Question: 9. In the Capital Asset Pricing Model, the expected return of the market minus the risk-free rate is called the market risk premium. Explain (in

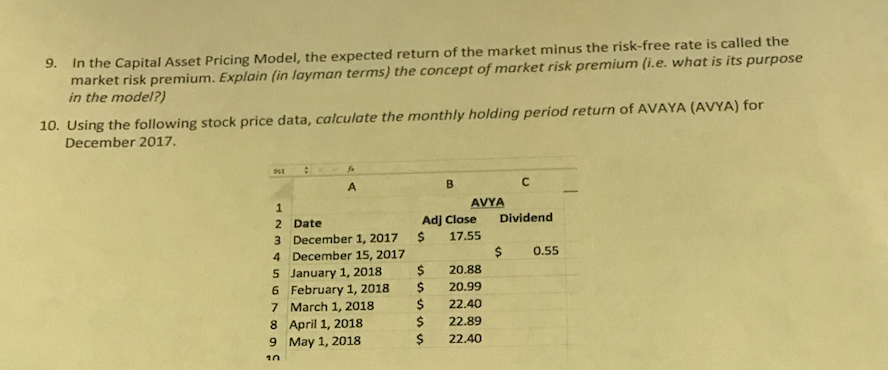

9. In the Capital Asset Pricing Model, the expected return of the market minus the risk-free rate is called the market risk premium. Explain (in loyman terms) the concept of market risk premium (i.e. what is its purpose in the model?) 10. Using the following stock price data, calculate the monthly holding period return of AVAYA (AVYA) for December 2017. AVYA Adj Close Dividend 2 Date 3 December 1, 2017 17.55 4 December 15, 2017 5 January 1, 201820.88 6 February 1, 2018 20.99 7 March 1, 2018 22.40 8 April 1, 2018 9 May 1, 2018 $ o.s5 $22.89 22.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts