Question: 9 is the first question which should be A. Use that to find #10 (Finding the value of the firm using Miller Model given Cost

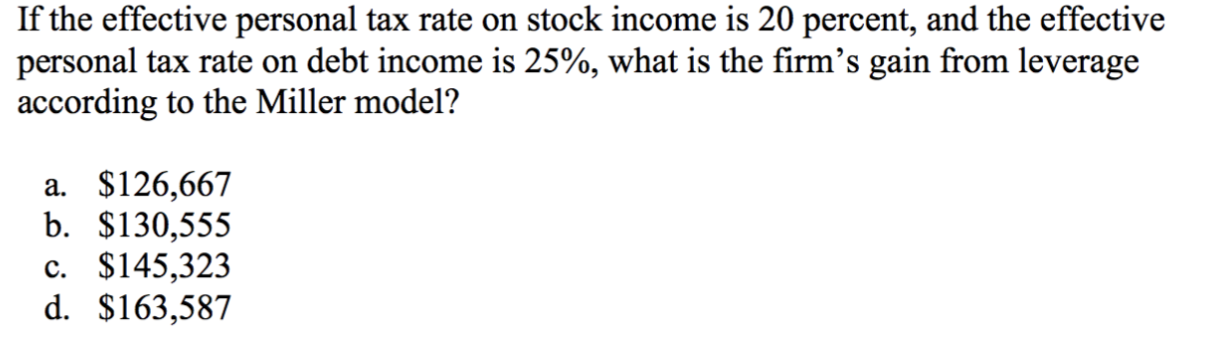

9 is the first question which should be A. Use that to find #10 (Finding the value of the firm using Miller Model given Cost of Equity (Unlevered) = 20%. Upon further review of the problem, it appears the information of the first two questions will help toward finding #10.

9 is the first question which should be A. Use that to find #10 (Finding the value of the firm using Miller Model given Cost of Equity (Unlevered) = 20%. Upon further review of the problem, it appears the information of the first two questions will help toward finding #10.

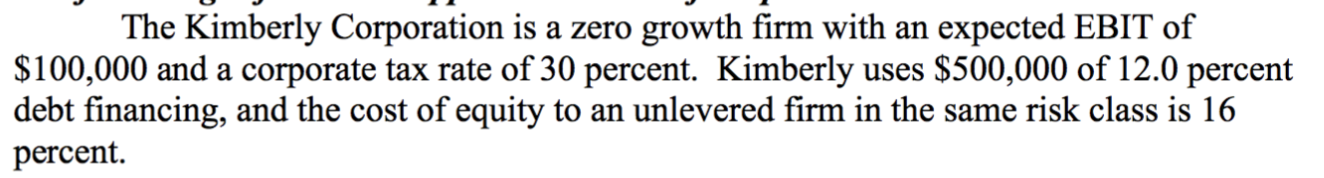

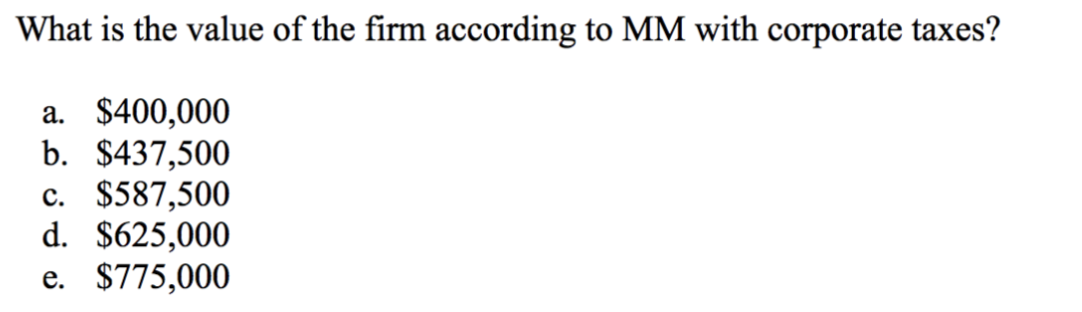

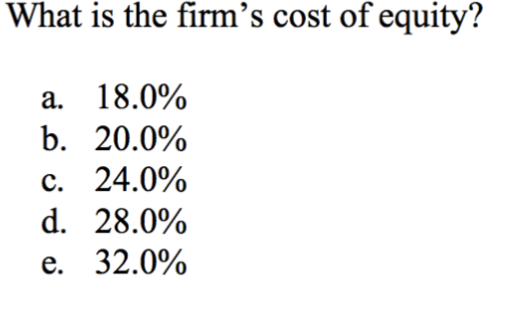

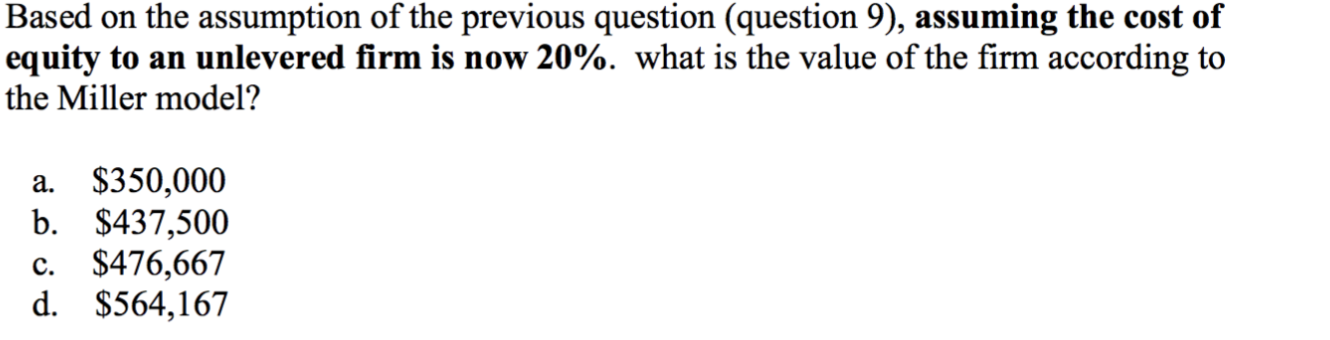

The Kimberly Corporation is a zero growth firm with an expected EBIT of $100,000 and a corporate tax rate of 30 percent. Kimberly uses $500,000 of 12.0 percent debt financing, and the cost of equity to an unlevered firm in the same risk class is 16 percent. What is the value of the firm according to MM with corporate taxes? a. $400,000 b. $437,500 c. $587,500 d. $625,000 e. $775,000 What is the firm's cost of equity? a. 18.0% b. 20.0% c. 24.0% d. 28.0% e. 32.0% If the effective personal tax rate on stock income is 20 percent, and the effective personal tax rate on debt income is 25%, what is the firm's gain from leverage according to the Miller model? a. $126,667 b. $130,555 c. $145,323 d. $163,587 Based on the assumption of the previous question (question 9), assuming the cost of equity to an unlevered firm is now 20%. what is the value of the firm according to the Miller model? a. $350,000 b. $437,500 c. $476,667 d. $564,167

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts