.7629 yield 0.05 0.06 0.065 0.07 Table 2: Prices and yields of zeros Edgar and Co require a forward contract to borrow 50 million three years from now, for one year. The chief loan officer of Bellini Bank PLC needs to quote a rate for Edgar Co. Work out what this rate should be and provide a strategy (for Bellini Bank) to lock in the cash flows from the 50 million. Explain each step of your answer. [10 marks] (d) What is the purpose of credit rating agencies such as Moody's and Standard and Poor's? Can they be trusted? [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts