Question: 9. Calculating the APR when the add-on method is used Add-on interest rates and APRs are not equivalent. This is because the add-on calculation (using

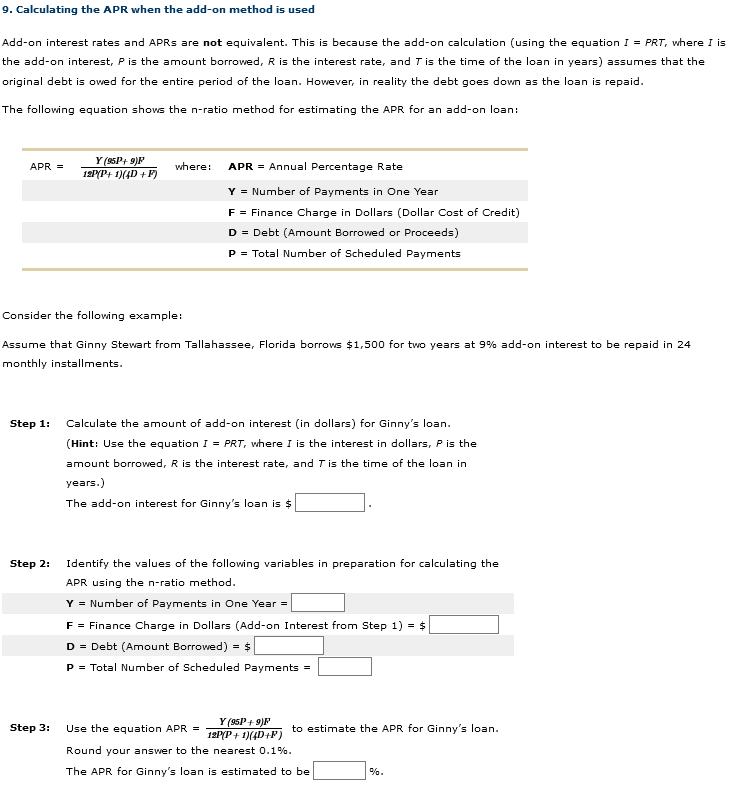

9. Calculating the APR when the add-on method is used Add-on interest rates and APRs are not equivalent. This is because the add-on calculation (using the equation I = PRT, where I is the add-on interest, P is the amount borrowed, R is the interest rate, and T is the time of the loan in years) assumes that the original debt is owed for the entire period of the loan. However, in reality the debt goes down as the loan is repaid. The following equation shows the n-ratio method for estimating the APR for an add-on loan: APR = Y(95P+ 9)P 12PYP+ 1)(4D +17 where: APR = Annual Percentage Rate Y = Number of Payments in One Year F = Finance Charge in Dollars (Dollar Cost of Credit) D = Debt (Amount Borrowed or Proceeds) P = Total Number of Scheduled Payments Consider the following example: Assume that Ginny Stewart from Tallahassee, Florida borrows $1,500 for two years at 9% add-on interest to be repaid in 24 monthly installments. Step 1: Calculate the amount of add-on interest (in dollars) for Ginny's loan. (Hint: Use the equation I = PRT, where I is the interest in dollars, P is the amount borrowed, R is the interest rate, and T is the time of the loan in years.) The add-on interest for Ginny's loan is $ Step 2: Identify the values of the following variables in preparation for calculating the APR using the n-ratio method. Y = Number of Payments in One Year = F = Finance Charge in Dollars (Add-on Interest from Step 1) = $ D = Debt (Amount Borrowed) = $ P = Total Number of Scheduled Payments = Step 3: Y (95P+9)P Use the equation APR = 12PYP + 1)(4D+P) to estimate the APR for Ginny's loan. Round your answer to the nearest 0.1%. The APR for Ginny's loan is estimated to be %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts