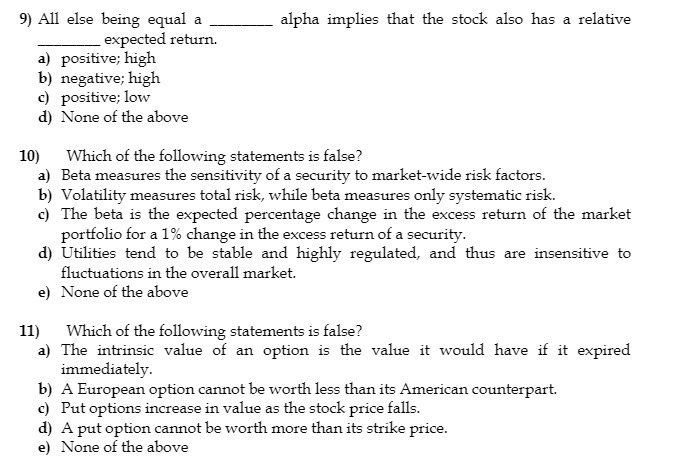

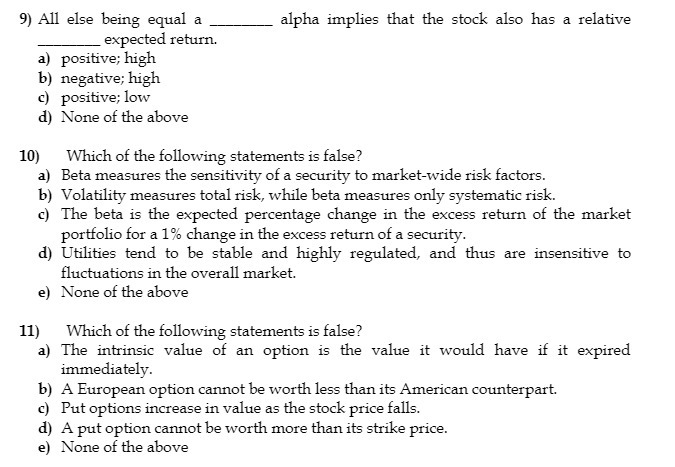

Question: 9 ) All else being equal a alpha implies that the stock also has a relative expected return a ) positive high b ) negative

9 ) All else being equal a alpha implies that the stock also has a relative expected return a ) positive high b ) negative high ( ) positive ; low d ) None of the above 10 ) Which of the following statements is false a ) Beta measures the sensitivity of a security to market - wide risk factors b ) Volatility measures total risk , while beta measures only systematic risk ( ) The beta is the expected percentage change in the excess return of the market portfolio for a I'd change in the excess return of a security 1 ) Utilities tend to be stable and highly regulated , and thus are insensitive to fluctuations in the overall market e ) None of the above 1 1 ) Which of the following statements is false a ) The intrinsic value of an option is the value it would have if it expired immediately b ) A European option cannot be worth less than its American counterpart ( ) Put options increase in value as the stock price falls d ) A put option cannot be worth more than its strike price e ) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts