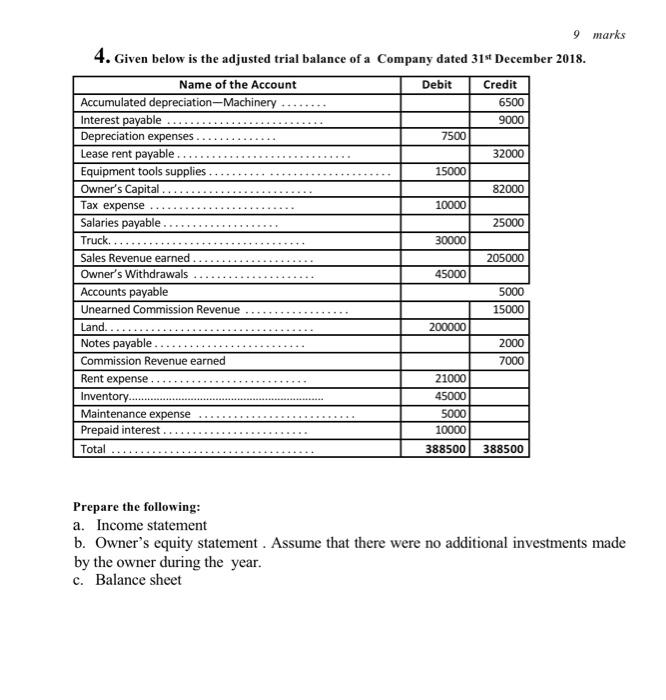

Question: 9 marks 4. Given below is the adjusted trial balance of a company dated 31st December 2018. Name of the Account Debit Credit Accumulated depreciation--

9 marks 4. Given below is the adjusted trial balance of a company dated 31st December 2018. Name of the Account Debit Credit Accumulated depreciation-- Machinery 6500 Interest payable 9000 Depreciation expenses 7500 Lease rent payable. 32000 Equipment tools supplies. 15000 Owner's Capital .. 82000 Tax expense 10000 Salaries payable 25000 Truck 30000 Sales Revenue earned. 205000 Owner's Withdrawals 45000 Accounts payable 5000 Unearned Commission Revenue 15000 Land.... 200000 Notes payable 2000 Commission Revenue earned 7000 Rent expense 21000 Inventory........ 45000 Maintenance expense 5000 Prepaid interest 10000 Total 388500 388500 Prepare the following: a. Income statement b. Owner's equity statement. Assume that there were no additional investments made by the owner during the year. c. Balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts