Question: 9. Identify the statement below concerning the LIFO inventory method that is INCORRECT o) In the abscuce af changes ncosts e esalts f singLIFO would

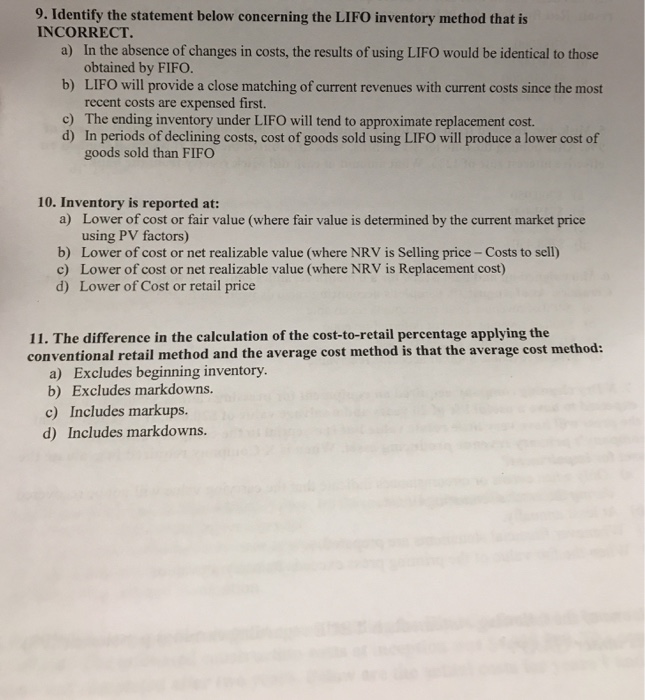

9. Identify the statement below concerning the LIFO inventory method that is INCORRECT o) In the abscuce af changes ncosts e esalts f singLIFO would be dentia to e obtained by FIFO LIFO will provide a close matching of current revenues with current costs since the most recent costs are expensed first. The ending inventory under LIFO will tend to approximate replacement cost. In periods of declining costs, cost of goods sold using LIFO will produce a lower cost of goods sold than FIFO b) c) d) 10. Inventory is reported at: Lower of cost or fair value (where fair value is determined by the current market price using PV factors) Lower of cost or net realizable value (where NRV is Selling price-Costs to sell) Lower of cost or net realizable value (where NRV is Replacement cost) Lower of Cost or retail price a) b) c) d) 11. The difference in the calculation of the cost-to-retail percentage applying the conventional retail method and the average cost method is that the average cost method: a) Excludes beginning inventory b) Excludes markdowns. c) Includes markups. d) Includes markdowns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts