Question: .9 E2-14 (Static) Calculating and Evaluating the Current Ratio [LO 2-1, LO 2-5) Columbia Sportswear Company reported the following in recent balance sheets (amounts in

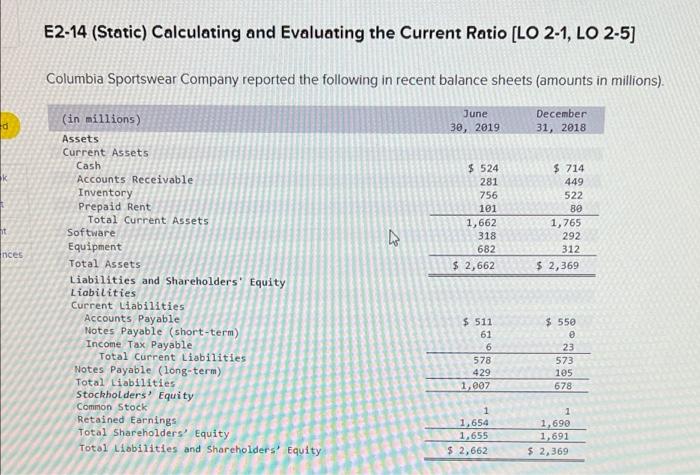

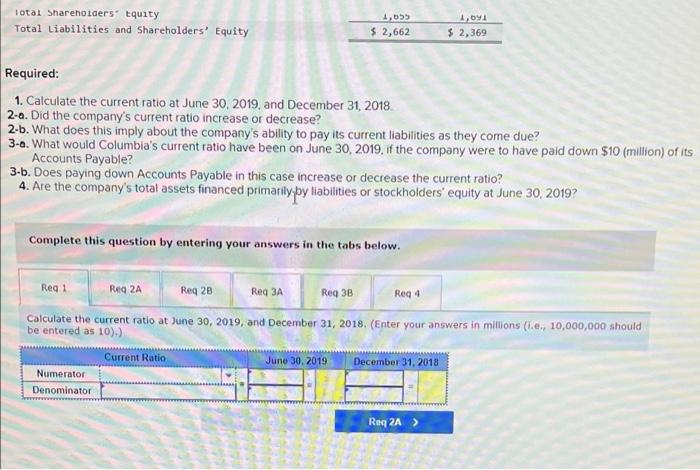

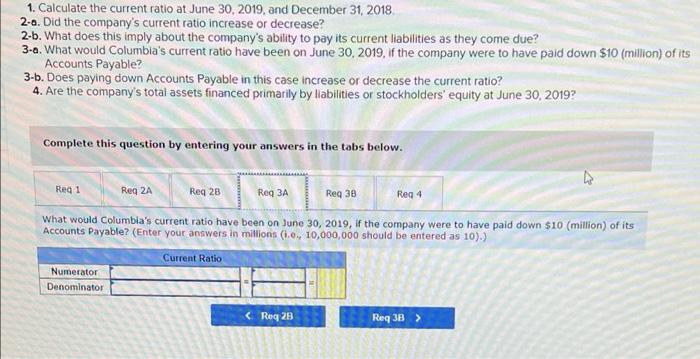

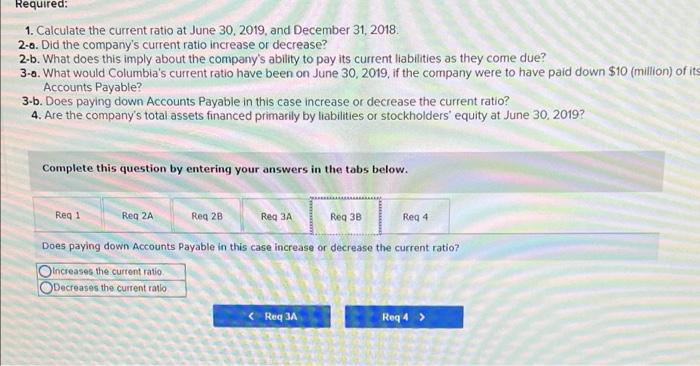

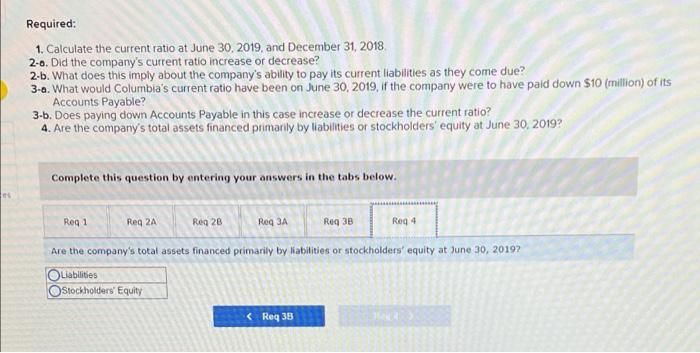

E2-14 (Static) Calculating and Evaluating the Current Ratio [LO 2-1, LO 2-5) Columbia Sportswear Company reported the following in recent balance sheets (amounts in millions). June 30, 2019 December 31, 2018 K $ 524 281 756 101 1,662 318 682 $ 2,662 $ 714 449 522 80 1,765 292 312 fit nces $ 2,369 (in millions) Assets Current Assets Cash Accounts Receivable Inventory Prepaid Rent Total Current Assets Software Equipment Total Assets Liabilities and Shareholders' Equity Liabilities Current Liabilities Accounts Payable Notes Payable (short-term) Income Tax Payable Total Current Liabilities Notes Payable (long-term) Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity $ 550 $ 511 61 6 578 429 1,007 23 573 105 678 1 1,654 1,655 $ 2,662 1 1,690 1,691 $ 2,369 Total Shareholders tquity Total Liabilities and Shareholders' Equity .1 1,091 $ 2,369 $ 2,662 Required: 1. Calculate the current ratio at June 30, 2019, and December 31, 2018 2-a. Did the company's current ratio increase or decrease? 2-b. What does this imply about the company's ability to pay its current liabilities as they come due? 3-0. What would Columbia's current ratio have been on June 30, 2019, if the company were to have paid down $10 million) of its Accounts Payable? 3-b. Does paying down Accounts Payable in this case increase or decrease the current ratio? 4. Are the company's total assets financed primarily by liabilities or stockholders' equity at June 30, 2019? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Reg 3A Req 3B Reg 4 Calculate the current ratio at June 30, 2019, and December 31, 2018. (Enter your answers in millions (.e. 10,000,000 should be entered as 10).) Current Ratio June 30, 2019 December 31, 2018 Numerator Denominator Req2A > 1. Calculate the current ratio at June 30, 2019, and December 31, 2018 2-a. Did the company's current ratio increase or decrease? 2-b. What does this imply about the company's ability to pay its current liabilities as they come due? 3-6. What would Columbia's current ratio have been on June 30, 2019, if the company were to have paid down $10 million) of Accounts Payable? 3-b. Does paying down Accounts Payable in this case increase or decrease the current ratio? 4. Are the company's total assets financed primarily by liabilities or stockholders' equity at June 30, 2019? w Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Reg 3A Reg 3B Req 4 Did the company's current ratio increase or decrease? Increase Decrease 1. Calculate the current ratio at June 30, 2019, and December 31, 2018 2-6. Did the company's current ratio increase or decrease? 2-b. What does this imply about the company's ability to pay its current liabilities as they come due? 3-a. What would Columbia's current ratio have been on June 30, 2019. If the company were to have paid down $10 (million) of its Accounts Payable? 3-b. Does paying down Accounts Payable in this case increase or decrease the current ratio? 4. Are the company's total assets financed primarily by liabilities or stockholders' equity at June 30, 2019 Complete this question by entering your answers in the tabs below. tes Reg 1 Reg 2A Reg 28 Reg 3A Reg 30 Reg 4 What does this imply about the company's ability to pay its current liabilities as they come due? Incroaned ability to pay current liabilities Decreased ability to pay current liabilities Required: 1. Calculate the current ratio at June 30, 2019, and December 31, 2018 2-6. Did the company's current ratio increase or decrease? 2-b. What does this imply about the company's ability to pay its current liabilities as they come due? 3-6. What would Columbia's current ratio have been on June 30, 2019, if the company were to have paid down $10 (million) of its Accounts Payable? 3-b. Does paying down Accounts Payable in this case increase or decrease the current ratio? 4. Are the company's total assets financed primarily by liabilities or stockholders' equity at June 30, 2019? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Reg 3A Reg 3B Reg 4 Does paying down Accounts Payable in this case increase or decrease the current ratio? Increases the current ratio Decreases the current ratlo Required: 1. Calculate the current ratio at June 30, 2019, and December 31, 2018 2-0. Did the company's current ratio increase or decrease? 2-b. What does this imply about the company's ability to pay its current liabilities as they come due? 3-a. What would Columbia's current ratio have been on June 30, 2019, if the company were to have paid down $10 million) of its Accounts Payable? 3-b. Does paying down Accounts Payable in this case increase or decrease the current ratio? 4. Are the company's total assets financed primarily by liabilities or stockholders' equity at June 30, 2019 Complete this question by entering your answers in the tabs below. es Reg 1 Reg 2A Reg 20 Req 3A Reg38 Roq 4 Are the company's total assets financed primarily by abilities or stockholders' equity at June 30, 20197 Liabilities Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts