Question: 9. From the data given below, determine the Non-Controlling Interest as of December 31, 2020. On January 1, 2018 JYN Company purchased 80% of the

9. From the data given below, determine the Non-Controlling Interest as of December 31, 2020.

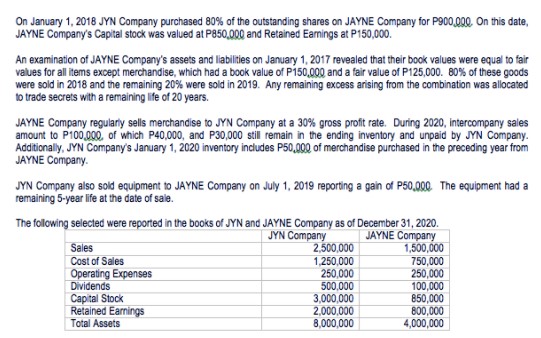

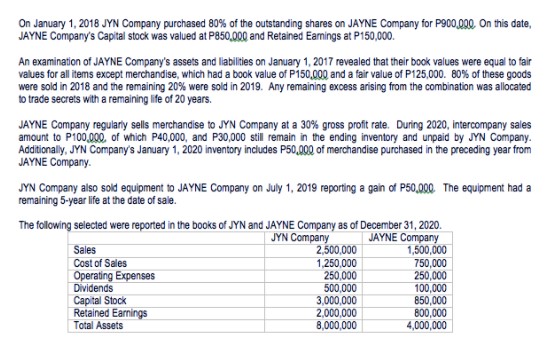

On January 1, 2018 JYN Company purchased 80% of the outstanding shares on JAYNE Company for P900,000, On this date, JAYNE Company's Capital stock was valued at P850,000 and Retained Earnings at P150,000. An examination of JAYNE Company's assets and liabilities on January 1, 2017 revealed that their book values were equal to fair values for all items except merchandise, which had a book value of P150,000 and a fair value of P125,000. 80% of these goods were sold in 2018 and the remaining 20% were sold in 2019. Any remaining excess arising from the combination was allocated to trade secrets with a remaining life of 20 years. JAYNE Company regularly sells merchandise to JYN Company at a 30% gross profit rate. During 2020, intercompany sales amount to P100,000, of which P40,000, and P30,000 still remain in the ending inventory and unpaid by JYN Company. Additionally, JYN Company's January 1, 2020 inventory includes P50,000 of merchandise purchased in the preceding year from JAYNE Company. JYN Company also sold equipment to JAYNE Company on July 1, 2019 reporting a gain of P50,090. The equipment had a remaining 5-year life at the date of sale. The following selected were reported in the books of JYN and JAYNE Company as of December 31, 2020. JYN Company JAYNE Company Sales 2.500,000 1,500,000 Cost of Sales 1.250,000 750,000 Operating Expenses 250,000 250,000 Dividends 500,000 100,000 Capital Stock 3,000,000 850,000 Retained Earnings 2,000,000 800,000 Total Assets 8,000,000 4,000,000On January 1, 2018 JYN Company purchased 80% of the outstanding shares on JAYNE Company for P900,000, On this date, JAYNE Company's Capital stock was valued at P850,000 and Retained Earnings at P150,000. An examination of JAYNE Company's assets and liabilities on January 1, 2017 revealed that their book values were equal to fair values for all items except merchandise, which had a book value of P150,000 and a fair value of P125,000. 80% of these goods were sold in 2018 and the remaining 20% were sold in 2019. Any remaining excess arising from the combination was allocated to trade secrets with a remaining life of 20 years. JAYNE Company regularly sells merchandise to JYN Company at a 30% gross profit rate. During 2020, intercompany sales amount to P100,000, of which P40,000, and P30,000 still remain in the ending inventory and unpaid by JYN Company. Additionally, JYN Company's January 1, 2020 inventory includes P50,000 of merchandise purchased in the preceding year from JAYNE Company. JYN Company also sold equipment to JAYNE Company on July 1, 2019 reporting a gain of P50,000. The equipment had a remaining 5-year life at the date of sale. The following selected were reported in the books of JYN and JAYNE Company as of December 31, 2020. JYN Company JAYNE Company Sales 2,500,000 1,500,000 Cost of Sales 1.250,000 750,000 Operating Expenses 250,000 250,000 Dividends 500,000 100,000 Capital Stock 3,000,000 850,000 Retained Earnings 2,000,000 800,000 Total Assets 8,000,000 4,000,000