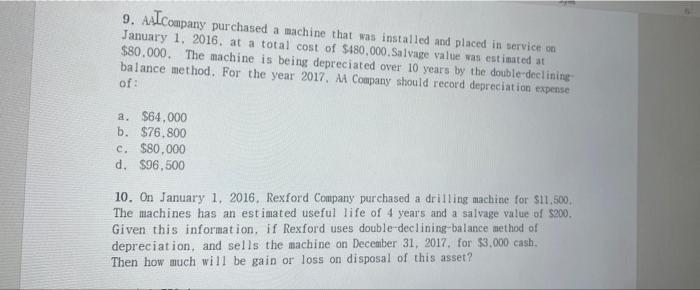

Question: 9. AAICompany purchased a machine that was installed and placed in service on January 1, 2016. at a total cost of $480,000. Salvage value was

9. AAICompany purchased a machine that was installed and placed in service on January 1, 2016. at a total cost of $480,000. Salvage value was estimated at $80,000. The machine is being depreciated over 10 years by the double-declining balance method. For the year 2017, AA Company should record depreciation expense of: a. $64,000 b. $76,800 c. $80,000 d. $96,500 10. On January 1, 2016. Rexford Company purchased a drilling machine for $11.500. The machines has an estimated useful life of 4 years and a salvage value of $200. Given this information, if Rexford uses double-declining-balance method of depreciation, and sells the machine on December 31, 2017, for $3,000 cash. Then how much will be gain or loss on disposal of this asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts