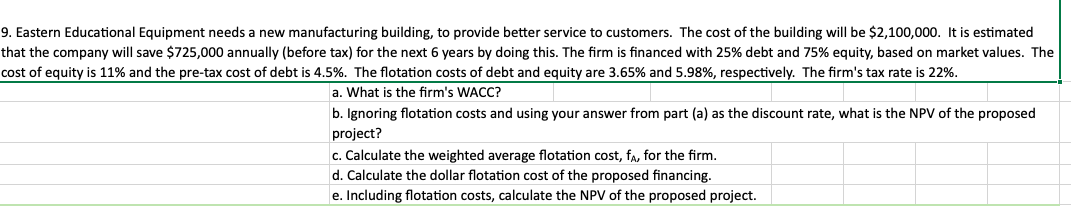

Question: 9. Eastern Educational Equipment needs a new manufacturing building, to provide better service to customers. The cost of the building will be $2,100,000. It is

9. Eastern Educational Equipment needs a new manufacturing building, to provide better service to customers. The cost of the building will be $2,100,000. It is estimated that the company will save $725,000 annually (before tax) for the next 6 years by doing this. The firm is financed with 25% debt and 75% equity, based on market values. The cost of equity is 11% and the pre-tax cost of debt is 4.5%. The flotation costs of debt and equity are 3.65% and 5.98%, respectively. The firm's tax rate is 22%. a. What is the firm's WACC? b. Ignoring flotation costs and using your answer from part (a) as the discount rate, what is the NPV of the proposed project? c. Calculate the weighted average flotation cost, fa, for the firm. d. Calculate the dollar flotation cost of the proposed financing. e. Including flotation costs, calculate the NPV of the proposed project. 9. Eastern Educational Equipment needs a new manufacturing building, to provide better service to customers. The cost of the building will be $2,100,000. It is estimated that the company will save $725,000 annually (before tax) for the next 6 years by doing this. The firm is financed with 25% debt and 75% equity, based on market values. The cost of equity is 11% and the pre-tax cost of debt is 4.5%. The flotation costs of debt and equity are 3.65% and 5.98%, respectively. The firm's tax rate is 22%. a. What is the firm's WACC? b. Ignoring flotation costs and using your answer from part (a) as the discount rate, what is the NPV of the proposed project? c. Calculate the weighted average flotation cost, fa, for the firm. d. Calculate the dollar flotation cost of the proposed financing. e. Including flotation costs, calculate the NPV of the proposed project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts