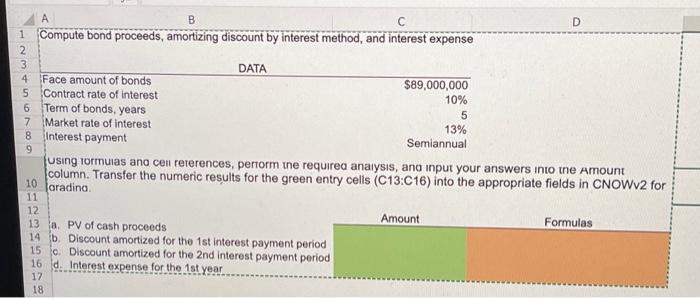

Question: 9 B C D 1 Compute bond proceeds, amortizing discount by interest method, and interest expense 2 3 DATA 4 Face amount of bonds $89,000,000

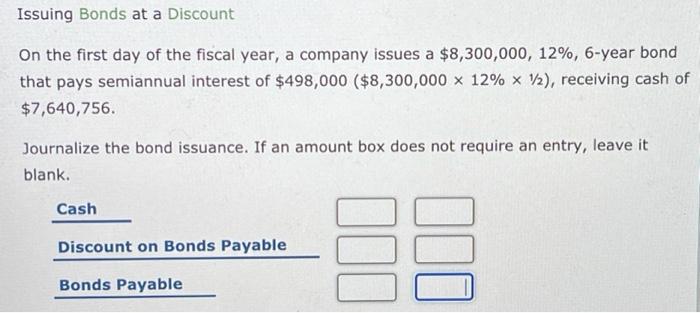

9 B C D 1 Compute bond proceeds, amortizing discount by interest method, and interest expense 2 3 DATA 4 Face amount of bonds $89,000,000 5 Contract rate of interest 10% 6 Term of bonds, years 5 7 Market rate of interest 13% 8 Interest payment Semiannual using formulas ana cell references, perform the requirea analysis, ana input your answers into tne Amount column. Transfer the numeric results for the green entry cells (C13:C16) into the appropriate fields in CNOWV2 for 10 Haradina 11 12 Amount 13 . PV of cash proceeds Formulas 14 b. Discount amortized for the 1st interest payment period 15 lc. Discount amortized for the 2nd Interest payment period 16 d. Interest expense for the 1st year 17 18 Issuing Bonds at a Discount On the first day of the fiscal year, a company issues a $8,300,000, 12%, 6-year bond that pays semiannual interest of $498,000 ($8,300,000 x 12% * V2), receiving cash of $7,640,756. Journalize the bond issuance. If an amount box does not require an entry, leave it blank. Cash Discount on Bonds Payable 59 Bonds Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts