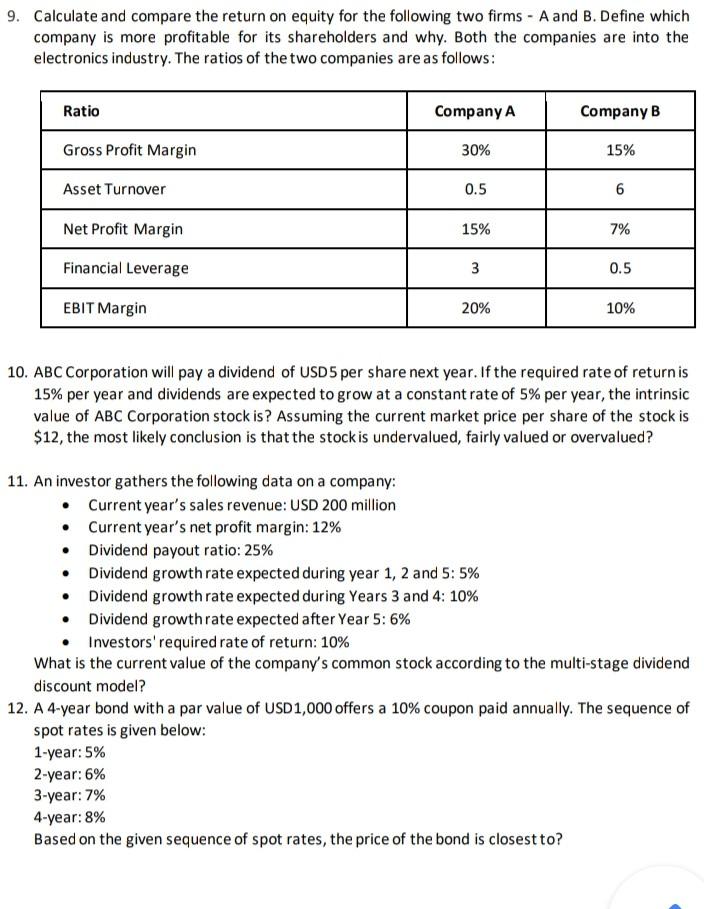

Question: 9. Calculate and compare the return on equity for the following two firms - A and B. Define which company is more profitable for its

9. Calculate and compare the return on equity for the following two firms - A and B. Define which company is more profitable for its shareholders and why. Both the companies are into the electronics industry. The ratios of the two companies are as follows: Ratio Company A Company B Gross Profit Margin 30% 15% Asset Turnover 0.5 6 Net Profit Margin 15% 7% Financial Leverage 3 0.5 EBIT Margin 20% 10% 10. ABC Corporation will pay a dividend of USD 5 per share next year. If the required rate of return is 15% per year and dividends are expected to grow at a constant rate of 5% per year, the intrinsic value of ABC Corporation stock is? Assuming the current market price per share of the stock is $12, the most likely conclusion is that the stock is undervalued, fairly valued or overvalued? 11. An investor gathers the following data on a company: Current year's sales revenue: USD 200 million Current year's net profit margin: 12% Dividend payout ratio: 25% Dividend growth rate expected during year 1, 2 and 5: 5% Dividend growth rate expected during Years 3 and 4: 10% Dividend growth rate expected after Year 5: 6% Investors' required rate of return: 10% What is the current value of the company's common stock according to the multi-stage dividend discount model? 12. A 4-year bond with a par value of USD 1,000 offers a 10% coupon paid annually. The sequence of spot rates is given below: 1-year: 5% 2-year: 6% 3-year: 7% 4-year: 8% Based on the given sequence of spot rates, the price of the bond is closest to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts