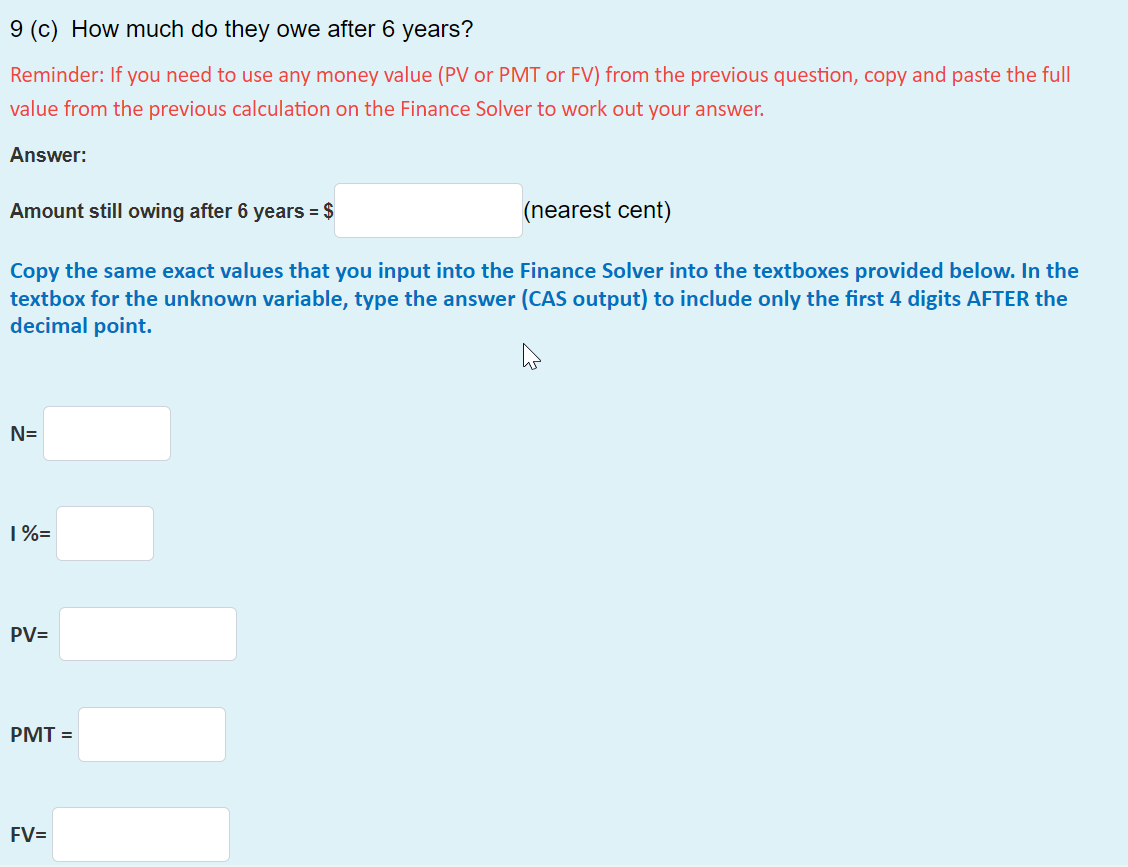

Question: 9 (c) How much do they owe after 6 years? Reminder: If you need to use any money value (PV or PMT or FV) from

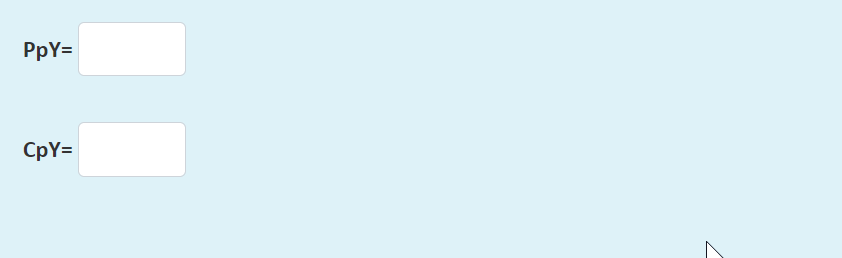

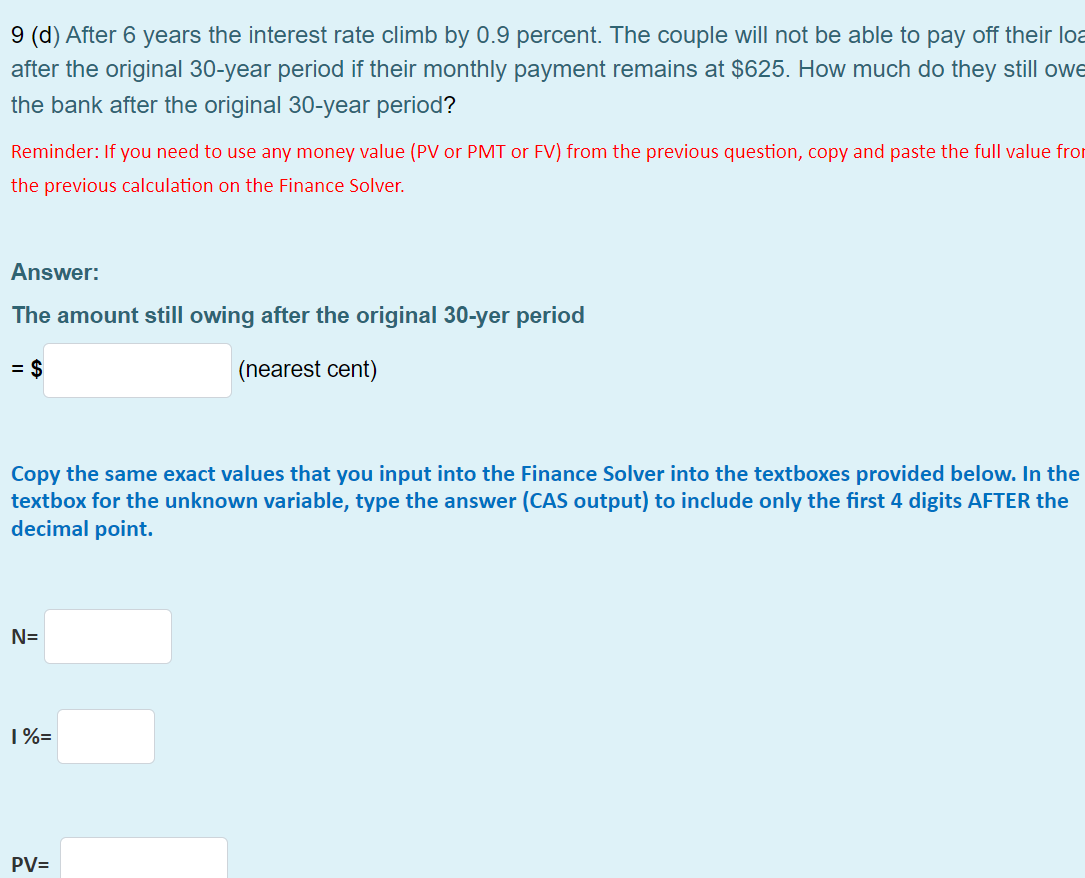

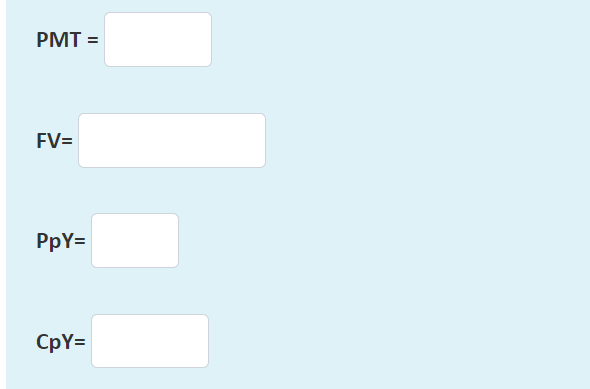

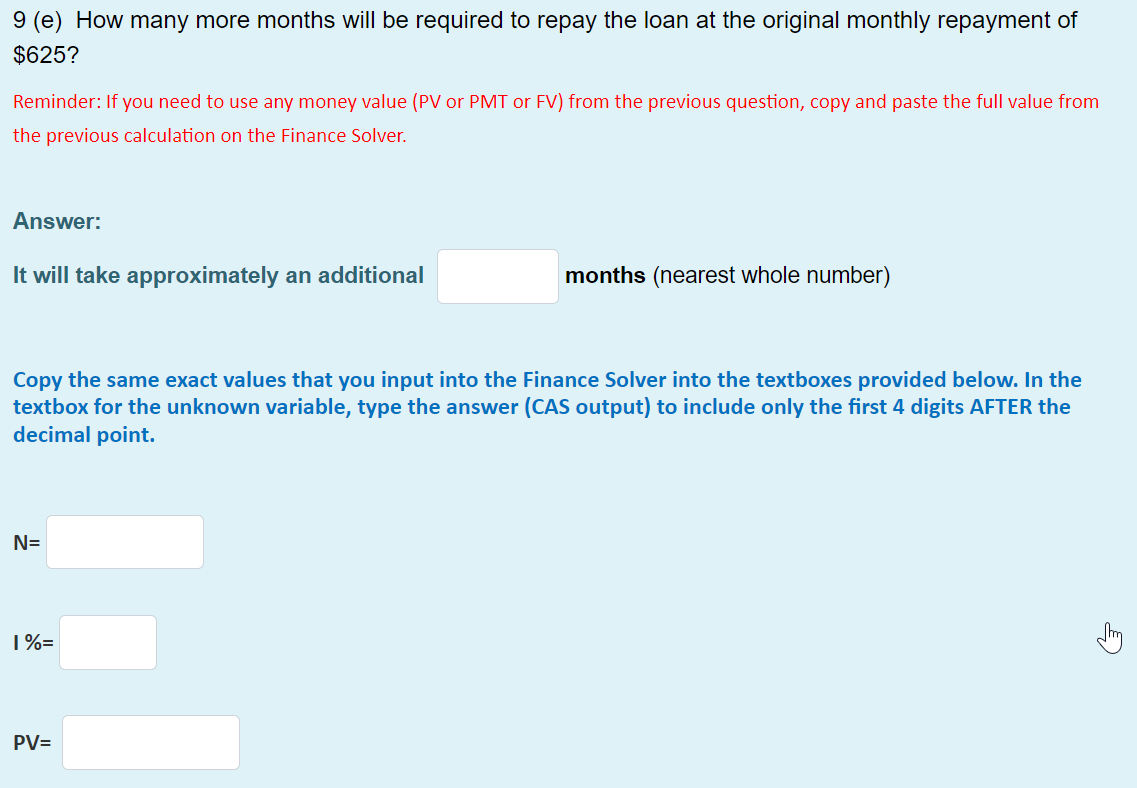

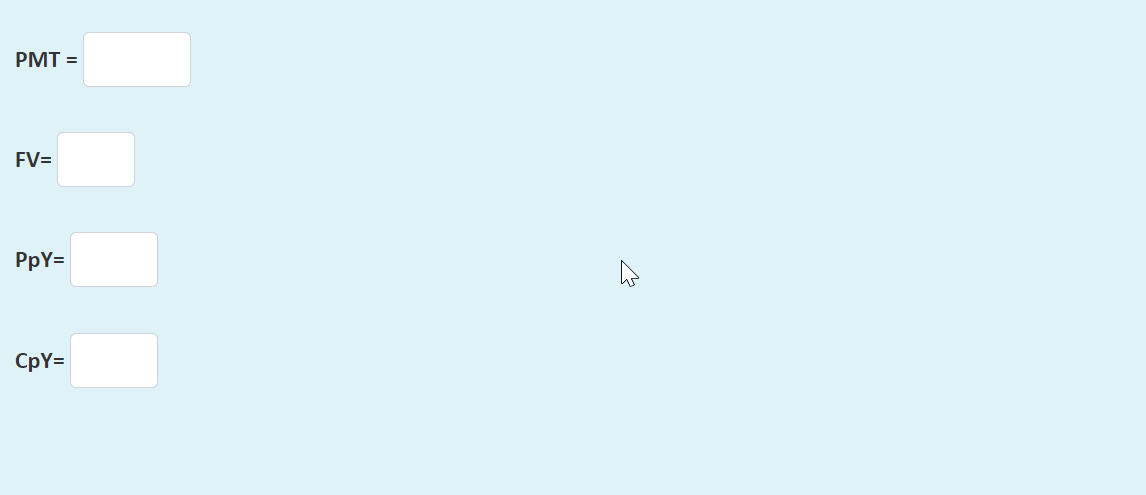

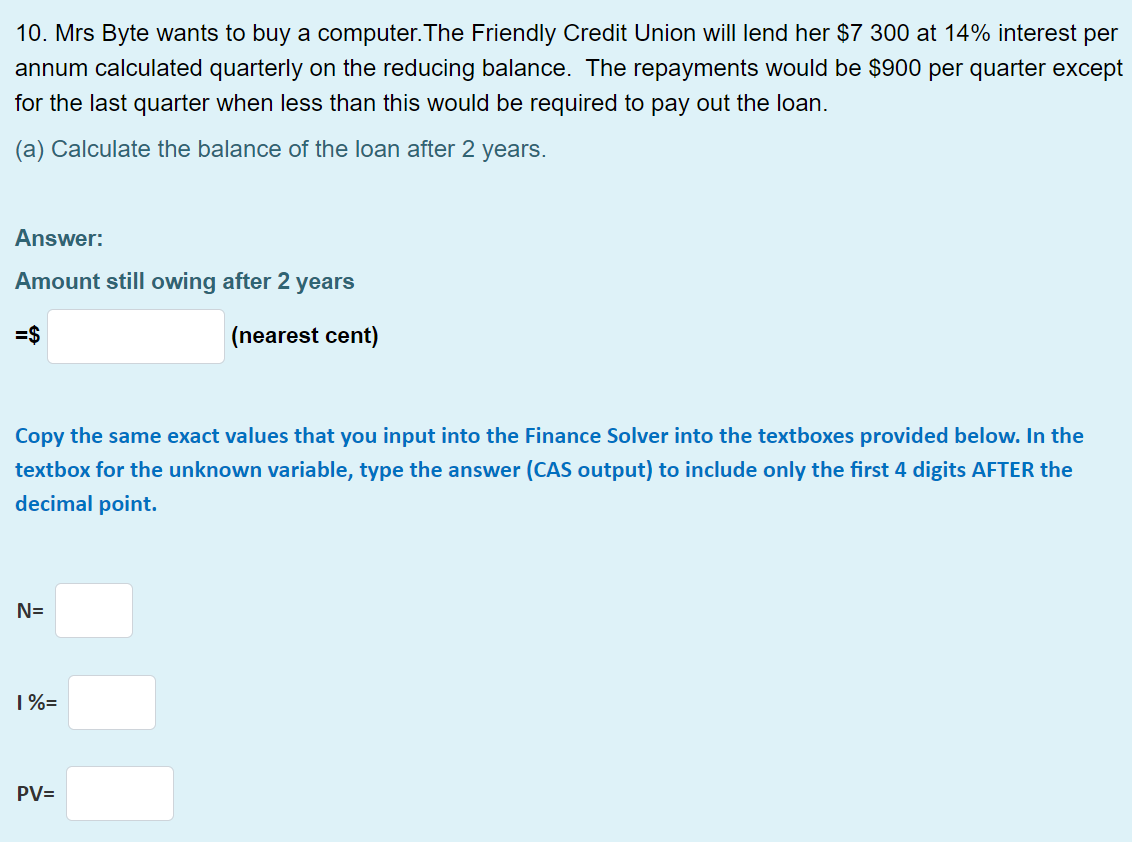

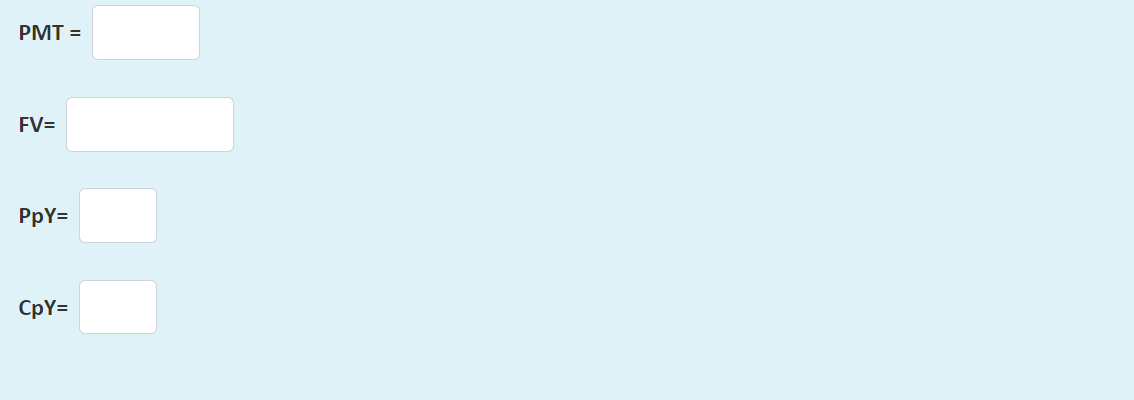

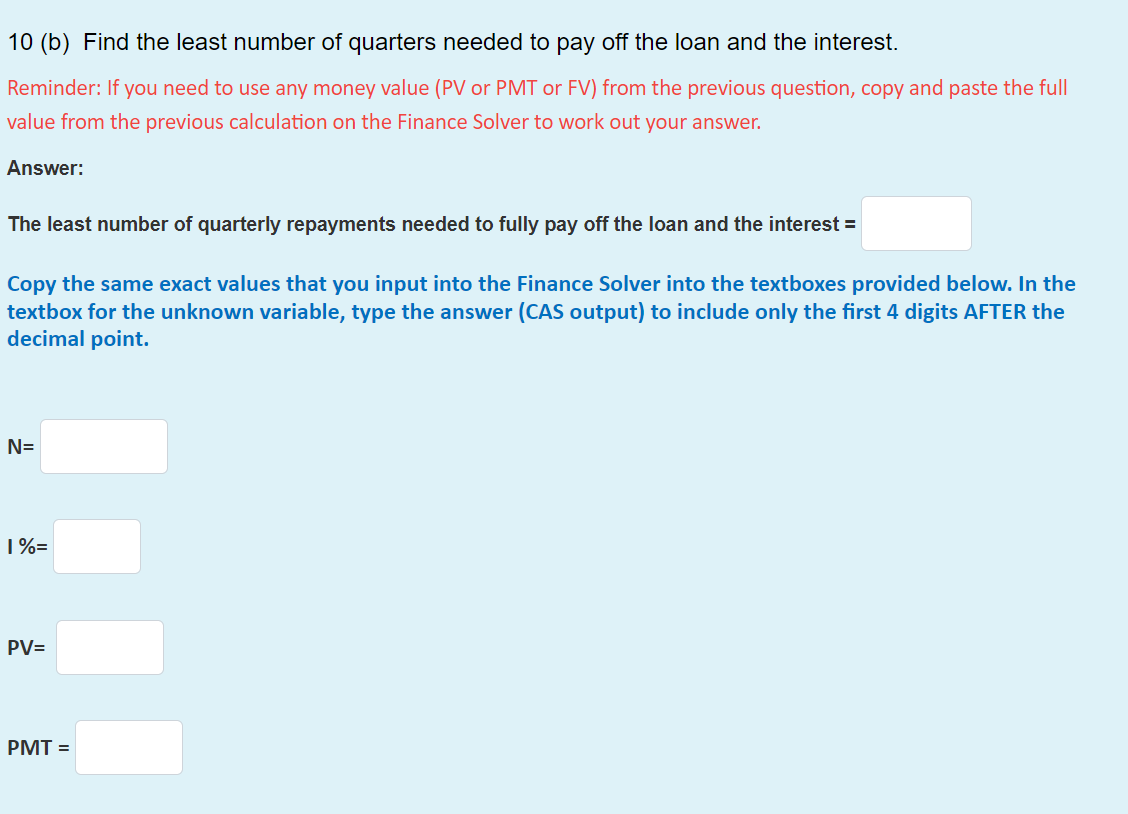

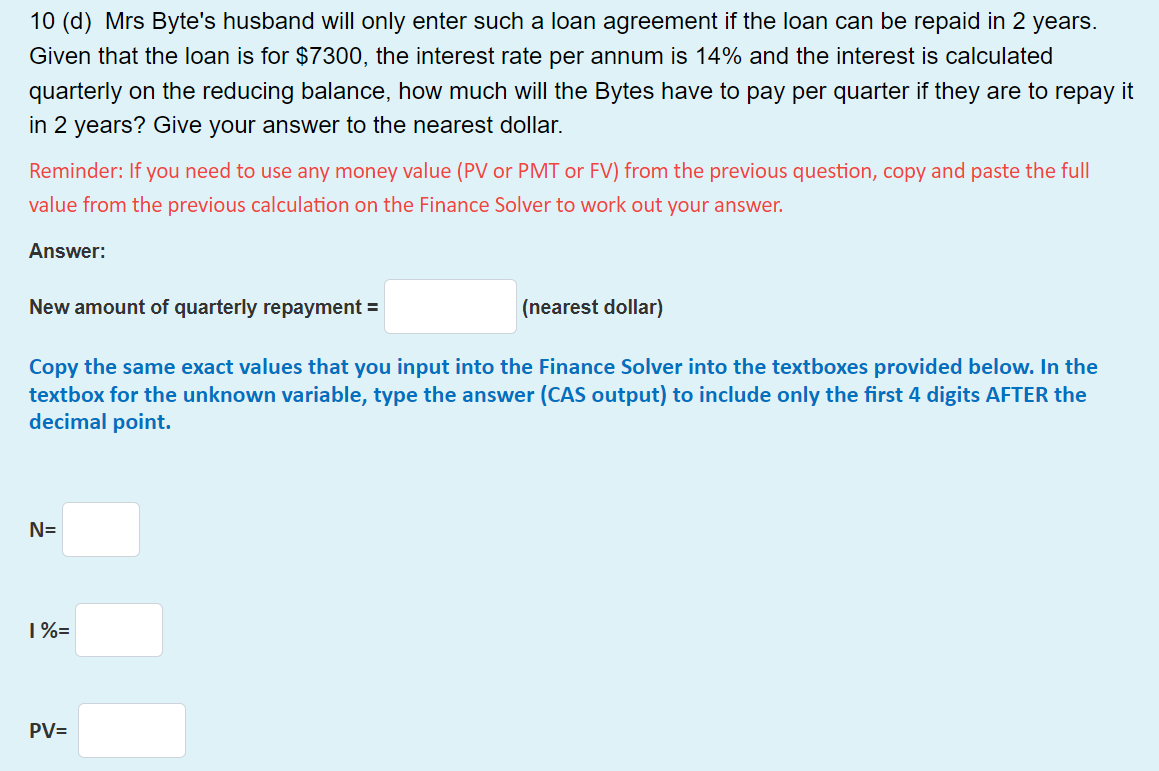

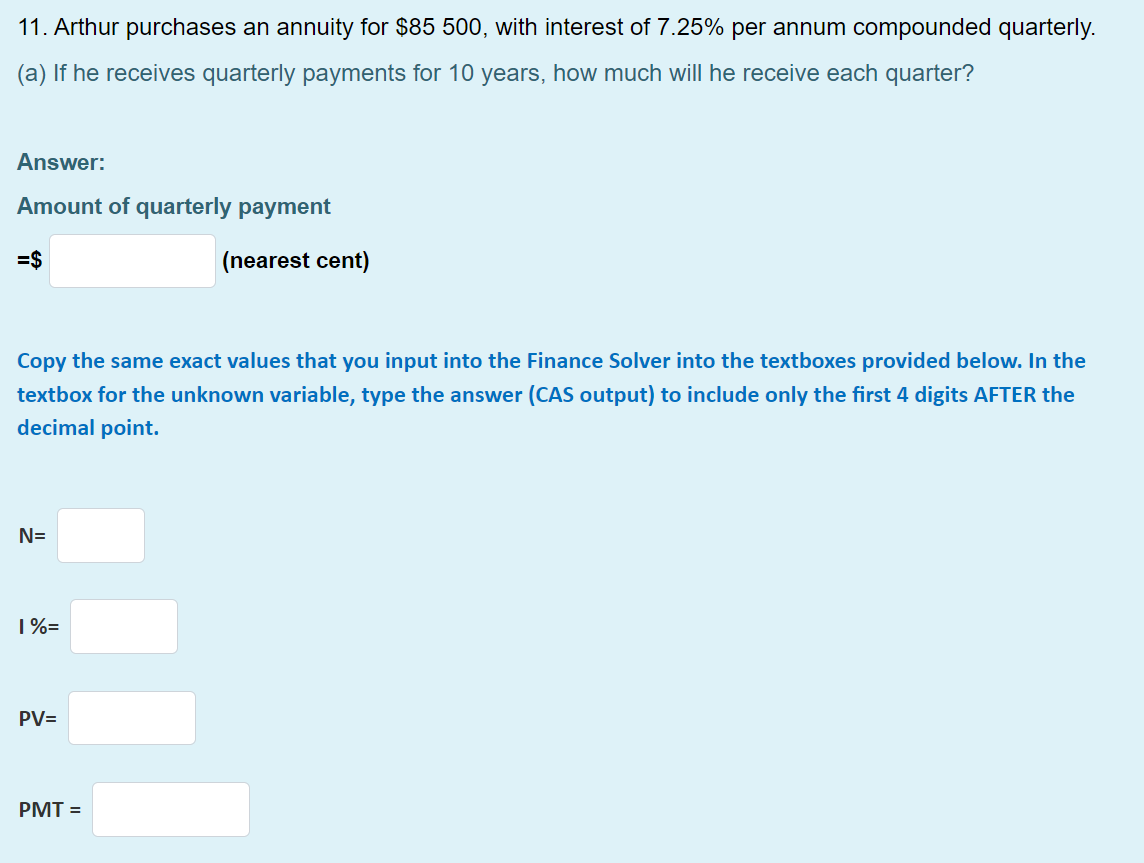

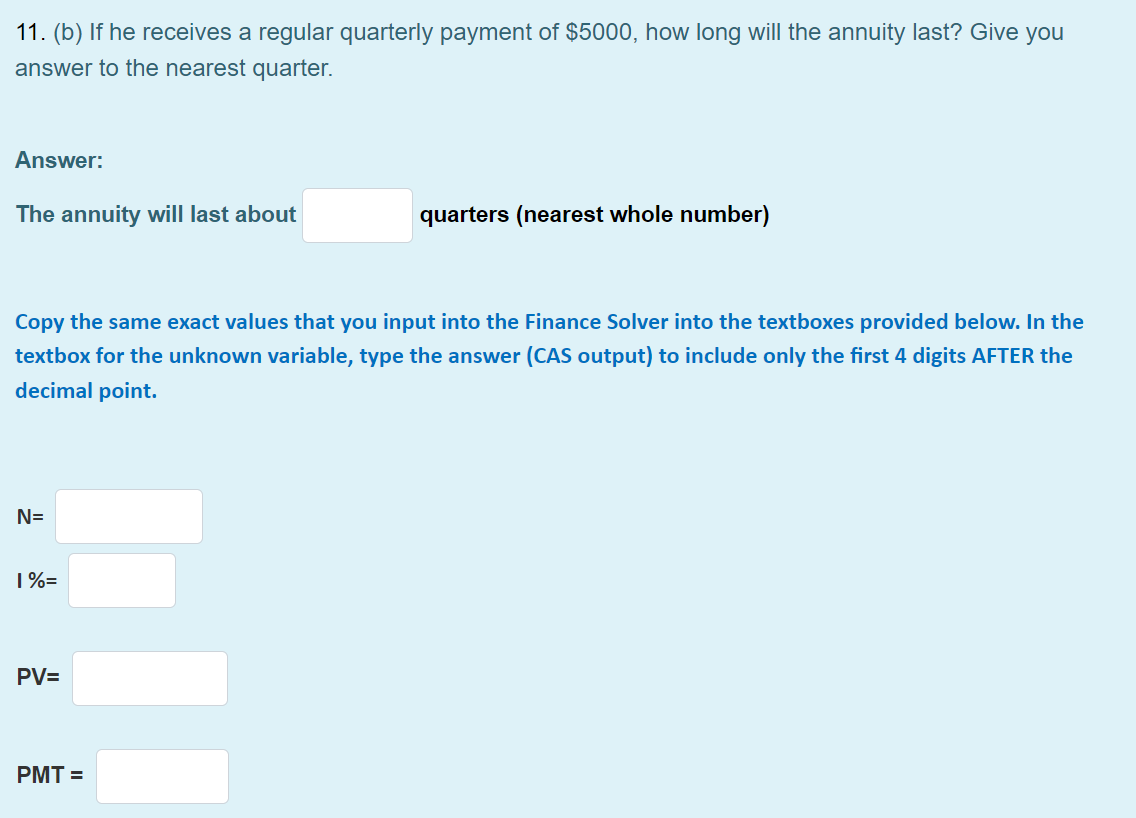

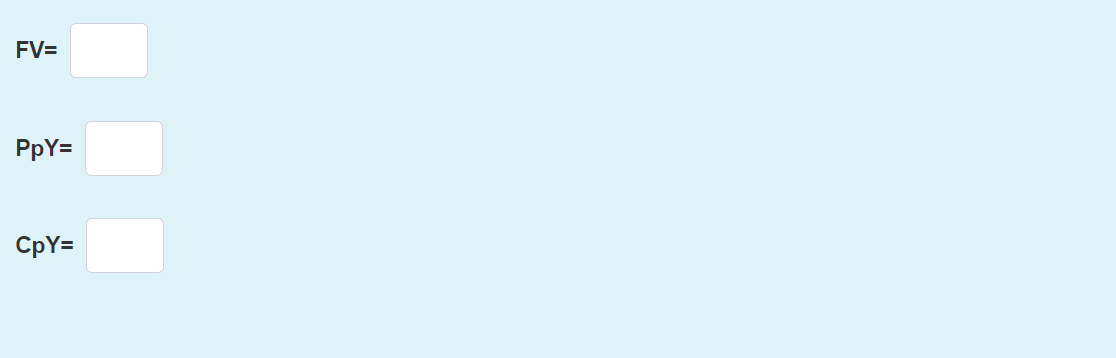

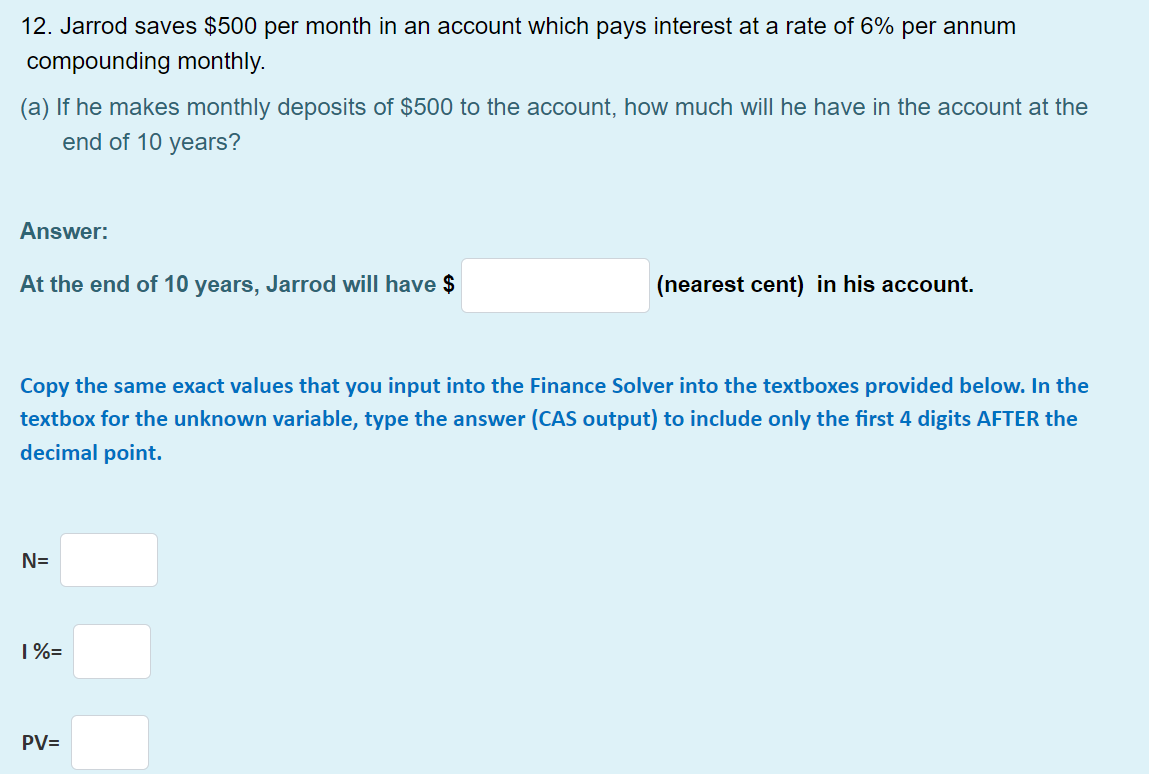

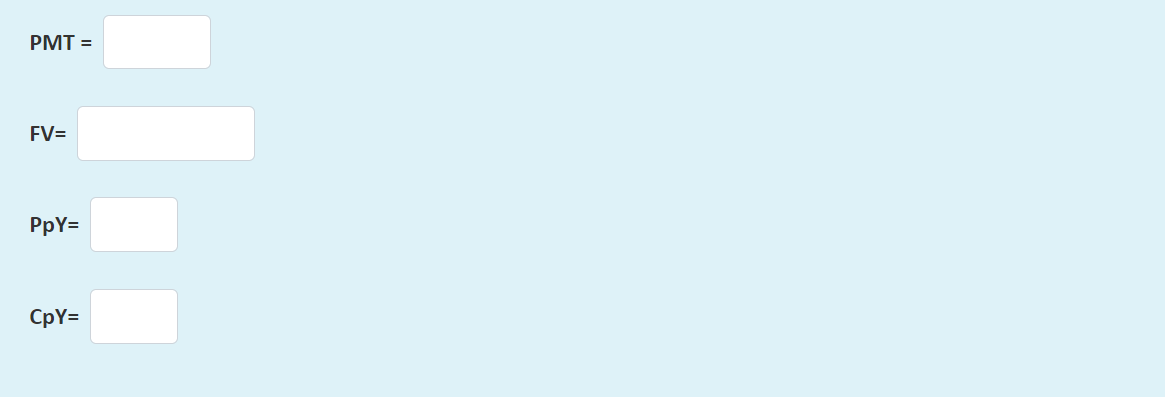

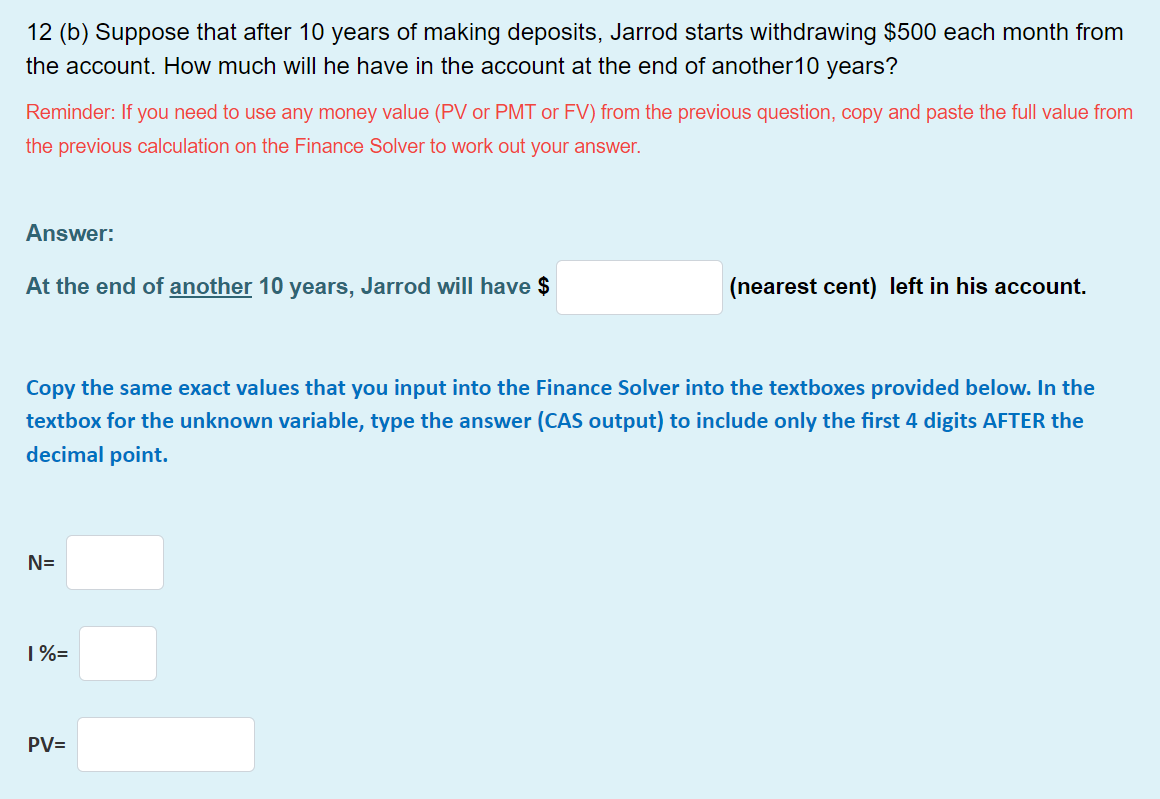

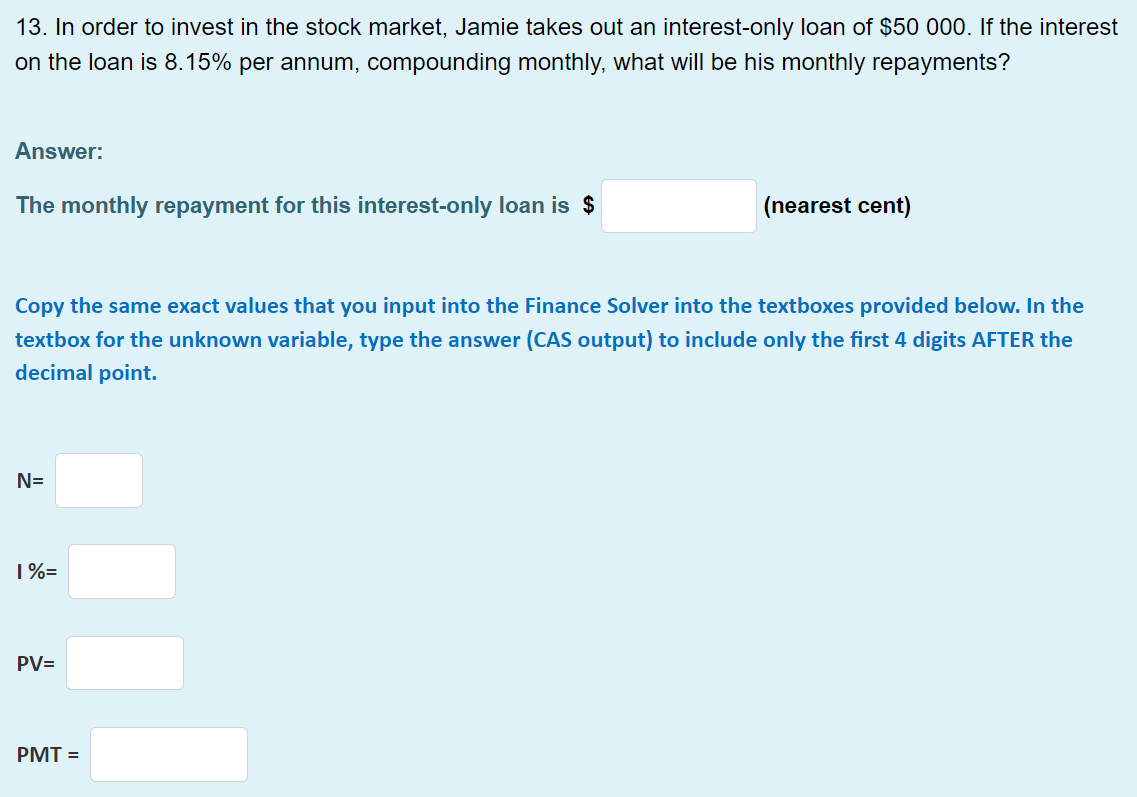

9 (c) How much do they owe after 6 years? Reminder: If you need to use any money value (PV or PMT or FV) from the previous question, copy and paste the full value from the previous calculation on the Finance Solver to work out your answer. Answer: Amount still owing after 6 years = $ (nearest cent) Copy the same exact values that you input into the Finance Solver into the textboxes provided below. In the textbox for the unknown variable, type the answer (CAS output) to include only the first 4 digits AFTER the decimal point. hs N= 1%= PV= PMT = FV=\f9 (d) After 6 years the interest rate climb by 0.9 percent. The couple will not be able to pay off their lo after the original 30-year period if their monthly payment remains at $625. How much do they still owe the bank after the original 30-year period? Reminder: If you need to use any money value (PV or PMT or FV) from the previous question, copy and paste the full value from the previous calculation on the Finance Solver. Answer: The amount still owing after the original 30-yer period = $ (nearest cent) Copy the same exact values that you input into the Finance Solver into the textboxes provided below. In the textbox for the unknown variable, type the answer (CAS output) to include only the first 4 digits AFTER the decimal point. N= 1%= PV=\f9 (e) How many more months will be required to repay the loan at the original monthly repayment of $625? Reminder: If you need to use any money value (PV or PMT or FV) from the previous question, copy and paste the full value from the previous calculation on the Finance Solver. Answer: It will take approximately an additional months (nearest whole number) Copy the same exact values that you input into the Finance Solver into the textboxes provided below. In the textbox for the unknown variable, type the answer (CA5 output) to include only the rst 4 digits AFTER the decimal point. |%= $3 PV= \f10. Mrs Byte wants to buy a computer.The Friendly Credit Union will lend her $7 300 at 14% interest per annum calculated quarterly on the reducing balance. The repayments would be $900 per quarter except for the last quarter when less than this would be required to pay out the loan. (a) Calculate the balance of the loan after 2 years. Answer: Amount still owing after 2 years =$ (nearest cent) Copy the same exact values that you input into the Finance Solver into the textboxes provided below. In the textbox for the unknown variable, type the answer (CA5 output) to include only the rst 4 digits AFTER the decimal point. |%= Pv= \f10 (b) Find the least number of quarters needed to pay off the loan and the interest. Reminder: If you need to use any money value (PV or PMT or FV) from the previous question, copy and paste the full value from the previous calculation on the Finance Solver to work out your answer. Answer: The least number of quarterly repayments needed to fullyr pay off the loan and the interest = Copy the same exact values that you input into the Finance Solver into the textboxes provided below. In the textbox for the unknown variable, type the answer (CA5 output) to include only the rst 4 digits AFTER the decimal point. I%= PV= PMT = \f10 (c) What is the amount of the final payment? [Hint: It will be less than the usual amount] Answer: Amount of the final repayment for this loan =$ (nearest cent) Note: There are more than one way to calculate the final repayment. In this question, you will not be required to show your working. Just refer to the solution provided by your teacher after you have completed this work submission.10 (d) Mrs Byte's husband will only enter such a loan agreement if the loan can be repaid in 2 years. Given that the loan is for $7300, the interest rate per annum is 14% and the interest is calculated quarterly on the reducing balance, how much will the Bytes have to pay per quarter if they are to repay it in 2 years? Give your answer to the nearest dollar. Reminder: If you need to use any money value (PV or PMT or FV) from the previous question, copy and paste the full value from the previous calculation on the Finance Solver to work out your answer. Answer: New amount of quarterly repayment = (nearest dollar) Copy the same exact values that you input into the Finance Solver into the textboxes provided below. In the textbox for the unknown variable, type the answer (CA5 output) to include only the rst 4 digits AFTER the decimal point. I%= \f11. Arthur purchases an annuity for $85 500, with interest of 7.25% per annum compounded quarterly. (a) If he receives quarterly payments for 10 years, how much will he receive each quarter? Answer: Amount of quarterly payment =$ (nearest cent) Copy the same exact values that you input into the Finance Solver into the textboxes provided below. In the textbox for the unknown variable, type the answer (CA5 output) to include only the rst 4 digits AFTER the decimal point. |%= PMT = \f11. (b) If he receives a regular quarterly payment of $5000, how long will the annuity last? Give you answer to the nearest quarter. Answer: The annuity will last about quarters (nearest whole number) Copy the same exact values that you input into the Finance Solver into the textboxes provided below. In the textbox for the unknown variable, type the answer (CAS output) to include only the first 4 digits AFTER the decimal point. N= 1%= PV= PMT =\f12. Jarrod saves $500 per month in an account which pays interest at a rate of 6% per annum compounding monthly. (a) If he makes monthly deposits of $500 to the account, how much will he have in the account at the end of 10 years? Answer: At the end of 10 years, Jarrod will have $ (nearest cent) in his account. Copy the same exact values that you input into the Finance Solver into the textboxes provided below. In the textbox for the unknown variable, type the answer (CA5 output) to include only the rst 4 digits AFTER the decimal point. |%= Pv= PMT = FV= PpY= CpY=12 (b) Suppose that after 10 years of making deposits, Jarrod starts withdrawing $500 each month from the account. How much will he have in the account at the end of another'lO years? Reminder: If you need to use any money value {PV or PMT or FV) from the previous question, copy and paste the full value from the previous calculation on the Finance Solver to work out your answer. Answer: At the end of another 10 years, Jarrod will have S (nearest cent) left in his account. Copy the same exact values that you input into the Finance Solver into the textboxes provided below. In the textbox for the unknown variable, type the answer (CA5 output) to include only the rst 4 digits AFTER the decimal point. Pv= PMT = FV= PpY= CpY=13. In order to invest in the stock market, Jamie takes out an interest-only loan of $50 000. If the interest on the loan is 8.15% per annum, compounding monthly, what will be his monthly repayments? Answer: The monthly repayment for this interest-only loan is $ (nearest cent) Copy the same exact values that you input into the Finance Solver into the textboxes provided below. In the textbox for the unknown variable, type the answer (CA5 output) to include only the rst 4 digits AFTER the decimal point. |%= PMT = FV= PpY= Cpy=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts