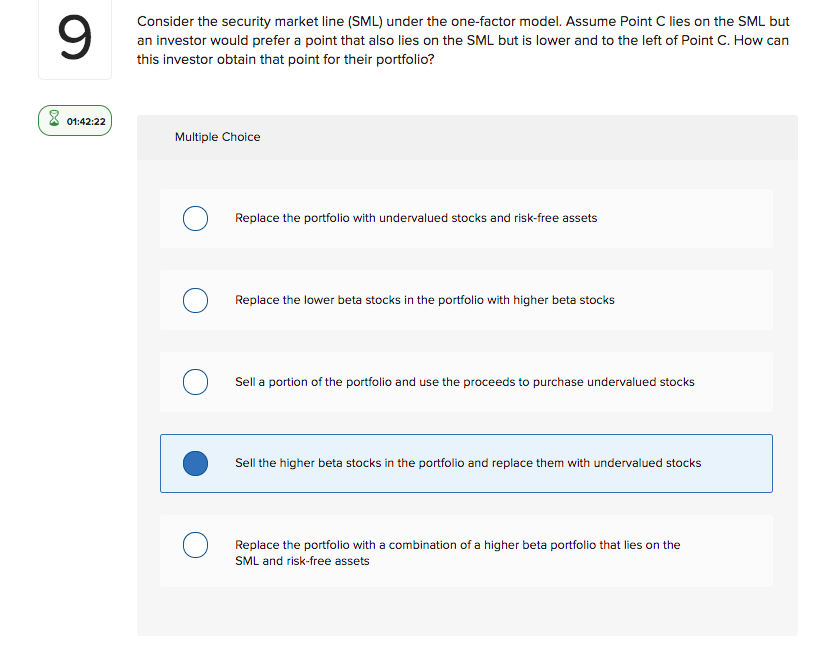

Question: 9 Consider the security market line (SML) under the one-factor model. Assume Point C lies on the SML but an investor would prefer a point

9 Consider the security market line (SML) under the one-factor model. Assume Point C lies on the SML but an investor would prefer a point that also lies on the SML but is lower and to the left of Point C. How can this investor obtain that point for their portfolio? 8 01:42:22 Multiple Choice Replace the portfolio with undervalued stocks and risk-free assets Replace the lower beta stocks in the portfolio with higher beta stocks Sell a portion of the portfolio and use the proceeds to purchase undervalued stocks Sell the higher beta stocks in the portfolio and replace them with undervalued stocks Replace the portfolio with a combination of a higher beta portfolio that lies on the SML and risk-free assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts