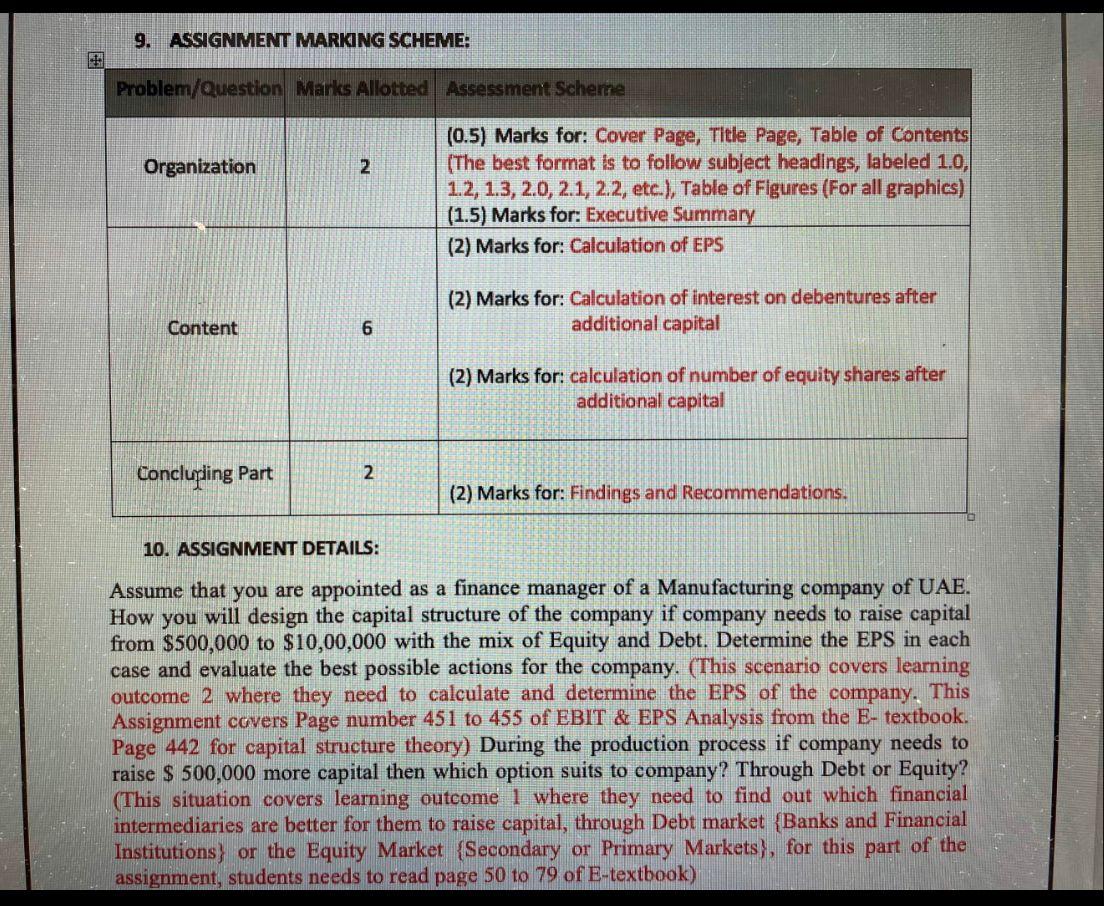

Question: 9. ASSIGNMENT MARKING SCHEME: Problem/Question Marks Allotted Assessment Scheme Organization 2 (0.5) Marks for: Cover Page, Title Page, Table of Contents (The best format is

9. ASSIGNMENT MARKING SCHEME: Problem/Question Marks Allotted Assessment Scheme Organization 2 (0.5) Marks for: Cover Page, Title Page, Table of Contents (The best format is to follow subject headings, labeled 1.0, 1.2, 1.3, 2.0, 2.1, 2.2, etc.), Table of Figures (For all graphics) (1.5) Marks for: Executive Summary (2) Marks for: Calculation of EPS (2) Marks for: Calculation of interest on debentures after additional capital Content 6 (2) Marks for: calculation of number of equity shares after additional capital Concluzling Part 2 (2) Marks for: Findings and Recommendations. 10. ASSIGNMENT DETAILS: Assume that you are appointed as a finance manager of a Manufacturing company of UAE. How you will design the capital structure of the company if company needs to raise capital from $500,000 to $10,00,000 with the mix of Equity and Debt. Determine the EPS in each case and evaluate the best possible actions for the company. (This scenario covers learning outcome 2 where they need to calculate and determine the EPS of the company. This Assignment covers Page number 451 to 455 of EBIT & EPS Analysis from the E- textbook. Page 442 for capital structure theory) During the production process if company needs to raise $ 500,000 more capital then which option suits to company? Through Debt or Equity? (This situation covers learning outcome 1 where they need to find out which financial intermediaries are better for them to raise capital, through Debt market {Banks and Financial Institutions) or the Equity Market (Secondary or Primary Markets), for this part of the assignment, students needs to read page 50 to 79 of E-textbook) 9. ASSIGNMENT MARKING SCHEME: Problem/Question Marks Allotted Assessment Scheme Organization 2 (0.5) Marks for: Cover Page, Title Page, Table of Contents (The best format is to follow subject headings, labeled 1.0, 1.2, 1.3, 2.0, 2.1, 2.2, etc.), Table of Figures (For all graphics) (1.5) Marks for: Executive Summary (2) Marks for: Calculation of EPS (2) Marks for: Calculation of interest on debentures after additional capital Content 6 (2) Marks for: calculation of number of equity shares after additional capital Concluzling Part 2 (2) Marks for: Findings and Recommendations. 10. ASSIGNMENT DETAILS: Assume that you are appointed as a finance manager of a Manufacturing company of UAE. How you will design the capital structure of the company if company needs to raise capital from $500,000 to $10,00,000 with the mix of Equity and Debt. Determine the EPS in each case and evaluate the best possible actions for the company. (This scenario covers learning outcome 2 where they need to calculate and determine the EPS of the company. This Assignment covers Page number 451 to 455 of EBIT & EPS Analysis from the E- textbook. Page 442 for capital structure theory) During the production process if company needs to raise $ 500,000 more capital then which option suits to company? Through Debt or Equity? (This situation covers learning outcome 1 where they need to find out which financial intermediaries are better for them to raise capital, through Debt market {Banks and Financial Institutions) or the Equity Market (Secondary or Primary Markets), for this part of the assignment, students needs to read page 50 to 79 of E-textbook)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts