Question: 9. (In this question, please keep as many digits as possible in all interim calculations. Any bit of rounding in the calculations used to answer

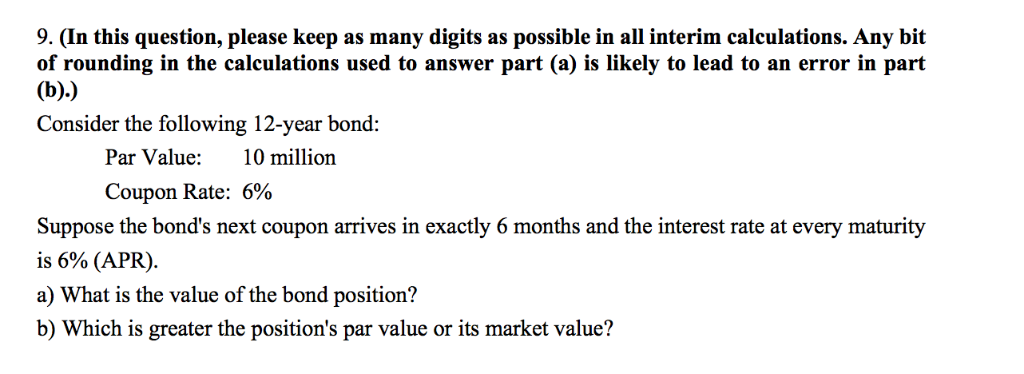

9. (In this question, please keep as many digits as possible in all interim calculations. Any bit of rounding in the calculations used to answer part (a) is likely to lead to an error in part (b).) Consider the following 12-year bond: Par Value 10 million Coupon Rate: 6% Suppose the bond's next coupon arrives in exactly 6 months and the interest rate at every maturity is 6% (APR) a) What is the value of the bond position? b) Which is greater the position's par value or its market value

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock