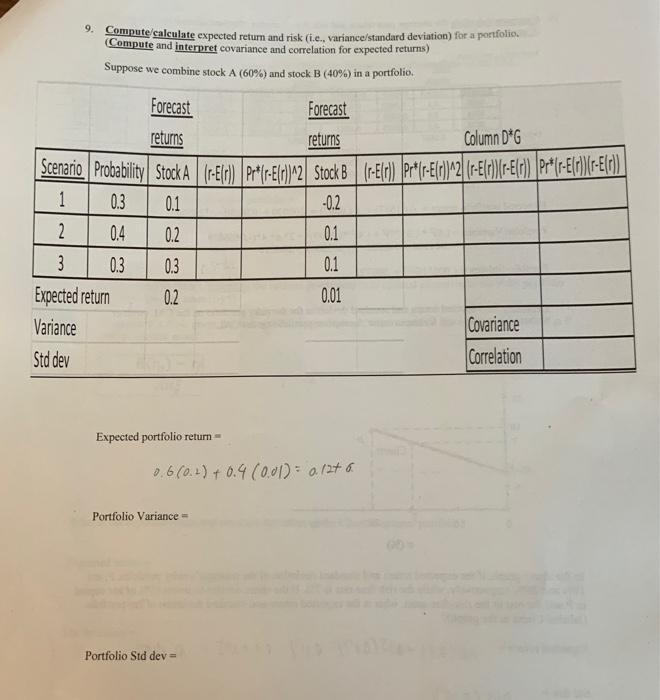

Question: 9. Compute/calculate expected return and risk (i.e., variance/standard deviation) for a portfolio. (Compute and interpret covariance and correlation for expected returns) Suppose we combine

9. Compute/calculate expected return and risk (i.e., variance/standard deviation) for a portfolio. (Compute and interpret covariance and correlation for expected returns) Suppose we combine stock A (60%) and stock B (40 %) in a portfolio. Forecast Forecast returns returns Column D*G Scenario Probability Stock A (r-E(r)) Pr*(r-E(r))^2 Stock B (r-E(r)) |Pr* (r-E(r))^2 (r-E(r))r-E(r)) Pr*(r-Er) (r-E(r)) 1 0.3 0.1 -0.2 2 0.4 0.2 0.1 3 0.3 0.3 0.1 0.2 0.01 Expected return Variance Std dev Expected portfolio return= 0.6 (0.1) + 0.4 (0.01) = a. 12+ 6. Portfolio Variance- Portfolio Std dev = Covariance Correlation

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Here are the steps to solve this 1 Calculate expected ret... View full answer

Get step-by-step solutions from verified subject matter experts