Question: 9. Hedging with Futures Refer to Table 25.2 in the text to answer this question. Suppose today is March 27, 2018, and your firm produces

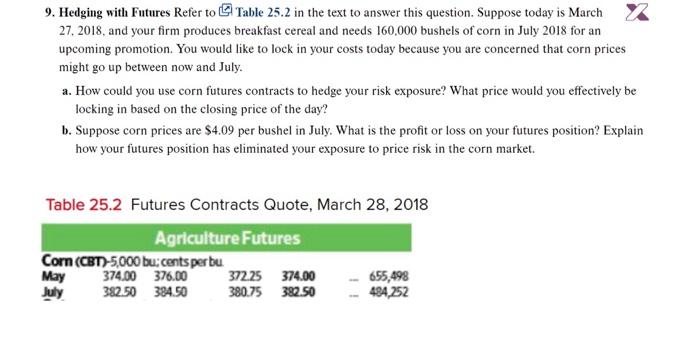

9. Hedging with Futures Refer to Table 25.2 in the text to answer this question. Suppose today is March 27, 2018, and your firm produces breakfast cereal and needs 160,000 bushels of corn in July 2018 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might go up between now and July. a. How could you use corn futures contracts to hedge your risk exposure? What price would you effectively be locking in based on the closing price of the day? b. Suppose corn prices are $4.09 per bushel in July. What is the profit or loss on your futures position? Explain how your futures position has eliminated your exposure to price risk in the corn market. Table 25.2 Futures Contracts Quote, March 28, 2018 Agriculture Futures Corn (CBT)-5,000 bu:cents per bu 374.00 376.00 372.25 374.00 655,498 382.50 384.50 380.75 382.50 494,252 May July

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts