Question: 9. Capital budgeting and the post-audit process Aa Aa Cramer Designs produces a wide range of women's apparel. Three years ago, the company spent $1.2

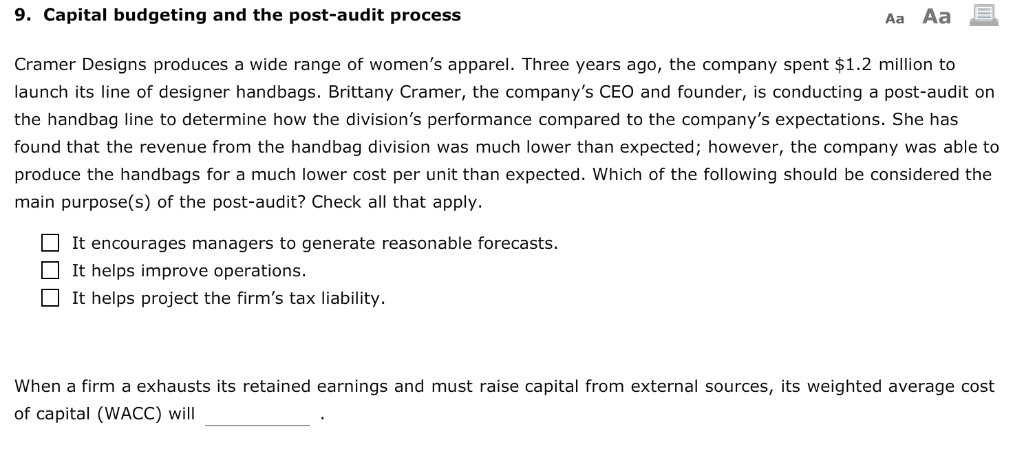

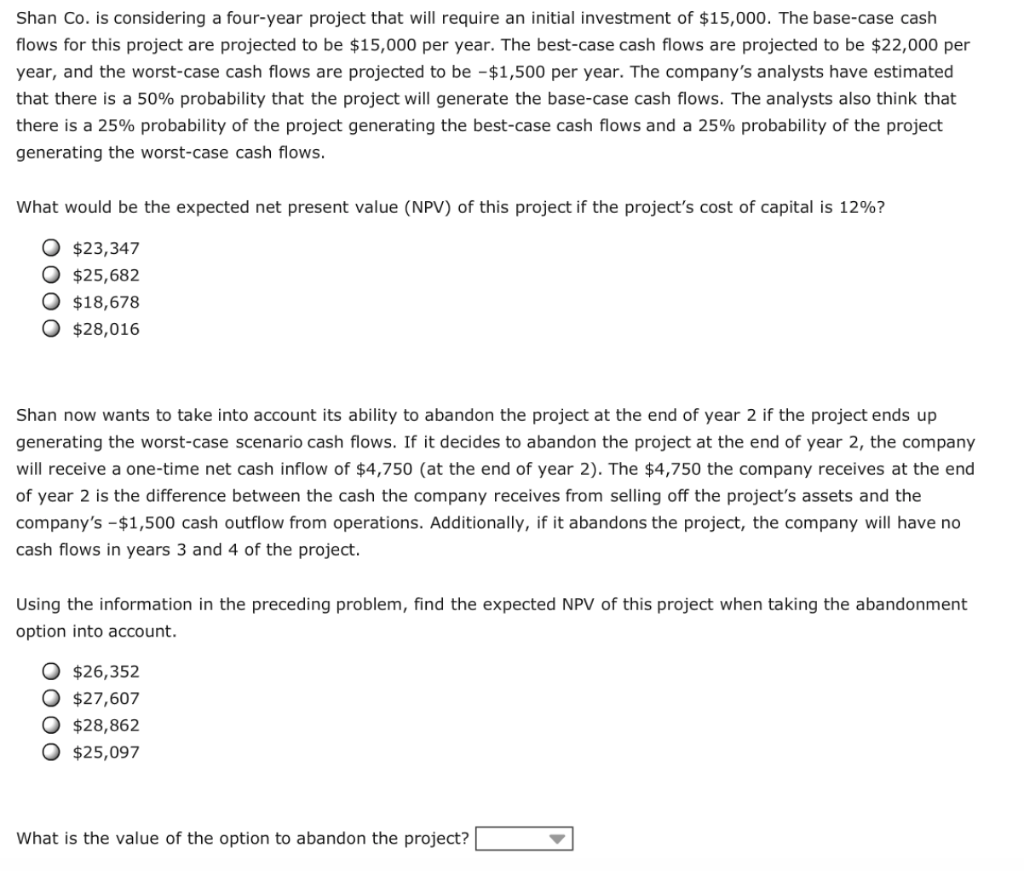

9. Capital budgeting and the post-audit process Aa Aa Cramer Designs produces a wide range of women's apparel. Three years ago, the company spent $1.2 million to launch its line of designer handbags. Brittany Cramer, the company's CEO and founder, is conducting a post-audit on the handbag line to determine how the division's performance compared to the company's expectations. She has found that the revenue from the handbag division was much lower than expected; however, the company was able to produce the handbags for a much lower cost per unit than expected. Which of the following should be considered the main purpose(s) of the post-audit? Check all that apply It encourages managers to generate reasonable forecasts. It helps improve operations It helps project the firm's tax liability. When a firm a exhausts its retained earnings and must raise capital from external sources, its weighted average cost of capital (WACC) will Shan Co. is considering a four-year project that will require an initial investment of $15,000. The base-case cash flows for this project are projected to be $15,000 per year. The best-case cash flows are projected to be $22,000 per year, and the worst-case cash flows are projected to be -$1,500 per year. The company's analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows. What would be the expected net present value (NPV) of this project if the project's cost of capital is 12%? O $23,347 O $25,682 O$18,678 O $28,016 Shan now wants to take into account its ability to abandon the project at the end of year 2 if the project ends up generating the worst-case scenario cash flows. If it decides to abandon the project at the end of year 2, the company will receive a one-time net cash inflow of $4,750 (at the end of year 2). The $4,750 the company receives at the end of year 2 is the difference between the cash the company receives from selling off the project's assets and the company's -$1,500 cash outflow from operations. Additionally, if it abandons the project, the company will have no cash flows in years 3 and 4 of the project Using the information in the preceding problem, find the expected NPV of this project when taking the abandonment option into account. O$26,352 O $27,607 $28,862 O $25,097 What is the value of the option to abandon the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts