Question: 9. Computing the federal transfer tax - Practice 2 Shane Morse died in 2012, leaving an estate of $27,000,000. Shane's wife died in 2009. In

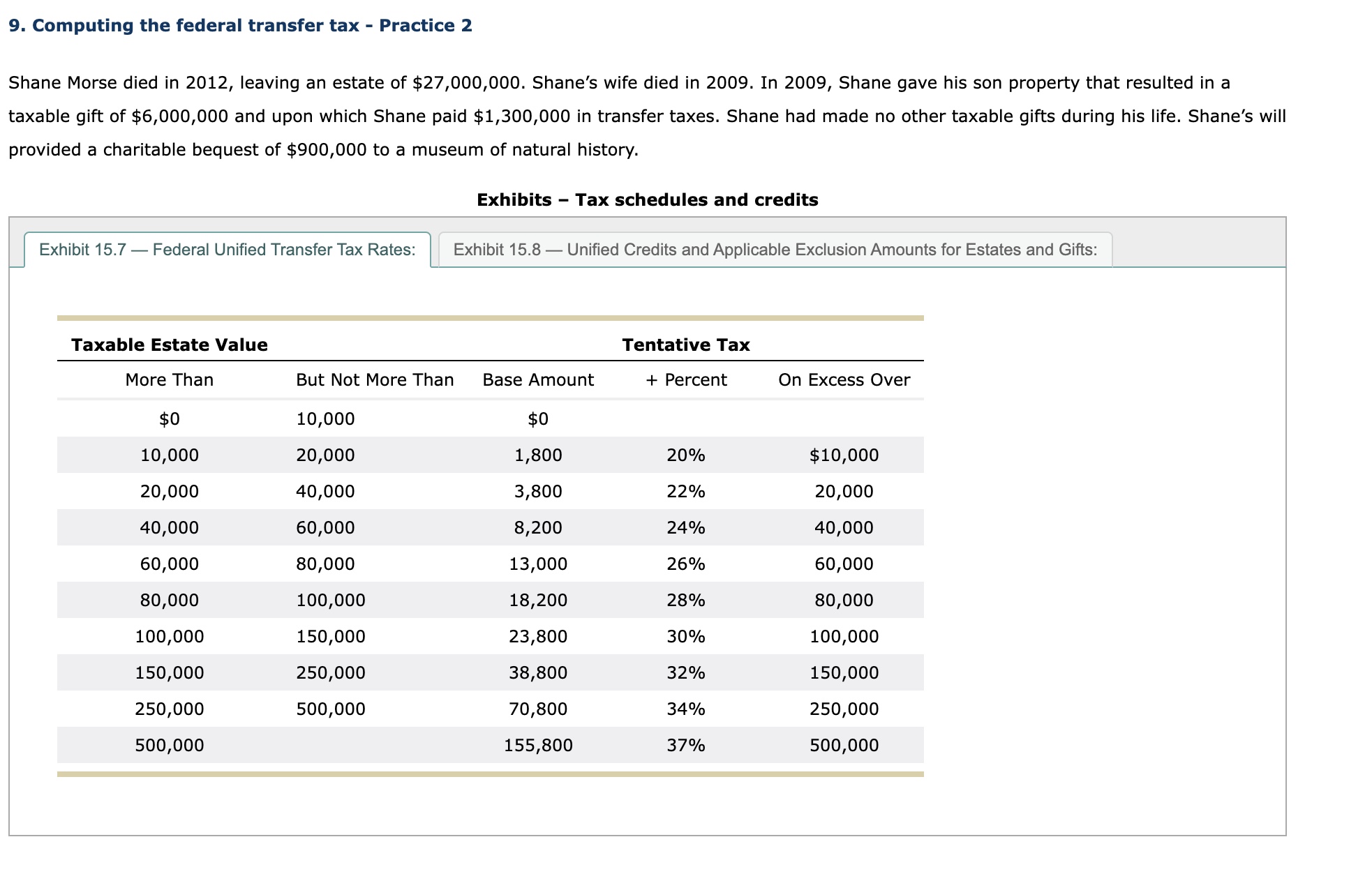

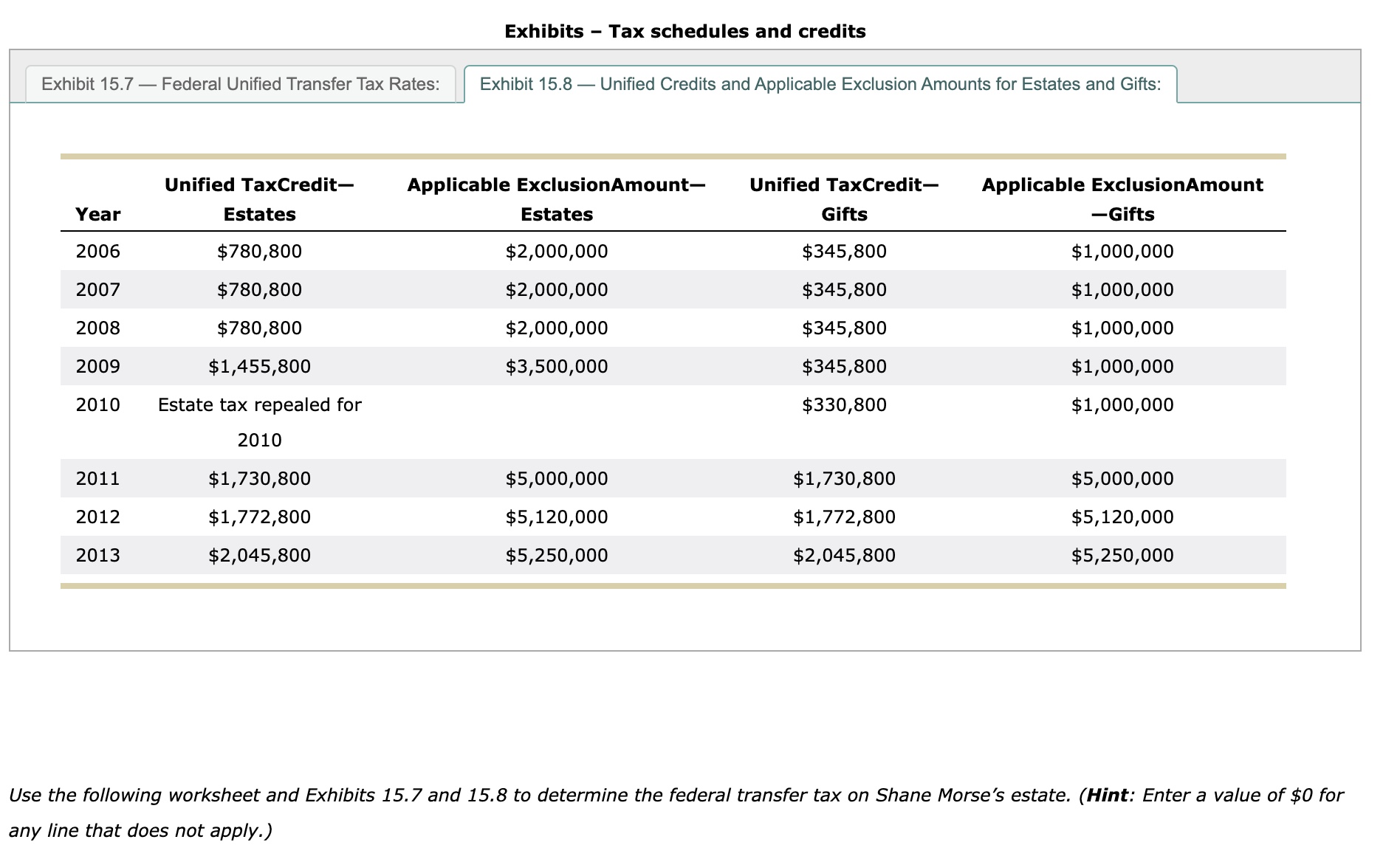

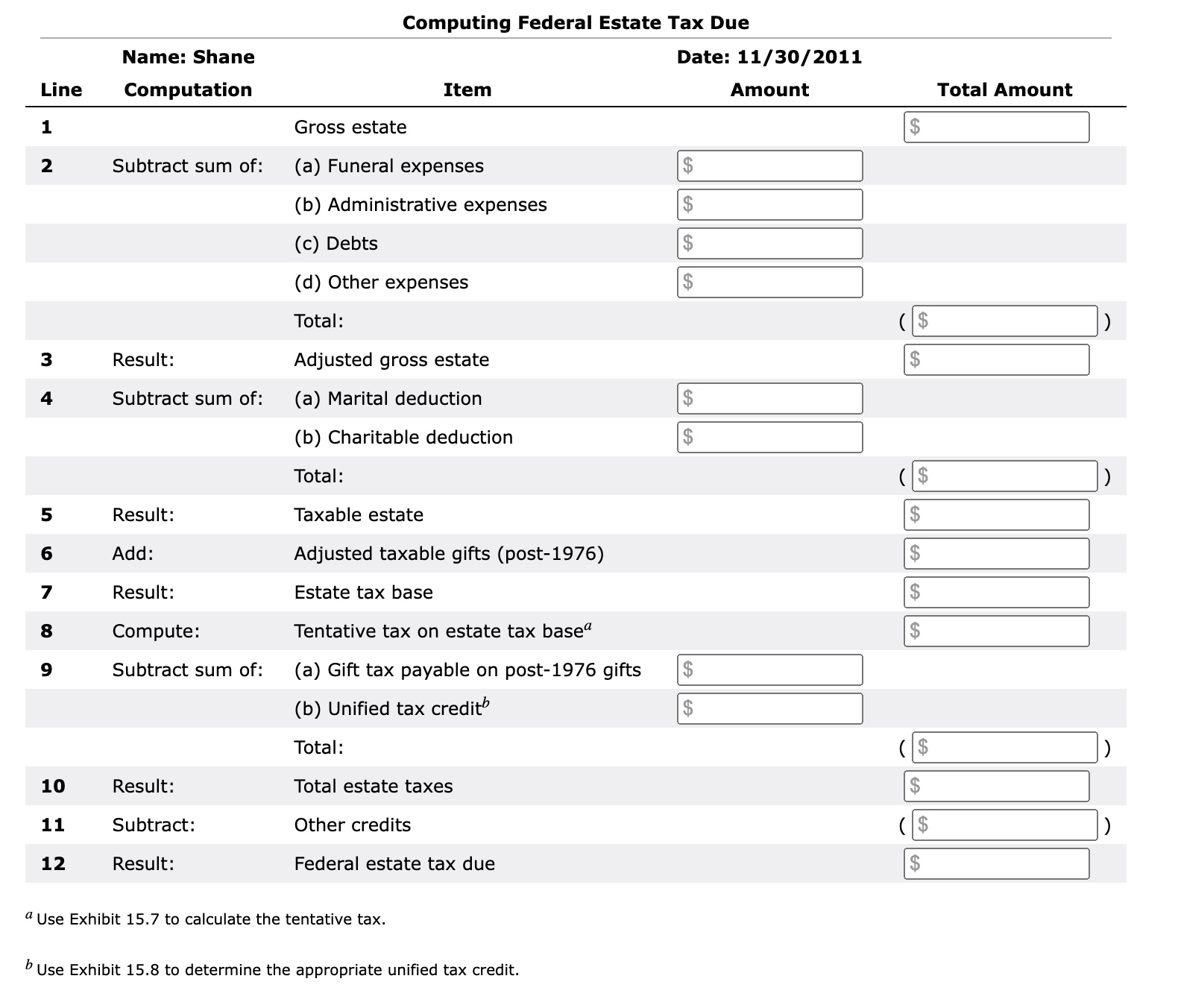

9. Computing the federal transfer tax - Practice 2 Shane Morse died in 2012, leaving an estate of \\$27,000,000. Shane's wife died in 2009. In 2009, Shane gave his son property that resulted in a taxable gift of \\( \\$ 6,000,000 \\) and upon which Shane paid \\( \\$ 1,300,000 \\) in transfer taxes. Shane had made no other taxable gifts during his life. Shane's will provided a charitable bequest of \\( \\$ 900,000 \\) to a museum of natural history. Exhibits - Tax schedules and credits Exhibit 15.7 - Federal Unified Transfer Tax Rates: Exhibit 15.8 - Unified Credits and Applicable Exclusion Amounts for Estates and Gifts: \\( { }^{b} \\) Use Exhibit 15.8 to determine the appropriate unified tax credit. Jse the following worksheet and Exhibits 15.7 and 15.8 to determine the federal transfer tax on Shane Morse's estate. (Hint: Enter a value of \\$0 for any line that does not apply.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts