Question: 9. Factors that affect the WACC equation Aa Aa Each of the following factors affects the weighted average cost of capital (WACC) equation. Which are

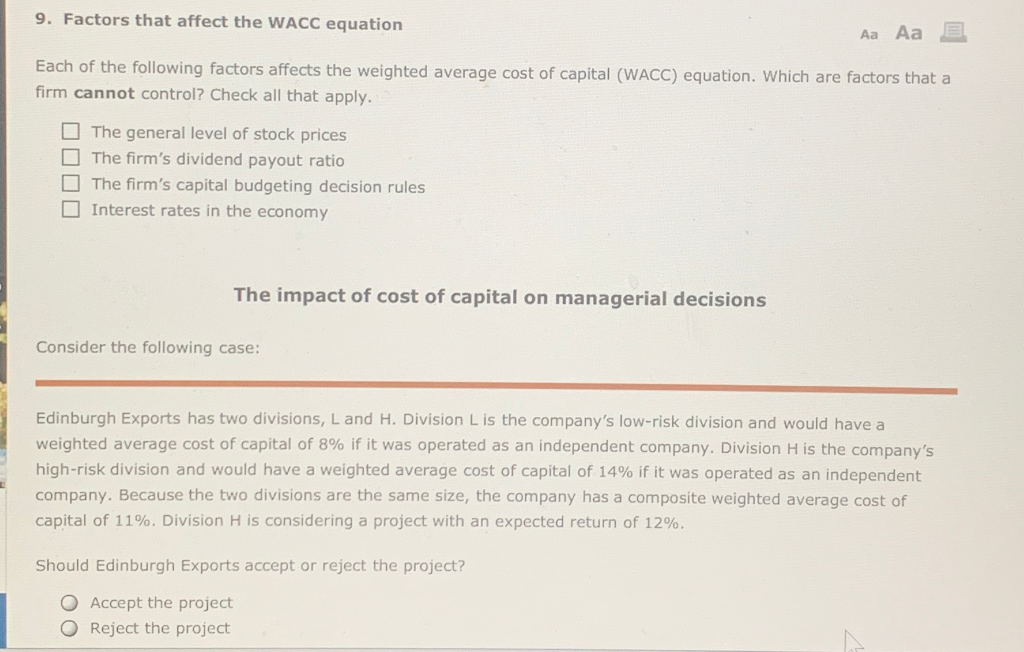

9. Factors that affect the WACC equation Aa Aa Each of the following factors affects the weighted average cost of capital (WACC) equation. Which are factors that a firm cannot control? Check all that apply The general level of stock prices The firm's dividend payout ratio The firm's capital budgeting decision rules Interest rates in the economy The impact of cost of capital on managerial decisions Consider the following case: Edinburgh Exports has two divisions, L and H. Division L is the company's low-risk division and would have a weighted average cost of capital of 8% if it was operated as an independent company. Division H is the company's high-risk division and would have a weighted average cost of capital of 14% if it was operated as an independent company. Because the two divisions are the same size, the company has a com posite weighted average cost of capital of 11%. Division H is considering a project with an expected return of 12 %o. Should Edinburgh Exports accept or reject the project? O Accept the project Reject the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts