Question: 9 . Each answer, a) and b) is worth 1 point . In answer b), each number is worth . 2 . Us ing the

9. Each answer, a) and b) is worth 1 point. In answer b), each number is worth .2. Using the Excel Spreadsheet providedseparately, do the following:

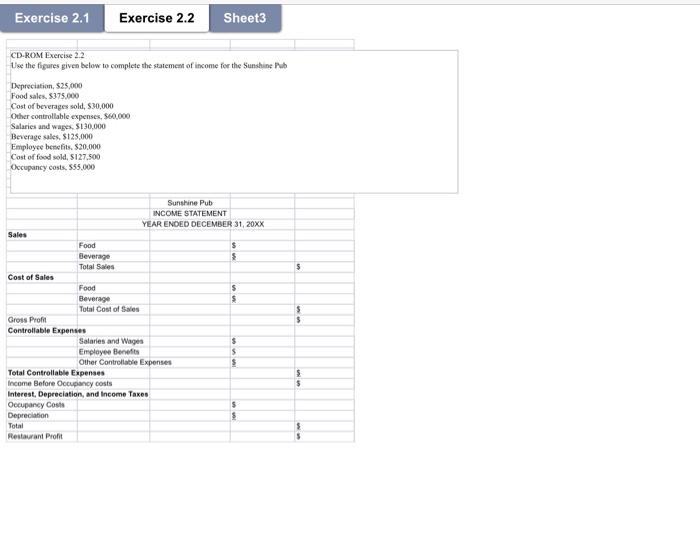

a) Prepare the Sunshine Pubs Income Statement and copy and paste your result below.

b) Determine the following percentages:

1) Food cost percent

2) Labor cost percent (payroll, plus employee benefits)

3) Beverage cost percent

4) Percentage of profit before income taxes

5) Assuming the restaurant has 75 seats, determine food sales per seat for the year.

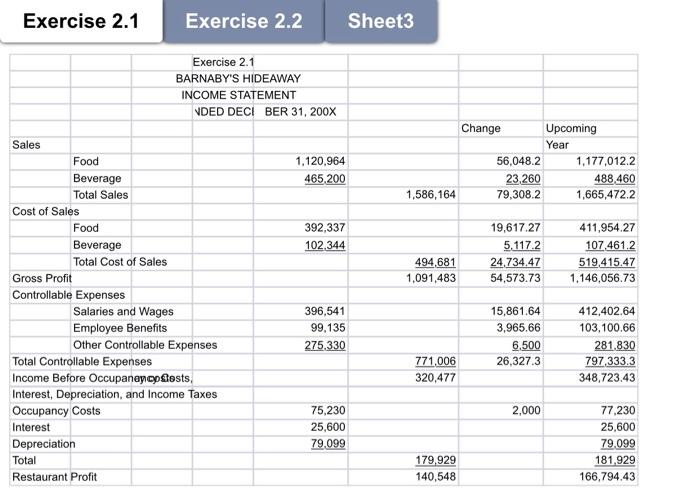

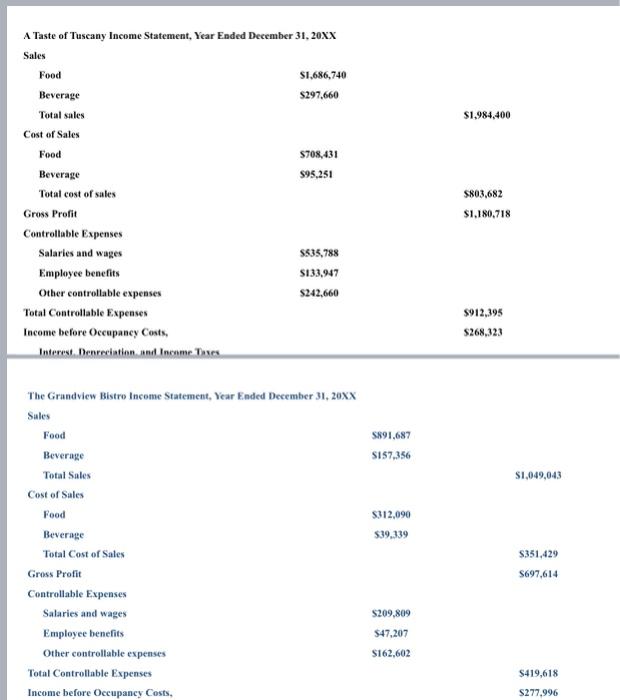

Exercise 2.1 Exercise 2.2 Sheet3 Exercise 2.1 BARNABY'S HIDEAWAY INCOME STATEMENT NDED DECI BER 31, 200X Change Upcoming Year 1.120,964 465 200 56,048.2 23.260 79,308.2 1,177,012.2 488,460 1,665,472.2 1,586,164 392,337 102.344 19,617.27 5.1172 24,734.47 54,573.73 411,954.27 107,461.2 519,415.47 1.146,056.73 494,681 1,091,483 Sales Food Beverage Total Sales Cost of Sales Food Beverage Total Cost of Sales Gross Profit Controllable Expenses Salaries and Wages Employee Benefits Other Controllable Expenses Total Controllable Expenses Income Before Occupanen postests, Interest, Depreciation, and Income Taxes Occupancy Costs Interest Depreciation Total Restaurant Profit 396,541 99,135 275,330 15,861.64 3,965.66 6.500 26,327.3 412,402.64 103,100.66 281.830 797,333.3 348,723.43 771,006 320,477 2,000 75,230 25,600 79,099 77,230 25,600 79.099 181.929 166,794.43 179,929 140,548 Exercise 2.1 Exercise 2.2 Sheet3 CD-ROM Exercise 2.2 Use the figures given below to complete the statement of income for the Sunshine Pub Depreciation, $25.000 Food sales. $375.000 Cost of beverages sold, 530,000 Other controllable expenses, 560.000 Salaries and wages, $130.000 Beverage sales, $125.000 Employee benefits. $20,000 Cost of food sold, 5127.500 Occupancy costs, 555.000 $ Sunshine Pub INCOME STATEMENT YEAR ENDED DECEMBER 31, 20XX Sales Food Beverage $ Total Sales Cost of Sales Food $ Beverage S Total Cost of Sales Gross Profit Controllable Expenses Salaries and Wages $ Employee Benefits $ Other Controllable Expenses $ Total Controllable Expenses Income Before Occupancy costs Interest, Depreciation, and Income Taxes Occupancy Costa $ Depreciation Total Restaurant Pont S $1,984,400 A Taste of Tuscany Income Statement, Year Ended December 31, 20XX Sales Food S1,686,740 Beverage $297.660 Total sales Cost of Sales Food 5708,431 Beverage 595,251 Total cost of sales Gross Profit Controllable Expenses Salaries and wages $535,788 Employee benefits $133,947 Other controllable expenses 5242,660 Total Controllable Expenses Income before Occupancy Costs, Interest. Denreciation and Income Taxes $803,682 $1,180,718 $912,395 $268.323 5891,687 S157,356 $1,049,043 $312.090 $39,339 The Grandview Bistro Income Statement, Year Ended December 31, 20XX Sales Food Beverage Total Sales Cost of Sales Food Beverage Total Cost of Sales Gross Profit Controllable Expenses Salaries and wages Employee benefits Other controllable expenses Total Controllable Expenses Income before Occupancy Costs, 351.429 S697,614 $209,809 $47,207 S162,602 $419,618 $277.996